Insight into Pershing Square's Latest Portfolio Adjustments

Bill Ackman (Trades, Portfolio), renowned for his activist investment approach through Pershing Square, has made significant moves in the third quarter of 2024. Starting his career in real estate before founding Pershing Square in November 2003, Ackman focuses on acquiring stakes in undervalued companies and pushing for changes to unlock shareholder value. His latest 13F filing reveals strategic adjustments, notably in Brookfield Corp and Nike Inc, reflecting his investment philosophy of capitalizing on market inefficiencies.

Key Position Increases

During the third quarter, Ackman increased his positions in two notable stocks:

- Brookfield Corp (BN, Financial) saw a substantial addition of 25,881,373 shares, bringing the total to 32,735,883 shares. This 377.58% increase in share count now constitutes a 10.66% impact on Ackman's current portfolio, with a total value of $1,739,912,180.

- Nike Inc (NKE, Financial) also experienced a significant boost with an additional 13,240,206 shares, totaling 16,280,338 shares. This adjustment represents a 435.51% increase in share count, valued at $1,439,181,880.

Key Position Reductions

Ackman also made reductions in three stocks, with the most significant changes in:

- Hilton Worldwide Holdings Inc (HLT, Financial) was reduced by 1,582,122 shares, a -17.67% decrease, impacting the portfolio by -3.32%. The stock had an average trading price of $216.45 during the quarter and has seen a 20.42% return over the past three months and 37.62% year-to-date.

- Restaurant Brands International Inc (QSR, Financial) saw a reduction of 141,628 shares, a -0.61% decrease, with a -0.1% portfolio impact. The stock traded at an average price of $70.28 during the quarter, with a -2.22% return over the past three months and -10.25% year-to-date.

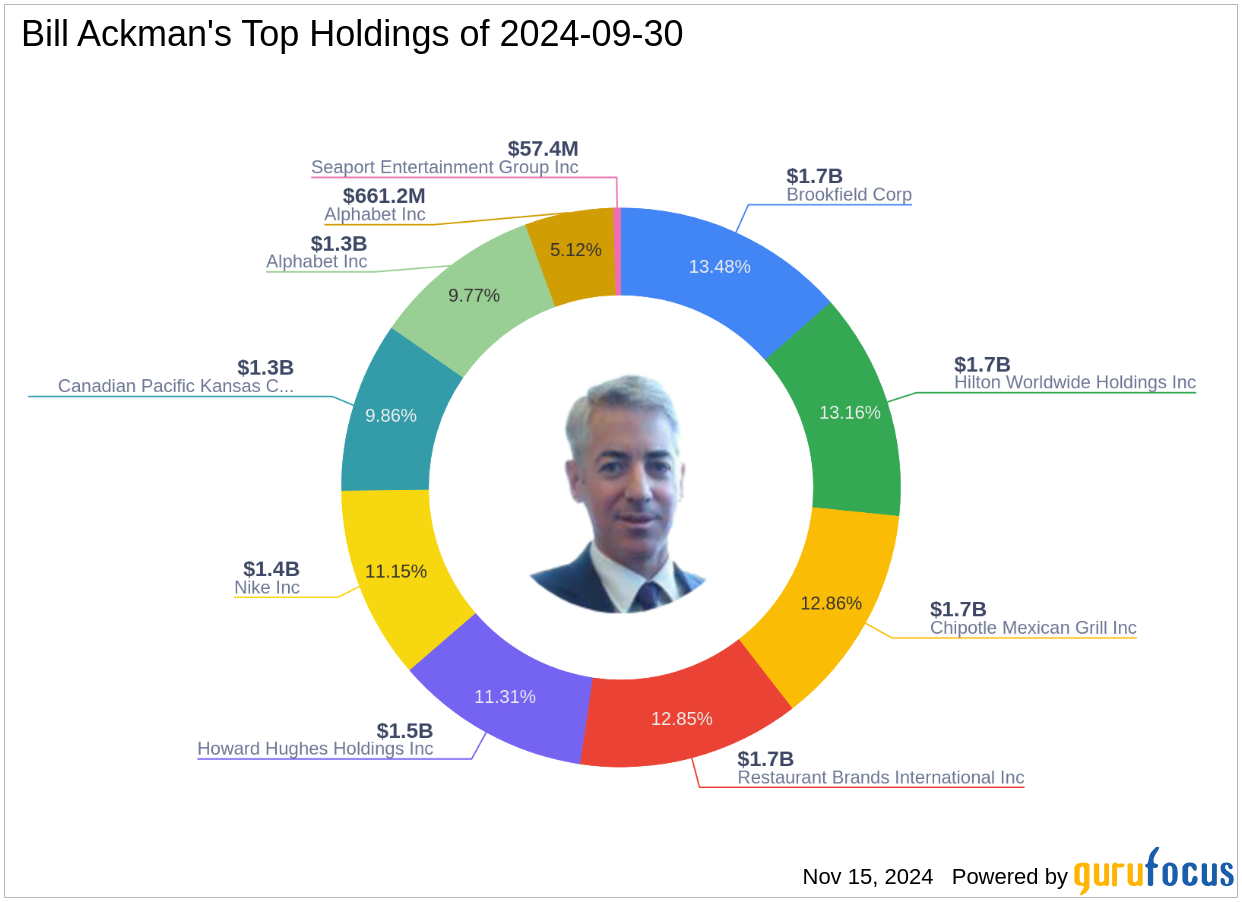

Portfolio Overview

As of the third quarter of 2024, Bill Ackman (Trades, Portfolio)'s portfolio comprises 10 stocks. The top holdings include 13.48% in Brookfield Corp (BN, Financial), 13.16% in Hilton Worldwide Holdings Inc (HLT), 12.86% in Chipotle Mexican Grill Inc (CMG, Financial), 12.85% in Restaurant Brands International Inc (QSR), and 11.31% in Howard Hughes Holdings Inc (HHH, Financial). The investments are primarily concentrated across five industries: Consumer Cyclical, Communication Services, Financial Services, Real Estate, and Industrials.

This strategic positioning by Bill Ackman (Trades, Portfolio), particularly in Brookfield Corp, underscores his confidence in the company's potential for growth and value realization. Investors and market watchers will undoubtedly keep a close eye on these developments as they unfold further.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.