Overview of the Recent Transaction

On September 30, 2024, Maverick Capital, led by Lee Ainslie (Trades, Portfolio), executed a significant transaction involving the shares of Fractyl Health Inc (GUTS, Financial). The firm reduced its holdings by 6,176 shares at a trading price of $2.53 per share. Following this transaction, Maverick Capital holds a total of 4,248,492 shares in the company, representing an 8.90% ownership stake and a 0.2% position in the firm's portfolio. This move reflects a strategic adjustment in Maverick Capital’s investment in the biotechnology sector.

Profile of Lee Ainslie (Trades, Portfolio) and Maverick Capital

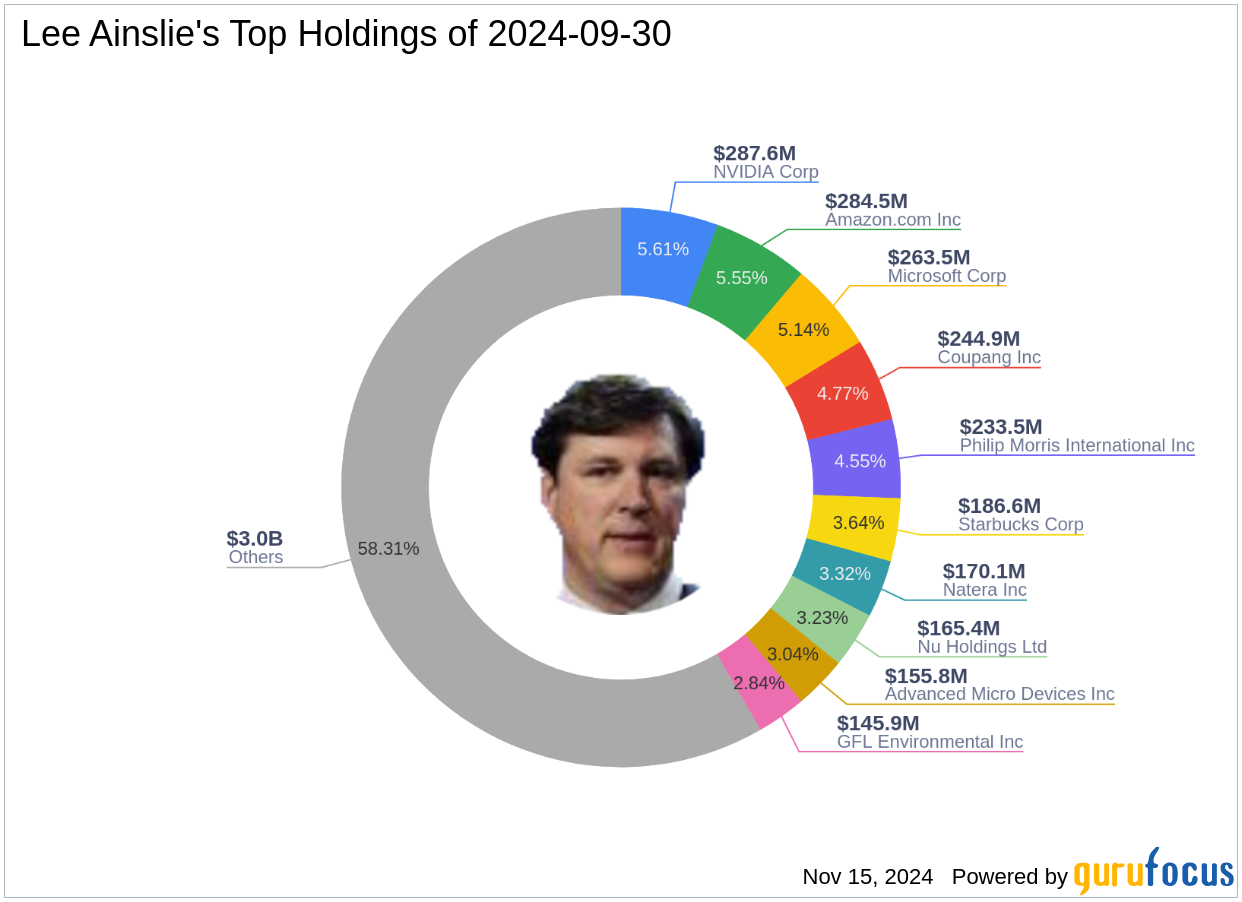

Lee Ainslie (Trades, Portfolio), the founder and CEO of Dallas-based Maverick Capital, has been a prominent figure in the investment world since establishing the firm in 1993 with an initial $38 million. Maverick Capital, under Ainslie's leadership, has grown significantly, leveraging the expertise of industry specialists across various sectors to inform its investment decisions. The firm's philosophy focuses on deep sectoral analysis and a collaborative decision-making process, which has guided its investments in top holdings such as Amazon.com Inc (AMZN, Financial) and Microsoft Corp (MSFT, Financial).

Introduction to Fractyl Health Inc

Fractyl Health Inc, trading under the symbol GUTS, operates within the biotechnology industry and is primarily focused on developing therapies for metabolic diseases such as type 2 diabetes and obesity. Since its IPO on February 2, 2024, the company has aimed to shift the treatment paradigm from symptomatic management to disease-modifying approaches. Despite its innovative focus, the company's financial metrics and stock performance have shown significant challenges, with a current market capitalization of $100.168 million and a stock price decline to $2.09, marking a significant drop since its public debut.

Analysis of the Trade's Impact

The reduction in Fractyl Health Inc shares by Maverick Capital could be indicative of a strategic realignment or risk mitigation given the stock's poor performance metrics. The firm's decision to decrease its stake by a modest percentage points to a cautious approach in managing its investment in a volatile sector. This move is particularly noteworthy considering the stock's significant decline in value since its IPO, alongside a GF Score of only 16/100, suggesting low future performance potential.

Market Context and Strategic Implications

At the time of the trade, the biotechnology market was experiencing heightened volatility, which likely influenced Maverick Capital’s decision to adjust its holdings. The timing of this transaction, amidst a downward trend in Fractyl Health Inc’s stock price, underscores a strategic move to limit exposure to potential further losses. For other investors, this action might signal a cautious approach to investing in the biotechnology sector, particularly in companies like Fractyl Health Inc, which are still in the early stages of financial and operational maturity.

Conclusion

In summary, Lee Ainslie (Trades, Portfolio)’s recent transaction involving Fractyl Health Inc shares reflects a strategic decision aligned with Maverick Capital’s rigorous investment philosophy and market analysis. The reduction in holdings at a time of significant market and company-specific challenges highlights the firm's proactive approach to portfolio management. Investors and market watchers will likely keep a close eye on Maverick’s future moves, particularly in the biotechnology sector, to gauge broader market sentiments and potential shifts in strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.