On November 30, 2024, AWM Investment Company, Inc. (Trades, Portfolio) executed a significant transaction involving Synchronoss Technologies Inc (SNCR, Financial). The firm reduced its holdings by 67,938 shares at a traded price of $9.88 per share. This transaction resulted in a total holding of 490,650 shares, marking a reduction impact of -0.08 on the firm's portfolio. Despite this reduction, Synchronoss Technologies Inc still represents 0.59% of AWM's total holdings, indicating its continued relevance in the firm's investment strategy.

AWM Investment Company, Inc. (Trades, Portfolio): A Profile

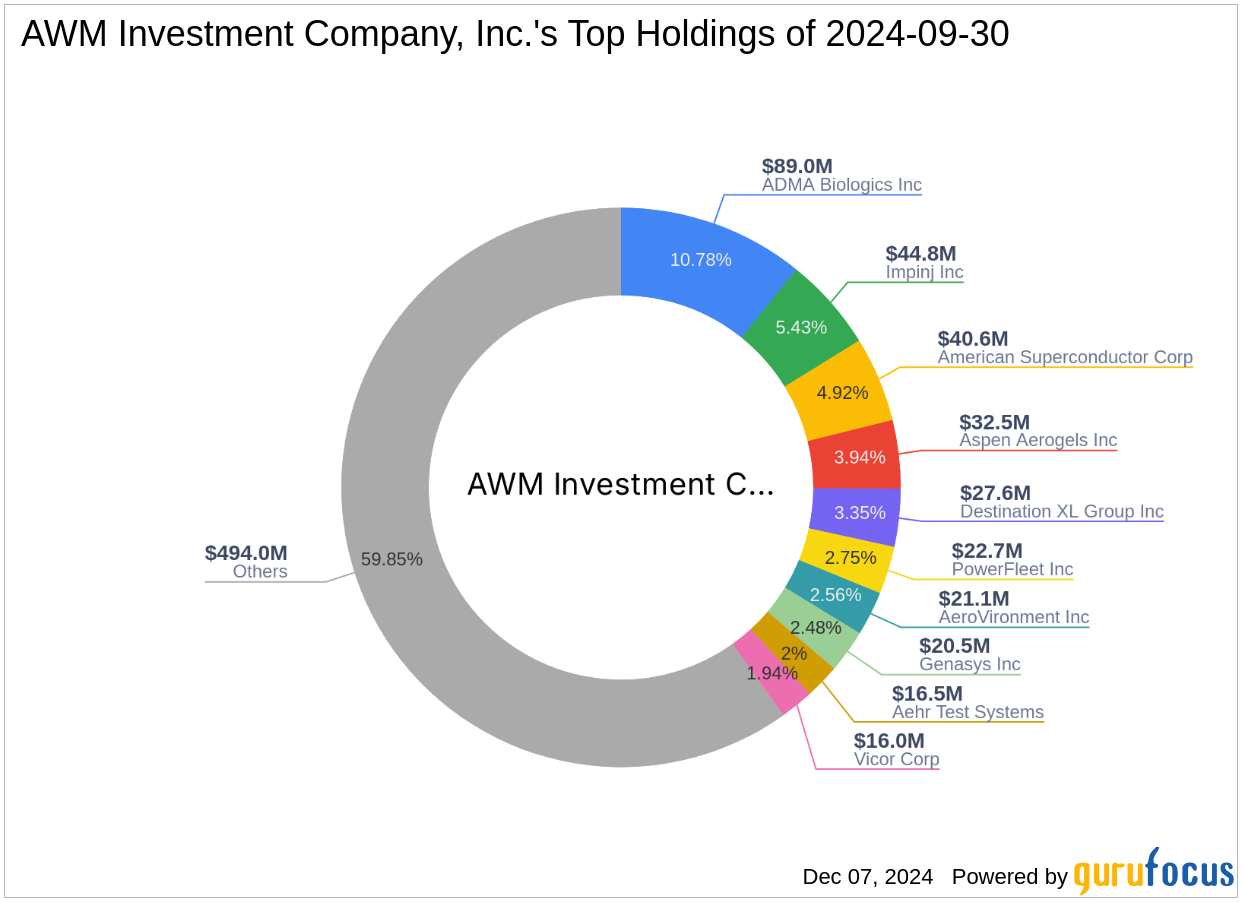

AWM Investment Company, Inc. (Trades, Portfolio), headquartered at 527 Madison Avenue, New York, is a well-regarded investment firm known for its strategic focus on the technology and healthcare sectors. The firm's investment philosophy emphasizes identifying growth opportunities within these dynamic industries. With a portfolio equity of $825 million, AWM's top holdings include companies such as ADMA Biologics Inc (ADMA, Financial), American Superconductor Corp (AMSC, Financial), and Impinj Inc (PI, Financial), reflecting its commitment to innovative and high-potential sectors.

Understanding Synchronoss Technologies Inc

Synchronoss Technologies Inc is a prominent provider of cloud, messaging, and network management solutions. The company's offerings, such as the Synchronoss Personal CloudTM, are designed to enhance customer engagement and content management. Synchronoss generates revenue primarily through subscriptions and transaction-based fees, with a significant portion of its income derived from the United States. The company's business model is segmented into License, Professional Services, Subscription Services, and Transaction Services, catering to a diverse client base.

Impact of the Transaction on AWM's Portfolio

The recent reduction in Synchronoss Technologies Inc shares by AWM Investment Company, Inc. (Trades, Portfolio) reflects a strategic adjustment within its portfolio. The transaction's impact was a modest -0.08, yet Synchronoss remains a notable component, constituting 0.59% of the firm's total holdings. This adjustment aligns with AWM's broader investment strategy, which may involve reallocating resources to optimize returns across its diverse portfolio.

Financial Metrics and Valuation of Synchronoss Technologies Inc

Synchronoss Technologies Inc currently holds a market capitalization of $107.742 million, with a stock price of $9.94. The stock is considered modestly overvalued, with a GF Value of $8.42 and a Price to GF Value ratio of 1.18. These metrics suggest that while the stock is trading above its intrinsic value, it may still offer potential for investors seeking exposure to the software industry.

Performance and Growth Indicators

Synchronoss Technologies Inc's financial performance presents several challenges. The company has a GF Score of 60/100, indicating poor future performance potential. Its Balance Sheet Rank is 3/10, and it faces growth challenges with a 3-year revenue growth rate of -35.40%. The Profitability Rank is also 3/10, reflecting ongoing operational difficulties.

Conclusion and Implications for Investors

AWM Investment Company, Inc. (Trades, Portfolio)'s recent transaction involving Synchronoss Technologies Inc highlights the firm's strategic portfolio management. For value investors, this move underscores the importance of evaluating both risks and opportunities within the technology sector. While Synchronoss faces growth and profitability challenges, its position in AWM's portfolio suggests potential for recovery or strategic realignment. Investors should consider these factors when assessing the stock's long-term viability and alignment with their investment goals.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.