Overview of the Recent Transaction

On September 30, 2024, Point72, led by Steven Cohen (Trades, Portfolio), expanded its investment portfolio by acquiring 2,709,292 shares of Caribou Biosciences Inc (CRBU, Financial). This transaction, executed at a price of $1.96 per share, marks a significant addition to the firm's holdings in the biotechnology sector. The trade not only increased the firm's total shares in Caribou Biosciences but also adjusted its portfolio position to 3.00% in the company, reflecting a strategic stake.

Profile of Steven Cohen (Trades, Portfolio) and Point72

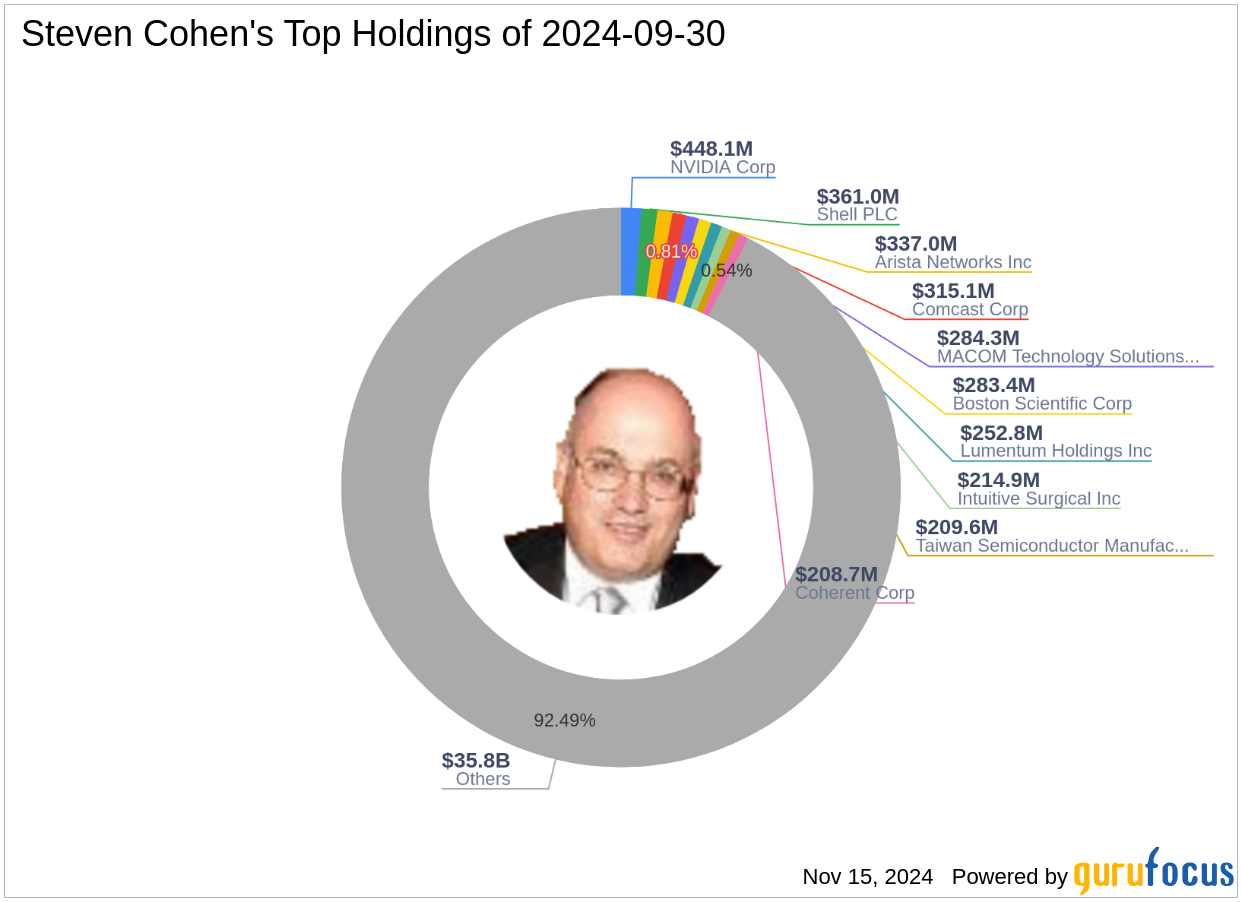

Steven A. Cohen, Chairman and CEO of Point72, is renowned for his extensive experience in the investment field, having founded S.A.C. Capital Advisors in 1992 before transitioning to Point72. The firm operates a long/short equity strategy, emphasizing a rigorous, bottom-up research process to drive its investment decisions. Cohen's leadership extends beyond finance into philanthropy and sports, notably owning the New York Mets. Point72 manages assets totaling $38.76 billion, with a strong inclination towards technology and healthcare sectors.

Introduction to Caribou Biosciences Inc

Caribou Biosciences Inc, a clinical-stage CRISPR biopharmaceutical company, focuses on developing innovative genome-edited cell therapies for various diseases. Since its IPO on July 23, 2021, the company has been dedicated to leveraging its proprietary CRISPR platform to advance its pipeline of allogeneic CAR-T and CAR-NK cell therapies. Despite challenging market conditions, Caribou continues to push the boundaries of biotechnological innovation.

Analysis of the Trade's Impact

The acquisition by Cohen's Point72 significantly bolsters its exposure to the biotechnology sector, aligning with its strategy of diversifying into high-growth potential areas. Holding 3.00% of Caribou Biosciences reflects a confident investment stance, likely driven by the firm's rigorous analysis and optimistic outlook on the company's technology and market position.

Market Context and Caribou's Performance Metrics

At the time of the transaction, Caribou Biosciences was navigating through a volatile market, with its stock price at $2.09, reflecting a 6.63% increase since the trade date. The company's financial health, indicated by a GF Score of 56/100, suggests moderate future performance potential. However, its valuation metrics, particularly a GF Value of $3.20, suggest caution as the stock trades at a significant discount, labeled as a possible value trap.

Comparative and Future Outlook Analysis

Compared to other major holdings in Cohen’s portfolio, such as Comcast Corp and NVIDIA Corp, Caribou Biosciences represents a smaller, albeit strategic, diversification into a high-risk, high-reward sector. This investment could either leverage sectoral growth or hedge against volatility in other segments. Moving forward, the biotechnology sector's dynamic nature and Caribou's innovative CRISPR solutions could play pivotal roles in shaping the performance of this investment.

Conclusion

The strategic acquisition of Caribou Biosciences shares by Steven Cohen (Trades, Portfolio)'s Point72 underscores a calculated move to capitalize on advancements in biotechnology. While the current market indicators suggest cautious optimism, Cohen's track record and strategic investment choices could potentially yield significant returns, aligning with broader portfolio objectives and market trends.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.