Insight into MSD Capital's Latest Investment Moves

Michael Dell (Trades, Portfolio), renowned for founding Dell Computer Corporation and later MSD Capital to manage his family's investments, has made significant portfolio adjustments in the third quarter of 2024. MSD Capital, known for its rigorous investment analysis and long-term strategy, focuses on generating superior risk-adjusted returns across diverse asset classes. This quarter, Dell's key transactions underscore a strategic focus, particularly in Hayward Holdings Inc, reflecting a substantial portfolio shift.

Summary of New Buys

Michael Dell (Trades, Portfolio)'s investment activities this quarter included the acquisition of new stocks, with a notable emphasis on:

- The significant addition was Hayward Holdings Inc (HAYW, Financial), with 27,307,732 shares, representing 70.02% of the portfolio and a total value of $418.9 million.

Key Position Reductions

Conversely, Dell has strategically reduced positions in certain stocks:

- He notably reduced his stake in Life Time Group Holdings Inc (LTH, Financial) by 11,192,988 shares, resulting in a -95.71% decrease in shares held and a -60.5% impact on the portfolio. During the quarter, LTH traded at an average price of $22.48 and has seen a return of 6.48% over the past three months and 57.96% year-to-date.

Portfolio Overview

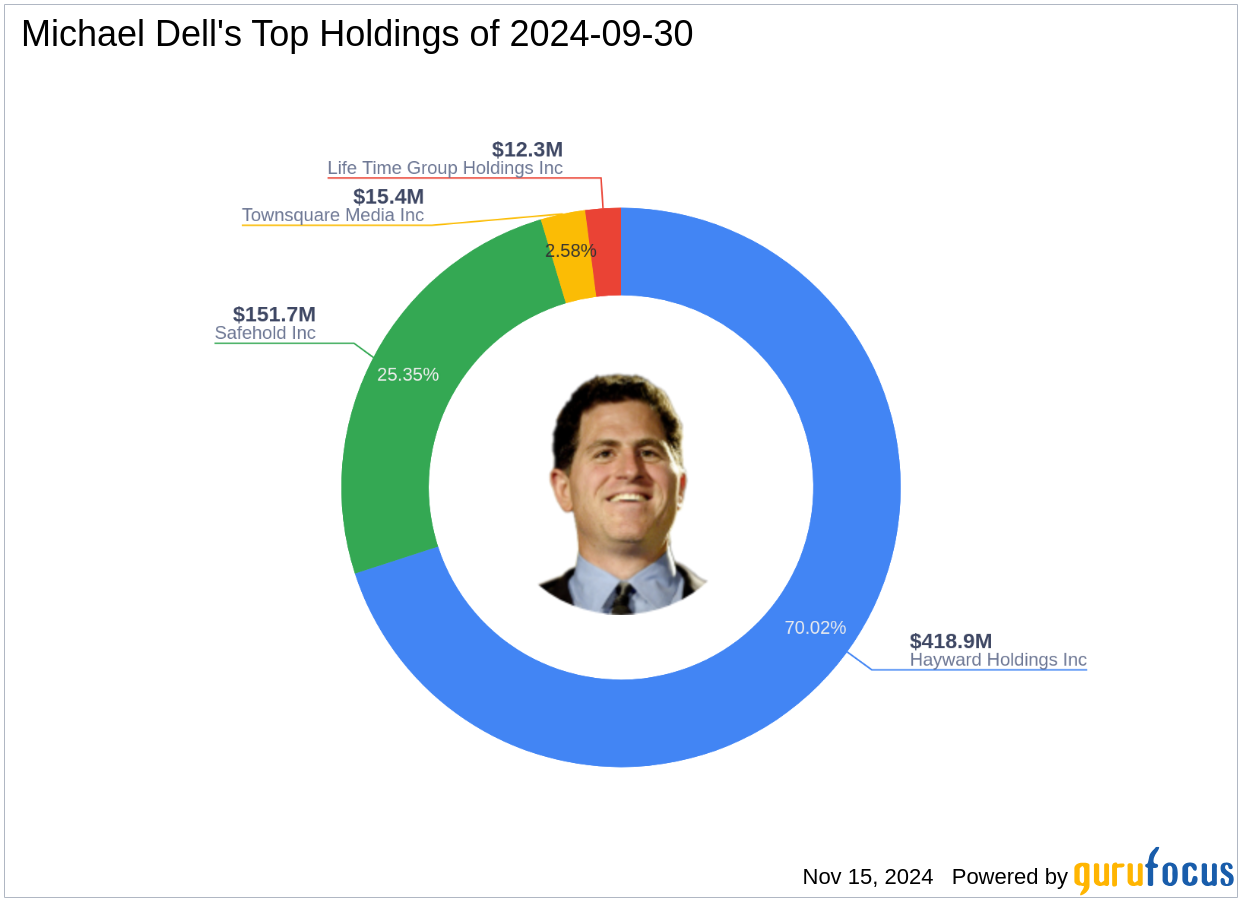

As of the third quarter of 2024, Michael Dell (Trades, Portfolio)'s investment portfolio comprised 4 stocks. The top holdings were:

- 70.02% in Hayward Holdings Inc (HAYW, Financial)

- 25.35% in Safehold Inc (SAFE, Financial)

- 2.58% in Townsquare Media Inc (TSQ, Financial)

- 2.05% in Life Time Group Holdings Inc (LTH, Financial)

This strategic realignment in Michael Dell (Trades, Portfolio)'s portfolio highlights a significant confidence in Hayward Holdings Inc, suggesting a bullish outlook on its market position and growth potential. Meanwhile, the reduction in Life Time Group Holdings Inc reflects a tactical decision to capitalize on recent gains and perhaps reallocate resources to more promising opportunities. These moves provide valuable insights for value investors looking to understand market trends and investment strategies from one of the industry's seasoned players.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.