On November 21, 2024, Edenbrook Capital, LLC (Trades, Portfolio) made a strategic move by acquiring an additional 16,806 shares of Brightcove Inc (BCOV, Financial) at a price of $3 per share. This transaction increased the firm's total holdings in Brightcove to 6,679,710 shares. The acquisition reflects a calculated decision by Edenbrook Capital to bolster its position in Brightcove, a company known for its cloud-based streaming technology and services. This move is indicative of the firm's confidence in Brightcove's potential for growth and value creation.

About Edenbrook Capital, LLC (Trades, Portfolio)

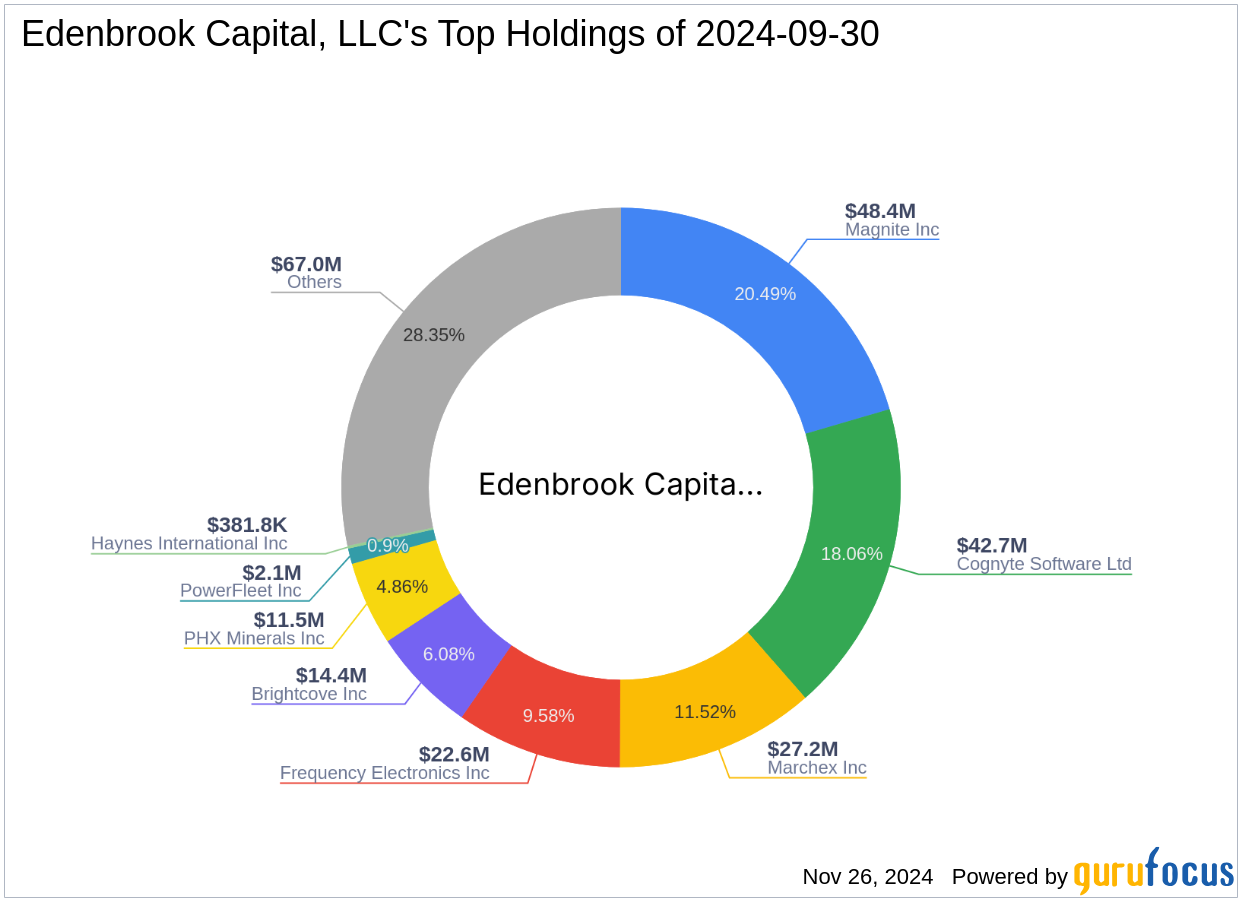

Edenbrook Capital, LLC (Trades, Portfolio) is a value-focused investment firm based in Mt. Kisco, New York. The firm is known for its strategic investments in undervalued companies with strong growth potential. Edenbrook Capital's portfolio is diversified across various sectors, with a significant emphasis on technology and communication services. Among its top holdings are Brightcove Inc (BCOV, Financial), Frequency Electronics Inc (FEIM, Financial), and Marchex Inc (MCHX, Financial). The firm's investment philosophy centers around identifying and investing in companies that are poised for long-term value creation.

Brightcove Inc: A Leader in Streaming Technology

Brightcove Inc is a prominent provider of cloud-based streaming technology and services, catering to a diverse range of clients including media companies, broadcasters, and digital publishers. The company's flagship product, Brightcove Video Cloud, enables customers to publish and distribute video content to internet-connected devices. Brightcove generates a significant portion of its revenue through a subscription-based software-as-a-service model. As of November 26, 2024, Brightcove has a market capitalization of $195.006 million, with its stock priced at $4.32. Despite being modestly overvalued with a GF Value of $3.72, the company remains a key player in the software industry.

Impact of the Transaction on Edenbrook Capital's Portfolio

The recent acquisition of Brightcove shares has increased the stock's representation in Edenbrook Capital's portfolio to 14.80%. This strategic move underscores the firm's commitment to Brightcove, which now accounts for 8.48% of its total holdings. The transaction reflects Edenbrook Capital's belief in Brightcove's potential to deliver substantial returns, despite the company's current financial challenges. The firm's decision to increase its stake in Brightcove is a testament to its confidence in the company's long-term growth prospects.

Financial Performance and Valuation of Brightcove Inc

Brightcove Inc's financial performance has been challenging, with a PE percentage of 0.00 indicating a loss. The stock is considered modestly overvalued, with a GF Value of $3.72. Despite these challenges, Brightcove's stock has gained 44% since the transaction, although it has experienced a -70.21% change since its IPO. The company's GF-Score of 64/100 suggests a poor future performance potential, highlighting the need for strategic improvements to enhance profitability and growth.

Growth and Profitability Metrics

Brightcove Inc's growth and profitability metrics reveal areas for improvement. The company has a Profitability Rank of 3/10 and a Growth Rank of 2/10, reflecting its struggles in achieving sustainable growth. Over the past three years, Brightcove has experienced a -2.30% revenue growth and a -130.00% earnings growth. These figures indicate the need for strategic initiatives to drive revenue and improve profitability.

Market and Industry Context

Within the software industry, Brightcove Inc faces significant competition and challenges. The company's negative return on equity (ROE) of -9.65% and return on assets (ROA) of -4.25% highlight its current financial difficulties. Despite these challenges, Brightcove remains a key player in the industry, with opportunities to leverage its technology and expand its market presence. The company's ability to navigate these challenges will be crucial in determining its future success.

Conclusion

Edenbrook Capital, LLC (Trades, Portfolio)'s increased stake in Brightcove Inc reflects a strategic decision to capitalize on the company's potential for growth and value creation. While Brightcove faces financial challenges, its position in the streaming technology market presents opportunities for future success. The firm's investment underscores its confidence in Brightcove's ability to overcome these challenges and deliver long-term value to shareholders. As the company continues to navigate the competitive landscape, its financial and market performance will be closely monitored by investors and industry analysts alike.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.