On November 21, 2024, SOFTBANK GROUP CORP. (Trades, Portfolio) executed a notable transaction by acquiring 20,451,570 shares of Pacific Biosciences of California Inc (PACB, Financial) at a price of $1.77 per share. This acquisition marks a new holding in SOFTBANK's diverse portfolio, reflecting the firm's strategic interest in the biotechnology sector. The transaction is significant, given the current market conditions and the valuation of PACB, which is trading at a fraction of its intrinsic value.

SOFTBANK GROUP CORP. (Trades, Portfolio): A Profile of the Investment Firm

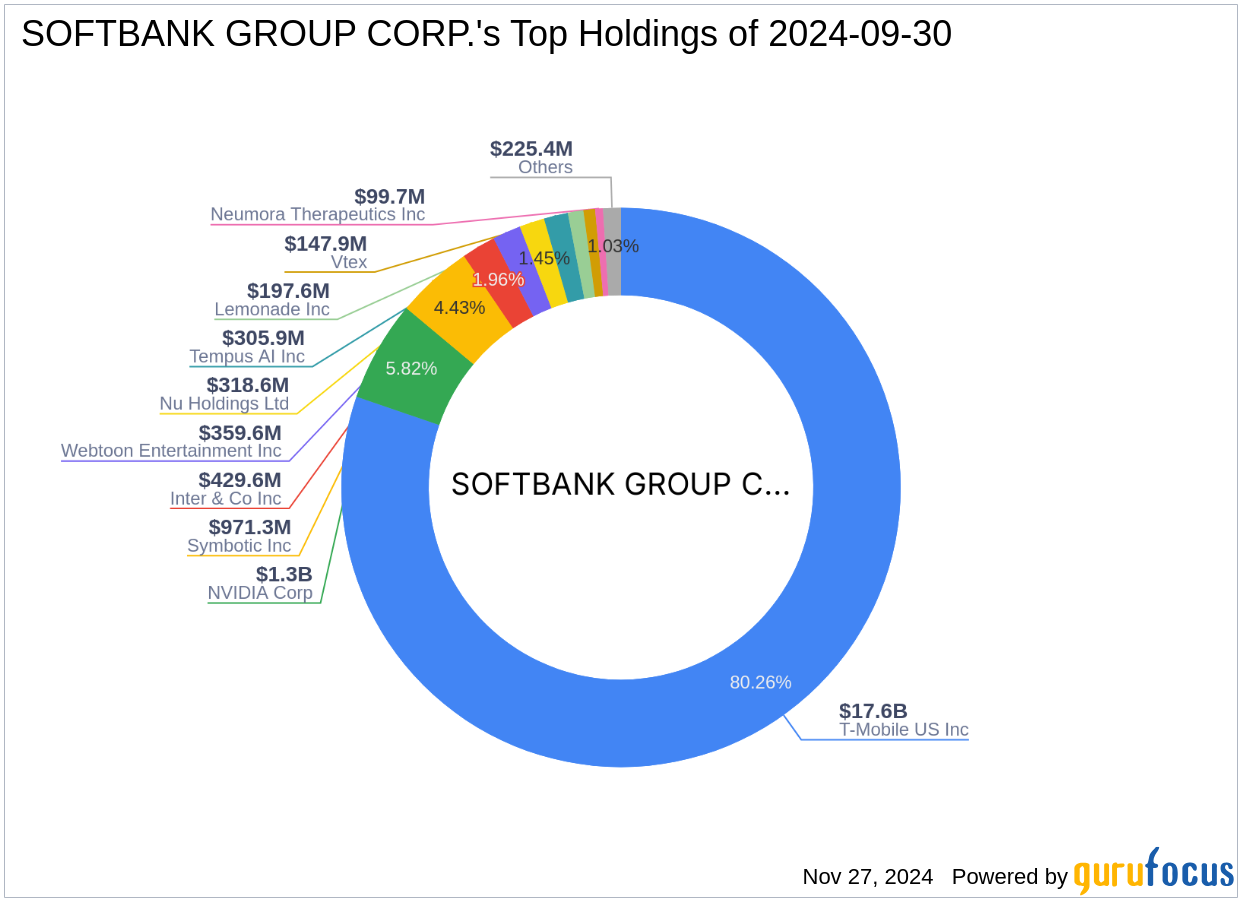

SOFTBANK GROUP CORP. (Trades, Portfolio), headquartered in Tokyo, Japan, is a prominent investment firm known for its focus on technology and communication services sectors. The firm has a diverse portfolio with top holdings in major companies such as NVIDIA Corp (NVDA, Financial) and T-Mobile US Inc (TMUS, Financial). With an equity value of $21.95 billion, SOFTBANK continues to expand its investment horizons, now venturing into the biotechnology field with its recent acquisition of PACB shares.

Understanding Pacific Biosciences of California Inc

Pacific Biosciences of California Inc is a biotechnology company that specializes in genetic analysis solutions. The company is focused on designing, developing, and manufacturing sequencing solutions that enable scientists and clinical researchers to enhance their understanding of the genome. Operating primarily in the Americas, with additional revenue from Asia-Pacific and EMEA regions, PACB is a key player in the medical devices and instruments industry. Despite its innovative offerings, the company faces financial challenges, as reflected in its current market capitalization of approximately $520.938 million and a stock price of $1.77.

Financial Metrics and Valuation of PACB

The financial metrics of PACB reveal a complex picture. The company's market capitalization stands at $520.938 million, with a current stock price of $1.77. The GF Valuation suggests a "Possible Value Trap," with a GF Value of $7.59, indicating that the stock is trading at just 23% of its intrinsic value. This valuation highlights potential risks and opportunities for investors, as the stock is significantly undervalued according to the GF Value metric.

Impact of the Acquisition on SOFTBANK's Portfolio

The acquisition of PACB shares represents 0.16% of SOFTBANK's portfolio, with PACB now constituting 7.50% of the firm's holdings in the stock. This strategic move underscores SOFTBANK's interest in expanding its investments in the biotechnology sector, aligning with its broader investment philosophy of diversifying across high-growth industries. The transaction reflects SOFTBANK's confidence in PACB's potential, despite the company's current financial challenges.

Performance and Risks Associated with PACB

PACB has experienced a year-to-date price decline of 81.54% and a significant drop of 89.31% since its IPO. The company's financial health is concerning, with a GF Score of 52/100, indicating poor future performance potential. Negative profitability metrics, including an ROE of -64.42%, further highlight the risks associated with investing in PACB. The company's Profitability Rank is 2/10, and its Altman Z score of -2.06 suggests financial distress.

Notable Investors in PACB

Despite its financial challenges, PACB has attracted interest from notable investors. Soros Fund Management LLC is the largest holder of PACB shares, with Ken Fisher (Trades, Portfolio) also maintaining a position in the stock. The involvement of these investors highlights the potential they see in PACB, even as the company navigates its current financial difficulties.

Transaction Analysis

The acquisition of PACB shares by SOFTBANK GROUP CORP. (Trades, Portfolio) is a strategic move that could influence both the stock and the firm's portfolio. By investing in PACB, SOFTBANK is positioning itself to potentially benefit from any future recovery or growth in the biotechnology sector. However, given PACB's current financial metrics and market performance, this investment carries inherent risks that SOFTBANK will need to manage carefully.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.