Introduction to the Transaction

On September 30, 2024, Brandes Investment Partners, LP (Trades, Portfolio), a prominent investment firm, expanded its portfolio by adding 266,482 shares of Park Aerospace Corp (PKE, Financial). This transaction increased the firm's total holdings in Park Aerospace to 2,417,055 shares, marking a significant endorsement of the aerospace company's potential. The trade, executed at a price of $13.03 per share, reflects a strategic move by Brandes Investment Partners, LP (Trades, Portfolio), emphasizing its confidence in Park Aerospace's market position and future growth prospects.

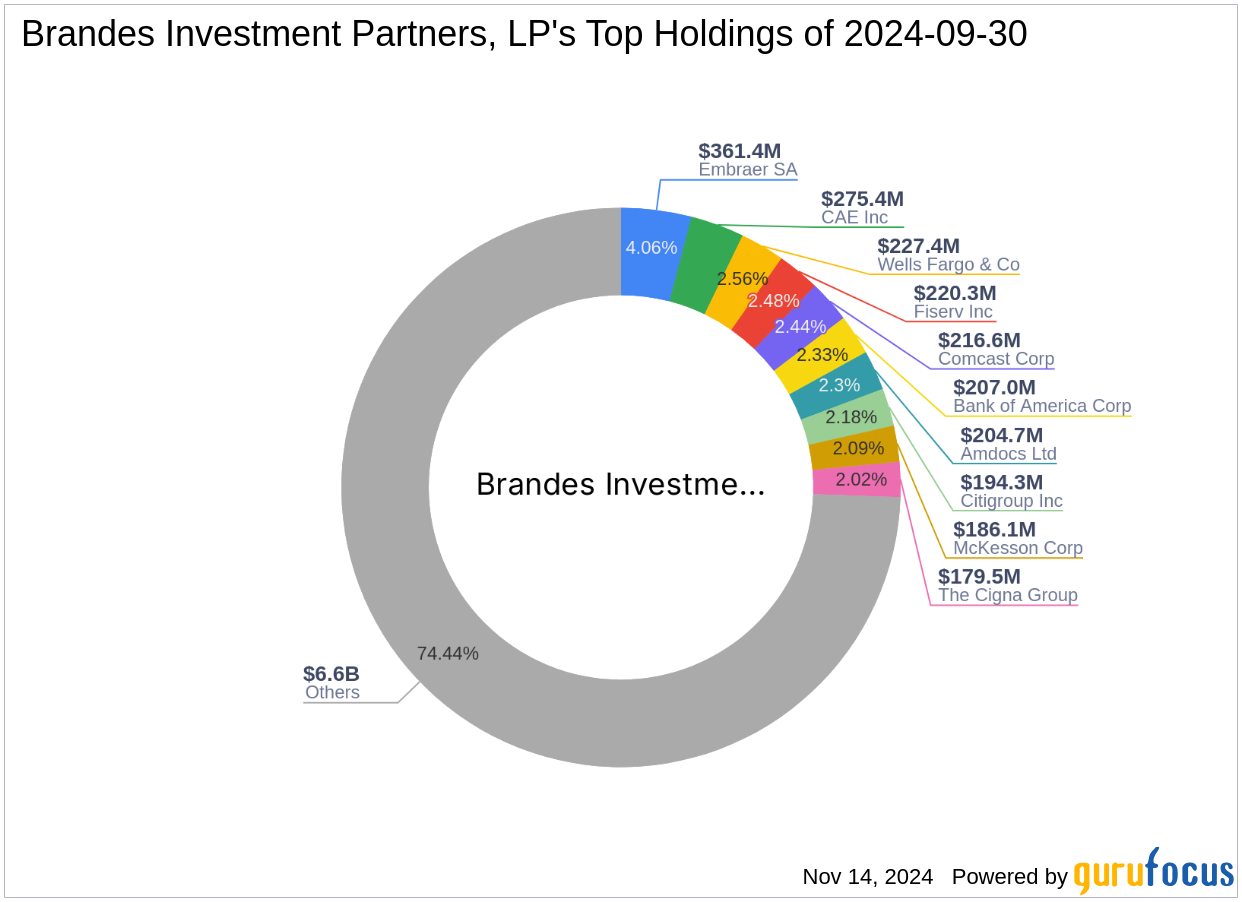

Profile of Brandes Investment Partners, LP (Trades, Portfolio)

Founded in 1974 by Charles Brandes, Brandes Investment Partners, LP (Trades, Portfolio) has established itself as a leader in global equity and fixed-income asset management. The firm is renowned for its rigorous application of value investing principles, inspired by Benjamin Graham. Brandes Investment Partners, LP (Trades, Portfolio) focuses on acquiring undervalued securities and holds them until their market value aligns with their intrinsic value. This disciplined approach has positioned the firm as a trusted advisor to investors worldwide, managing a diverse range of portfolios.

Overview of Park Aerospace Corp

Park Aerospace Corp, headquartered in the USA, specializes in the design, development, and manufacture of advanced composite materials for the aerospace sector. Since its IPO in 1984, the company has been a key player in North America's aerospace industry, with expanding operations in Asia and Europe. Park Aerospace's products are critical in constructing aircraft structures and interiors, leveraging its proprietary Sigma Strut and Alpha Strut technologies to meet the rigorous demands of the aerospace market.

Details of the Trade

The recent acquisition by Brandes Investment Partners, LP (Trades, Portfolio) represents a 0.04% impact on its portfolio, bringing its stake in Park Aerospace to a significant 11.93%. This move not only underscores the firm's strategy in the aerospace sector but also highlights its commitment to investing in companies with solid growth potential. The trade was conducted at a price slightly below the current market price of $14.53, suggesting a timely and strategic addition to Brandes Investment Partners, LP (Trades, Portfolio)'s holdings.

Market Analysis and Stock Performance

Park Aerospace Corp's market capitalization stands at approximately $290 million, with a stock price that has seen an 11.51% increase since the transaction date. Despite a year-to-date decline of 0.89%, the company's long-term performance remains strong, with a 1,787.01% increase since its IPO. The stock is currently rated as "Fairly Valued" with a GF Value of $14.82, closely aligning with its current trading price, which suggests a balanced market perception of its value and growth prospects.

Sector and Industry Context

Operating within the competitive Aerospace & Defense industry, Park Aerospace Corp faces both opportunities and challenges. The sector's dynamics, driven by technological advancements and varying global defense budgets, play a crucial role in shaping the company's strategies and market position. Brandes Investment Partners, LP (Trades, Portfolio)'s recent investment decision reflects a positive outlook on the company's ability to navigate these factors effectively.

Comparative Analysis with Other Gurus

Notably, other seasoned investors like Mario Gabelli (Trades, Portfolio) also hold stakes in Park Aerospace Corp, although Brandes Investment Partners, LP (Trades, Portfolio) remains the largest shareholder. This collective interest from multiple renowned investors further validates the confidence in Park Aerospace's market strategy and financial health.

Conclusion

The recent acquisition of additional shares in Park Aerospace by Brandes Investment Partners, LP (Trades, Portfolio) is a strategic move that aligns with the firm's long-standing investment philosophy. This transaction not only reinforces the firm's position in the aerospace industry but also highlights Park Aerospace's robust potential for growth and value creation. As the industry evolves, both Brandes Investment Partners, LP (Trades, Portfolio) and Park Aerospace are well-positioned to capitalize on emerging opportunities, making this a noteworthy development for investors and market watchers alike.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.