Insight into the Investment Guru's Latest Moves and Market Strategy

Glenn Greenberg (Trades, Portfolio), a notable figure in the investment world, co-founded Chieftain Capital Management in 1984, achieving a remarkable annual compound rate of 22.5% before fees over two decades. Now at the helm of Brave Warrior Advisors, Greenberg continues to apply a highly selective investment strategy, focusing on companies with minimal competition and robust returns on invested capital. His latest 13F filing for Q3 2024 reveals significant adjustments in his portfolio, including a major increase in Ryanair Holdings PLC and strategic exits and reductions in other areas.

Summary of New Buys

Glenn Greenberg (Trades, Portfolio)'s portfolio welcomed six new stocks in the third quarter of 2024. Key additions include:

- Ally Financial Inc (ALLY, Financial) with 10,000 shares, making up 0.01% of the portfolio, valued at $355.9 million.

- Dollar Tree Inc (DLTR, Financial) with 7,126 shares, also representing 0.01% of the portfolio, with a total value of $501.1 million.

- Mastercard Inc (MA, Financial) with 422 shares, valued at $208.38 million.

Key Position Increases

Significant enhancements were made to existing holdings, notably:

- Ryanair Holdings PLC (RYAAY, Financial), with an additional 4,979,919 shares, bringing the total to 5,104,019 shares. This adjustment marks a 4,012.83% increase in share count and a 4.66% impact on the current portfolio, totaling $230.6 million.

- TD Synnex Corp (SNX, Financial) saw an increase of 373,569 shares, bringing the total to 3,695,615 shares, representing an 11.25% increase in share count, valued at $443.77 million.

Summary of Sold Out Positions

In Q3 2024, Glenn Greenberg (Trades, Portfolio) exited one position:

- Applied Materials Inc (AMAT, Financial), where all 961 shares were sold, impacting the portfolio by -0.01%.

Key Position Reductions

Reductions were made in 12 stocks, with significant changes in:

- Apollo Global Management Inc (APO, Financial), reduced by 1,502,235 shares, a -39.74% decrease, impacting the portfolio by -3.93%. The stock traded at an average price of $115.44 during the quarter, returning 55.69% over the past three months and 78.44% year-to-date.

- Primerica Inc (PRI, Financial), reduced by 429,842 shares, a -22.74% reduction, impacting the portfolio by -2.25%. The stock traded at an average price of $252.55 during the quarter, returning 16.12% over the past three months and 45.68% year-to-date.

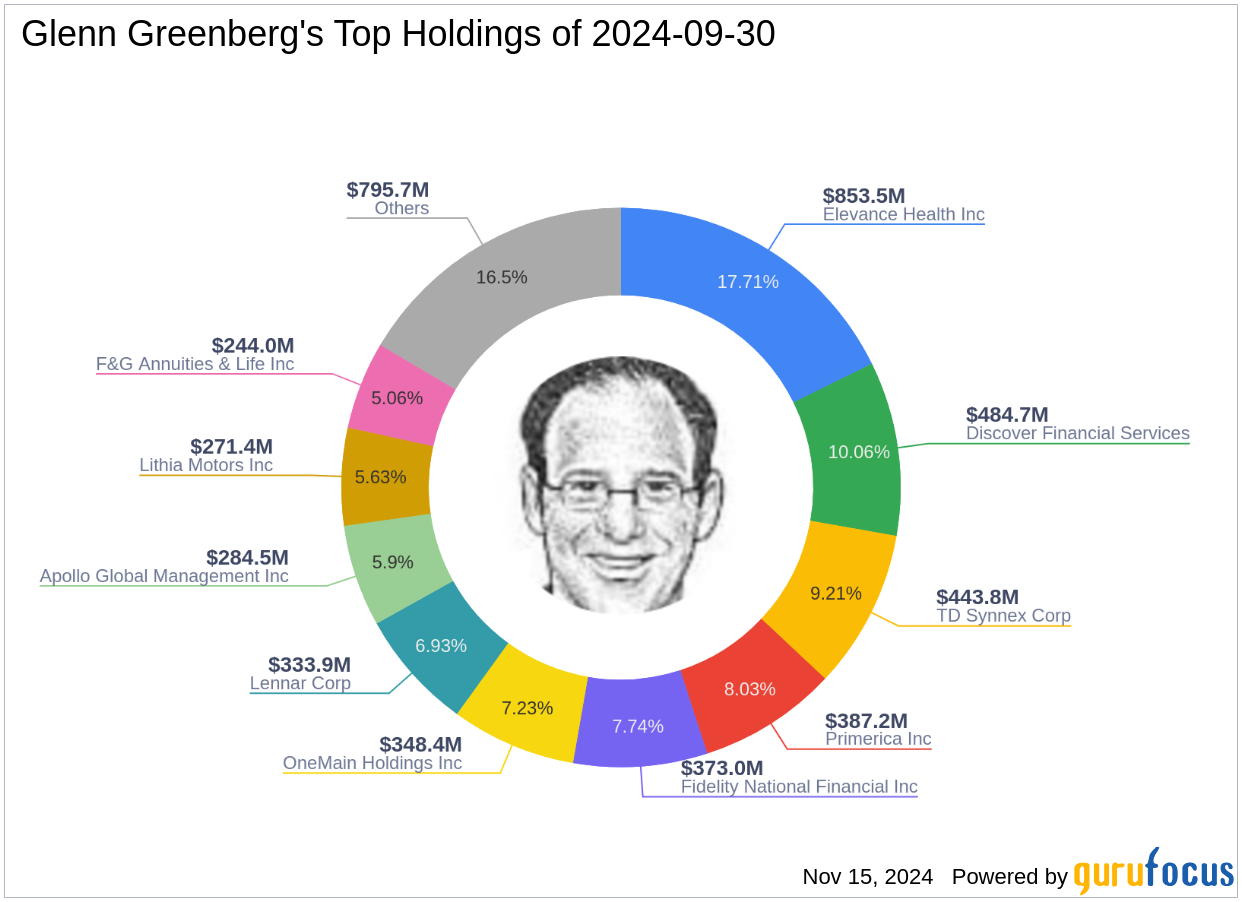

Portfolio Overview

As of the third quarter of 2024, Glenn Greenberg (Trades, Portfolio)'s portfolio comprised 32 stocks. Top holdings included 17.71% in Elevance Health Inc (ELV, Financial), 10.06% in Discover Financial Services (DFS, Financial), 9.21% in TD Synnex Corp (SNX, Financial), 8.03% in Primerica Inc (PRI), and 7.74% in Fidelity National Financial Inc (FNF, Financial). The investments are predominantly concentrated in eight industries: Financial Services, Consumer Cyclical, Healthcare, Technology, Industrials, Energy, Communication Services, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.