Overview of the Recent Transaction

On September 30, 2024, Jane Street Group, LLC made a significant addition to its investment portfolio by acquiring 14,049,321 shares of Aptiv PLC (APTV, Financial). This transaction, executed at a price of $72.01 per share, marks a notable expansion in the firm's holdings, increasing its total shares in Aptiv to the same number, and representing a 5.30% stake in the company. The trade had a 0.23% impact on Jane Street's portfolio, reflecting the firm's strategic intent to bolster its position in the automotive technology sector.

Insight into Jane Street Group, LLC

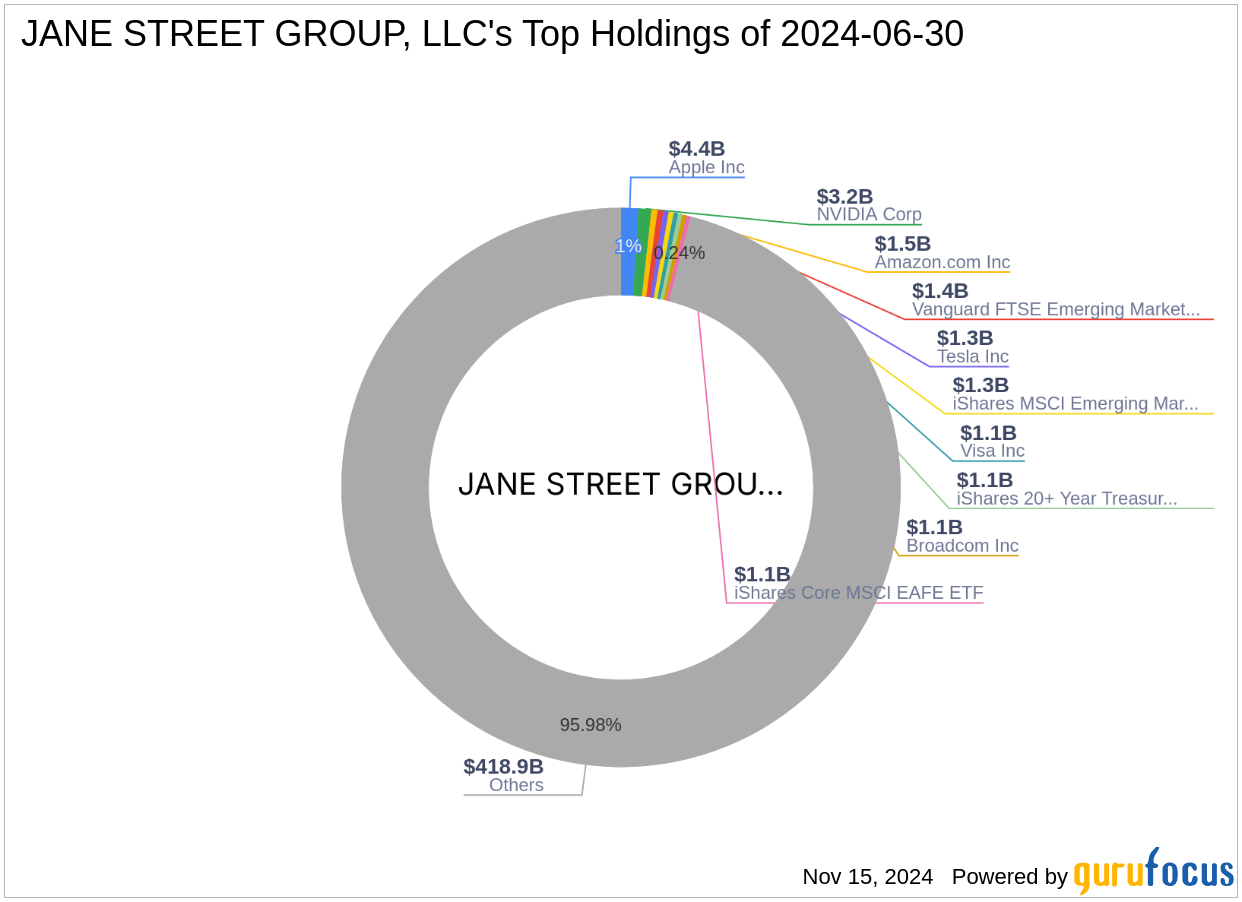

Jane Street Group, LLC, renowned for its prowess in electronic trading, operates globally with a strong emphasis on technology and algorithmic trading strategies. The firm trades a diverse array of financial products across multiple electronic exchanges worldwide. With a daily trading volume that significantly impacts the U.S. stock market, Jane Street is a major player in ETF liquidity, employing sophisticated software and in-house solutions to maintain its competitive edge. The firm's top holdings include major names like Vanguard FTSE Emerging Markets ETF (VWO, Financial), Apple Inc (AAPL, Financial), and Tesla Inc (TSLA, Financial).

Exploring Aptiv PLC

Aptiv PLC, headquartered in Ireland, is a pivotal player in the global automotive sector, specializing in advanced safety technologies, user experience, and power solutions. With a market capitalization of $12.7 billion, Aptiv is significantly undervalued with a GF Value of $113.15, indicating a strong potential for growth. The company's financial health is underscored by a robust return on equity (ROE) of 22.53% and a return on assets (ROA) of 9.99%, positioning it well within its industry for potential future gains.

Impact of the Trade on Jane Street's Portfolio

The acquisition of Aptiv shares significantly enhances Jane Street's exposure to the automotive technology market, aligning with its strategic investment in sectors poised for technological advancements. This move not only diversifies the firm's portfolio but also leverages Aptiv's potential in evolving automotive and electronic markets.

Market Performance and Valuation of Aptiv PLC

Despite a challenging market environment with a year-to-date price decline of 40.08%, Aptiv's stock remains attractive, trading at a price to GF Value ratio of 0.48. This suggests that the stock is significantly undervalued, offering a potentially lucrative opportunity for value investors. Aptiv's historical IPO performance also remains strong, with a 203.54% increase since its listing, highlighting its long-term growth potential despite recent market volatilities.

Comparative Analysis with Other Major Investors

Other notable investors in Aptiv include Barrow, Hanley, Mewhinney & Strauss, along with firms like Hotchkis & Wiley and individual investors such as John Rogers (Trades, Portfolio) and Robert Olstein (Trades, Portfolio). Jane Street's recent acquisition positions it among the top investors in Aptiv, indicating a strong conviction in the stock's future performance.

Investment Outlook and Future Prospects

Jane Street's decision to increase its stake in Aptiv likely stems from the company's solid fundamentals and undervaluation, suggesting a strategic move to capitalize on future growth driven by advancements in vehicle technology and electrification. The automotive industry's shift towards more connected and environmentally friendly technologies presents a favorable outlook for companies like Aptiv, making this investment particularly timely.

Conclusion

Jane Street Group, LLC's recent acquisition of Aptiv PLC shares is a strategic enhancement to its diverse and technologically oriented portfolio. With Aptiv's strong market fundamentals and undervaluation, this move is poised to yield significant returns, aligning with Jane Street's sophisticated investment approach and its focus on sectors with high growth potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.