On November 18, 2024, Michael Dell (Trades, Portfolio) executed a notable transaction involving Townsquare Media Inc (TSQ, Financial). This transaction saw a reduction of 54,092 shares, which impacted the portfolio by -0.09%. The adjustment reflects a strategic decision within the broader context of Dell's investment strategy, managed through MSD Capital. Despite the reduction, Townsquare Media Inc remains a significant component of the portfolio, indicating continued confidence in the company's potential.

Michael Dell (Trades, Portfolio) and MSD Capital

Michael Dell (Trades, Portfolio), renowned for founding Dell Computer Corporation, manages his investment portfolio through MSD Capital. Established in 1998, MSD Capital is a private investment firm dedicated to managing the assets of Michael Dell (Trades, Portfolio) and his family. The firm is known for its focus on generating superior risk-adjusted returns, guided by a philosophy of integrity and independent thinking. MSD Capital operates with a broad investment mandate, allowing flexibility across various asset classes, and maintains offices in New York, Santa Monica, and West Palm Beach.

Understanding Townsquare Media Inc

Townsquare Media Inc is a diversified media company based in the USA, primarily focused on local advertising and marketing solutions. The company operates through segments such as Broadcast Advertising, Digital Advertising, and Subscription Digital Marketing Solutions. Townsquare Media Inc earns the majority of its revenue from the Broadcasting Advertising segment, which includes local, regional, and national advertising products delivered via terrestrial radio broadcast. The company's portfolio features local media brands like WYRK.com and NJ101.5.com, as well as national music brands such as XXLmag.com and TasteofCountry.com.

Financial Metrics and Valuation

As of November 20, 2024, Townsquare Media Inc has a market capitalization of $154.073 million, with a stock price of $9.91. The stock is considered fairly valued, with a GF Value of $10.25 and a Price to GF Value ratio of 0.97. The company's financial strength is reflected in its Balance Sheet Rank of 3/10 and a Profitability Rank of 6/10. Despite these metrics, the GF Score of 69/100 suggests poor future performance potential.

Impact of the Transaction

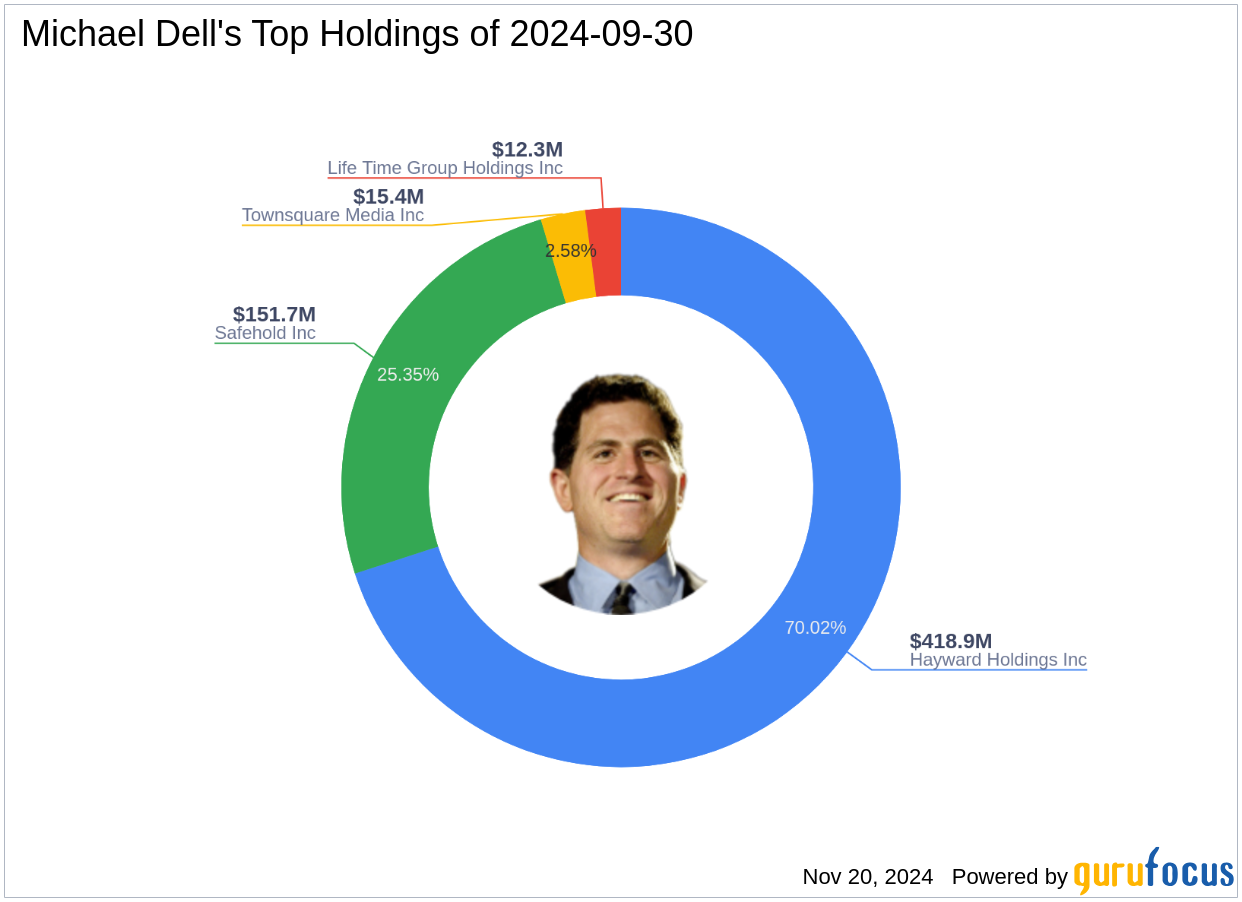

The reduction in shares represents a -3.59% change in Michael Dell (Trades, Portfolio)'s holdings in Townsquare Media Inc. Post-transaction, the stock constitutes 2.46% of the portfolio, with a total of 1,452,549 shares held. This adjustment aligns with MSD Capital's investment philosophy, which emphasizes long-term, risk-adjusted returns. Despite the reduction, Townsquare Media Inc remains a significant holding, indicating a strategic realignment rather than a lack of confidence in the company's prospects.

Performance and Growth Indicators

Townsquare Media Inc has demonstrated a 3-year revenue growth of 10.80% and a substantial earnings growth of 103.10%. However, the company's Growth Rank is 3/10, and its Momentum Rank is 5/10, indicating challenges in sustaining this growth trajectory. The Operating Margin growth of 1.20% and a Piotroski F-Score of 3 further highlight the mixed performance indicators.

Sector and Industry Context

Operating within the Media - Diversified industry, Townsquare Media Inc's top sector exposure in Michael Dell (Trades, Portfolio)'s portfolio includes Industrials and Real Estate. The company's interest coverage ratio of 1.65 and an Altman Z score of 0.11 suggest financial vulnerabilities, which are critical considerations for investors assessing the company's long-term viability.

Conclusion and Market Position

The transaction reflects a strategic adjustment in Michael Dell (Trades, Portfolio)'s portfolio, consistent with MSD Capital's investment philosophy. Townsquare Media Inc remains a significant holding, despite the reduction, indicating continued confidence in its business model and market position. As the company navigates the challenges and opportunities within the media industry, its performance will be closely monitored by investors seeking to understand the implications of this strategic realignment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.