Insight into the Strategic Moves of a Prominent Value Investor

Robert Karr (Trades, Portfolio), the founder of Joho Capital and a notable Tiger Cub protégé of Julian Robertson, has made significant adjustments to his investment portfolio in the third quarter of 2024. Known for his focus on Asian equities and a preference for a concentrated portfolio primarily in new technologies, Karr's latest 13F filing reveals strategic entries and exits that underscore his investment philosophy of minimalism and deep research.

New Additions to the Portfolio

During the third quarter, Robert Karr (Trades, Portfolio) introduced a new position in the portfolio:

- Texas Roadhouse Inc (TXRH, Financial) was the notable new addition with 1,600 shares, representing 0.04% of the portfolio and valued at $282,560 million.

Significant Increases in Existing Holdings

Karr also strategically increased his stakes in existing investments:

- The most significant increase was in Dutch Bros Inc (BROS, Financial), where he added 555,000 shares, bringing his total to 1,919,514 shares. This adjustment increased his share count by 40.67% and had a 2.81% impact on his current portfolio, totaling $61,482,030.

Complete Exits from Positions

The third quarter also saw complete divestments from certain stocks:

- Shoals Technologies Group Inc (SHLS, Financial) saw a complete sell-off of 9,642,545 shares, impacting the portfolio by -8.51%.

Reductions in Key Holdings

Adjustments were made to reduce positions in several stocks:

- Adobe Inc (ADBE, Financial) was reduced by 27,000 shares, marking an -18.92% decrease in shares and a -2.12% impact on the portfolio. The stock traded at an average price of $548.46 during the quarter and has seen a -1.61% return over the past three months and -10.98% year-to-date.

- Constellation Brands Inc (STZ, Financial) was reduced by 2,300 shares, resulting in an -18.98% reduction in shares and a -0.08% impact on the portfolio. The stock traded at an average price of $247.87 during the quarter and has returned 1.39% over the past three months and 2.30% year-to-date.

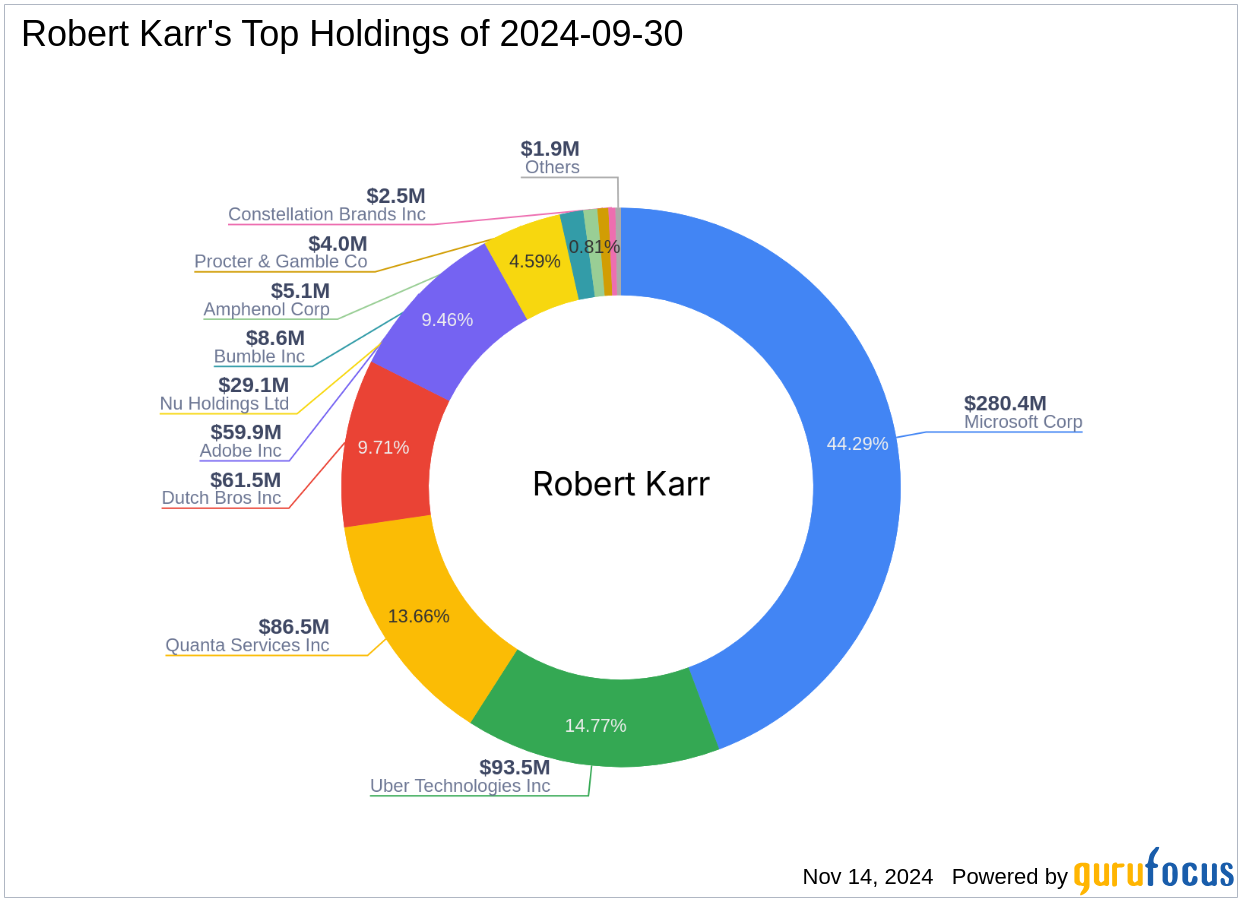

Portfolio Overview and Sector Focus

As of the third quarter of 2024, Robert Karr (Trades, Portfolio)'s portfolio included 12 stocks, with top holdings comprising 44.29% in Microsoft Corp (MSFT, Financial), 14.77% in Uber Technologies Inc (UBER, Financial), 13.66% in Quanta Services Inc (PWR, Financial), 9.71% in Dutch Bros Inc (BROS, Financial), and 9.46% in Adobe Inc (ADBE). The holdings are predominantly concentrated in five industries: Technology, Industrials, Consumer Cyclical, Financial Services, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.