Overview of the Recent Transaction

On September 30, 2024, Brandes Investment Partners, LP (Trades, Portfolio) executed a significant transaction involving the shares of Grifols SA (GRFS, Financial), a leading firm in the biopharmaceutical industry based in Spain. The firm reduced its holdings by 1,838,063 shares, which resulted in a 9.88% decrease in their previous stake. This adjustment left Brandes Investment Partners with a total of 16,758,727 shares in Grifols, reflecting a portfolio impact of -0.2%. The shares were traded at a price of $8.88 each.

Profile of Brandes Investment Partners, LP (Trades, Portfolio)

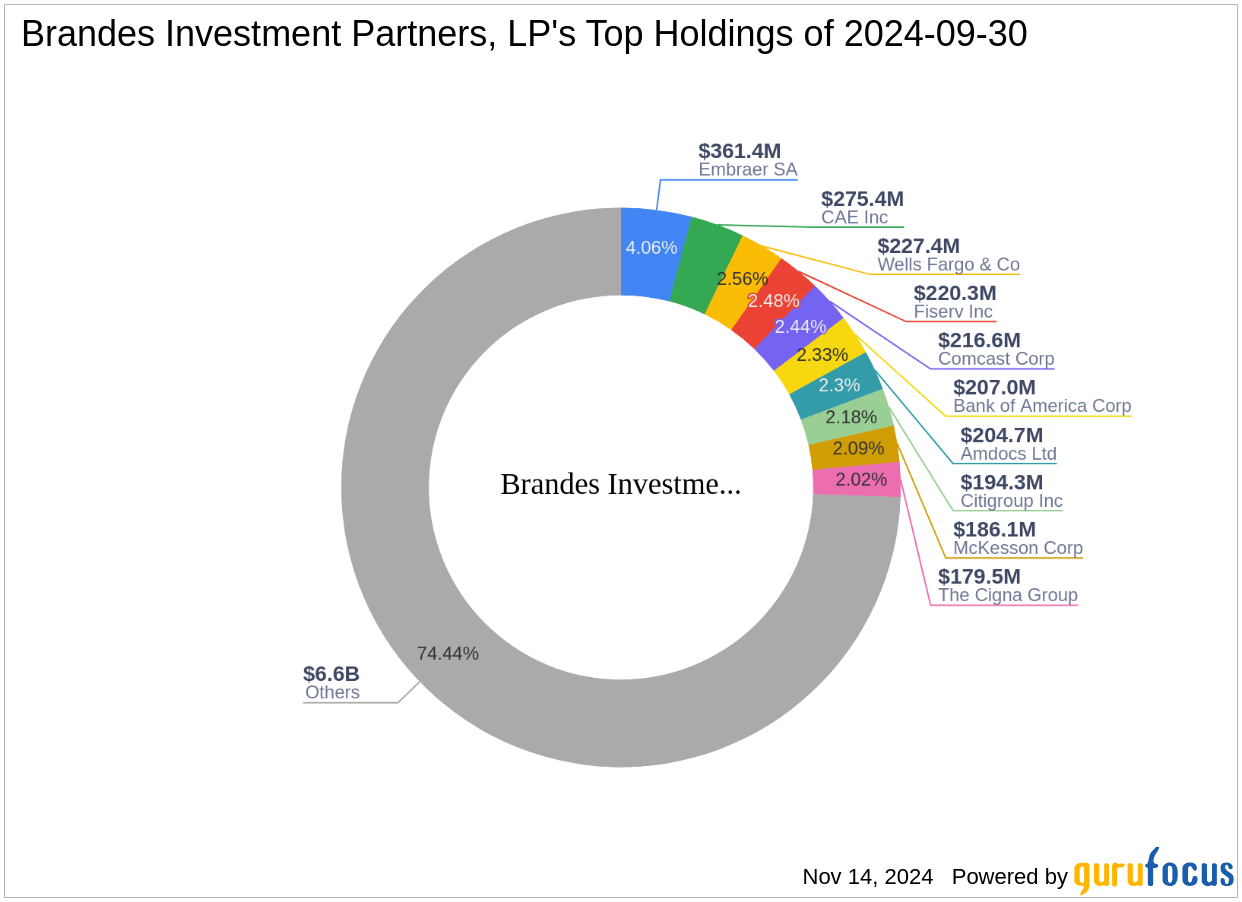

Founded in 1974 by Charles Brandes, Brandes Investment Partners, LP (Trades, Portfolio) has grown into a prominent investment advisory firm, managing a diverse range of global equity and fixed-income assets. The firm is known for its commitment to the value investing principles advocated by Benjamin Graham, focusing on acquiring undervalued securities and holding them until their market value is fully recognized. Brandes Investment Partners operates several funds, including the U.S. Equity and Global Equity Funds, and manages an equity portfolio valued at approximately $8.89 billion.

Introduction to Grifols SA

Grifols SA specializes in the production of plasma derivatives, leveraging its vertically integrated operations to collect plasma and manufacture as well as distribute plasma-derived products globally. The company expanded significantly after acquiring Talecris in 2011 and Biotest in April 2022. With a market capitalization of $6.51 billion, Grifols operates through various segments, with the biopharma segment accounting for 84% of its sales in 2023. Despite its strong market presence, the company's financial metrics such as a PE Ratio of 42.79 and a GF Value of 15.11 suggest a cautious investment approach.

Analysis of the Trade Impact

The reduction in Grifols SA shares by Brandes Investment Partners signifies a strategic portfolio adjustment, possibly reflecting the firm's assessment of Grifols' current valuation and future market potential. With a trade impact of -0.2% and a remaining position of 1.84% in their portfolio, this move could indicate a shift in the firm's investment strategy towards the stock, aligning with their value investment philosophy.

Market Context and Stock Performance

Grifols SA's stock has shown a price increase of 7.94% since the transaction, with a current price of $9.585. However, the stock has experienced a year-to-date decline of -13.26%. The GF Score of 75 suggests a potential for average performance in the future, supported by a moderate Profitability Rank of 7/10 and a Growth Rank of 5/10.

Sector and Industry Analysis

The healthcare sector, particularly the drug manufacturing industry, remains highly competitive and innovation-driven. Grifols, with its extensive product portfolio and global reach, stands as a significant player but faces challenges such as fluctuating profitability and market dynamics that influence investment attractiveness.

Insights from Other Significant Investors

Notable investors like George Soros (Trades, Portfolio) and Mario Gabelli (Trades, Portfolio) also hold stakes in Grifols SA, indicating the stock's appeal to diverse investment strategies. Comparing their investment approaches may provide deeper insights into the stock's varying perceptions in the financial community.

Future Outlook and Analyst Insights

Analysts remain cautiously optimistic about Grifols SA, considering its historical performance and strategic expansions. Future estimates and ratings will likely reflect the evolving dynamics of the global healthcare market and the company's operational adjustments.

This transaction by Brandes Investment Partners, LP (Trades, Portfolio) highlights a strategic reevaluation of Grifols SA within its portfolio, suggesting a nuanced approach to its investment in the healthcare sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.