On November 25, 2024, ION Crossover Partners Ltd (Trades, Portfolio) made a significant move by reducing its position in Similarweb Ltd, selling 1,800,000 shares at a transaction price of $12.80 per share. This transaction leaves the firm with a total holding of 3,972,183 shares in the company. The decision to reduce the stake in Similarweb Ltd, a company known for its digital intelligence platforms, may reflect strategic portfolio adjustments or concerns over the stock's current valuation and financial performance.

Profile of ION Crossover Partners Ltd (Trades, Portfolio)

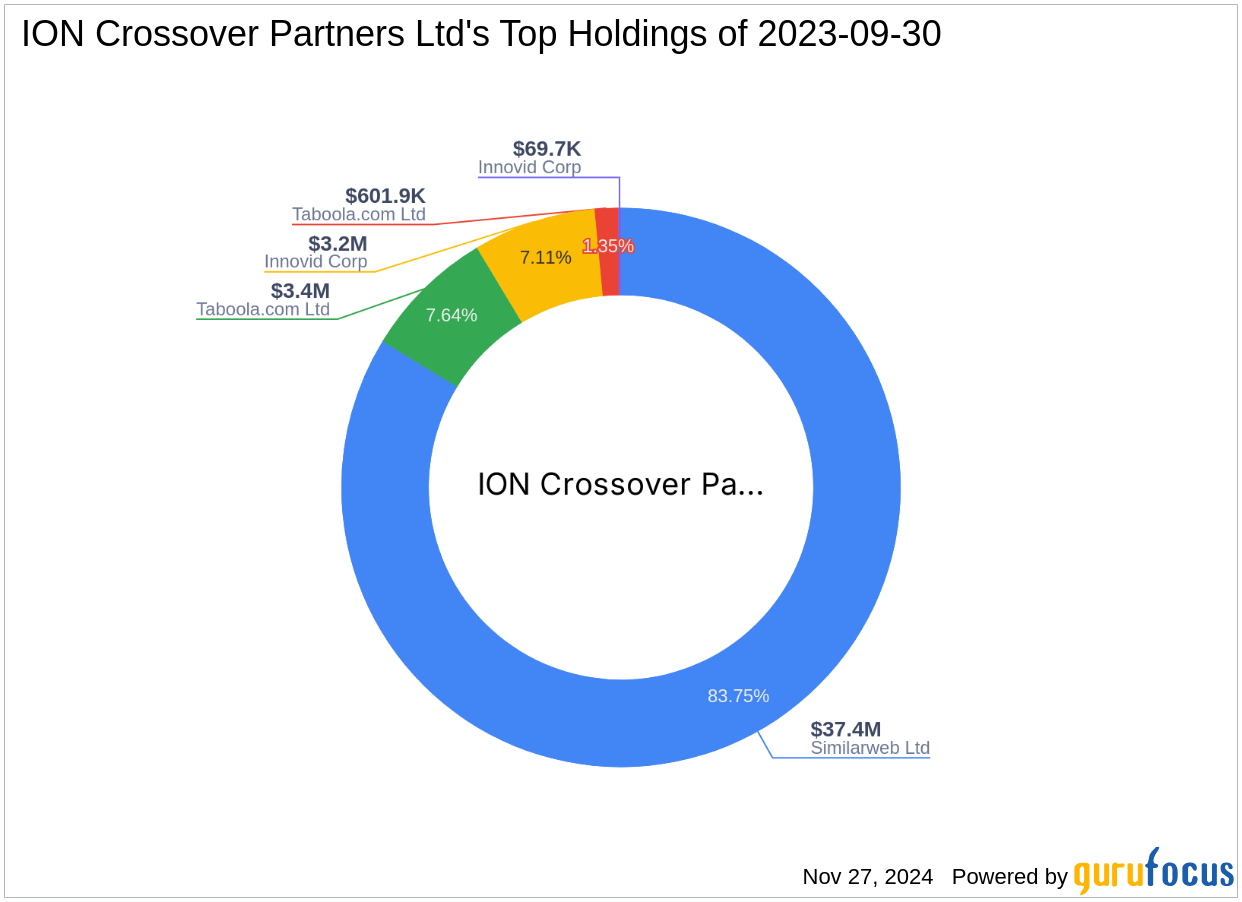

ION Crossover Partners Ltd (Trades, Portfolio) is an investment firm based at 89 Medinat Hayehudim St, Herzliya Pituach, L3 4676672. The firm focuses its investment philosophy on the technology and communication services sectors, managing a portfolio equity of $45 million. Its top holdings include Similarweb Ltd (SMWB, Financial), Taboola.com Ltd (TBLA, Financial), and Innovid Corp (CTV, Financial). The firm's strategic investments are aimed at capitalizing on growth opportunities within these dynamic sectors.

Overview of Similarweb Ltd

Similarweb Ltd, an Israeli company, provides a comprehensive digital intelligence platform that empowers businesses to enhance their competitive edge. The company primarily generates revenue through SaaS subscriptions, offering cloud-based digital intelligence solutions. While the majority of its revenue is derived from the United States, Similarweb also earns income from regions including Israel, the UK, Europe, and the Asia Pacific. The company's innovative technology analyzes vast amounts of digital interactions, transforming them into actionable insights for its clients.

Financial Metrics and Valuation of Similarweb Ltd

Similarweb Ltd currently holds a market capitalization of $1 billion, with a stock price of $12.28. According to the GF Valuation, the stock is significantly overvalued, with a Price to GF Value ratio of 1.47. This suggests that the stock is trading above its intrinsic value, which may be a factor in ION Crossover Partners Ltd (Trades, Portfolio)'s decision to reduce its stake. Investors should be cautious of the stock's valuation when considering investment opportunities.

Performance and Growth Indicators

Similarweb Ltd has experienced a year-to-date price change of 133.46%, indicating strong market performance. Over the past three years, the company has achieved a revenue growth of 25.60% and an EBITDA growth of 3.70%. However, the stock's GF Score of 54/100 suggests poor future performance potential, highlighting the need for investors to carefully assess the company's growth prospects and market position.

Profitability and Financial Health

The company's profitability metrics reveal challenges, with a Return on Equity (ROE) of -48.96% and a Return on Assets (ROA) of -4.20%, both indicating losses. However, Similarweb's cash to debt ratio of 1.47 reflects its ability to cover debt obligations with available cash. These financial health indicators are crucial for investors to consider when evaluating the company's long-term viability.

Market Sentiment and Momentum

Market sentiment for Similarweb Ltd appears positive, with a 14-day Relative Strength Index (RSI) of 82.86, suggesting the stock is overbought. The Momentum Index over 6-1 month is 8.53, and over 12-1 month is 67.56, indicating strong positive momentum. These metrics reflect investor optimism, but also caution against potential overvaluation.

Conclusion

ION Crossover Partners Ltd (Trades, Portfolio)'s decision to reduce its stake in Similarweb Ltd may be driven by concerns over the stock's overvaluation and profitability challenges. While the company shows strong growth indicators, its financial health and market position require careful consideration by investors. As the market continues to evolve, potential investors should weigh the risks and opportunities associated with Similarweb Ltd's current valuation and performance metrics.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.