Overview of Recent Transaction by Mason Hawkins (Trades, Portfolio)

On September 30, 2024, the investment firm led by Mason Hawkins (Trades, Portfolio) executed a significant transaction involving CNX Resources Corp (CNX, Financial), a key player in the natural gas sector. The firm reduced its holdings by 977,004 shares, which adjusted its total stake to 6,227,238 shares. This move resulted in a -1.39% impact on their portfolio, with the shares being traded at an average price of $32.57. Following this transaction, CNX Resources now comprises 8.96% of the firm's portfolio, reflecting a 4.10% ownership in the company.

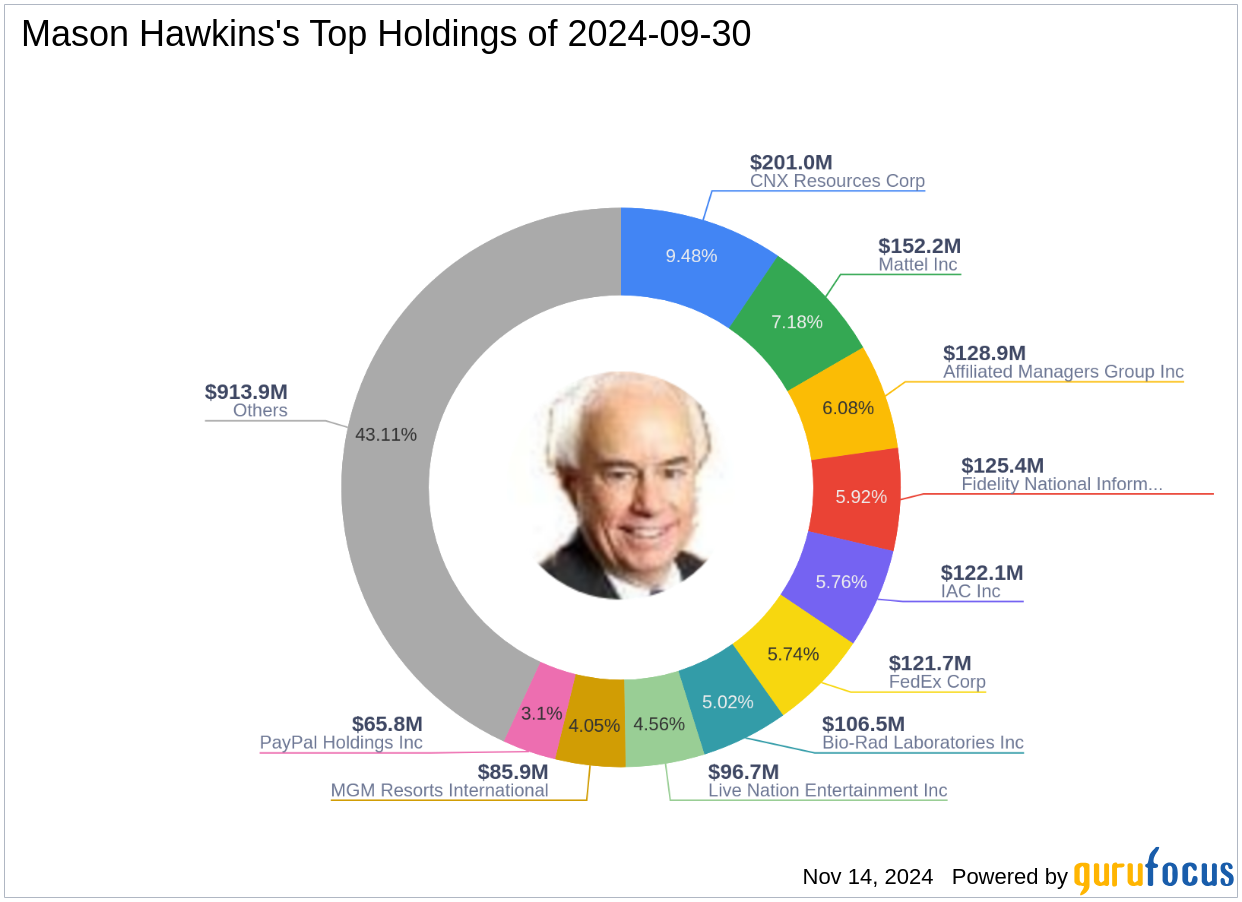

Insight into Mason Hawkins (Trades, Portfolio) and Southeastern Asset Management

Mason Hawkins (Trades, Portfolio), Chairman and CEO of Southeastern Asset Management since 1975, is renowned for his disciplined value investing approach. The firm, under Hawkins's leadership, focuses on acquiring stakes in undervalued companies with strong management and financials. Southeastern Asset Management is known for its concentrated investment strategy, typically holding fewer than 25 stocks. CNX Resources Corp remains a significant holding, aligning with the firm's criteria of investing in entities trading at substantial discounts to their intrinsic values.

Company Profile: CNX Resources Corp

Founded in 1999, CNX Resources Corp operates in the oil and gas industry, focusing primarily on natural gas extraction in the Appalachian Basin. The company is segmented into Shale and Coalbed Methane, with the majority of its revenue stemming from the Shale segment. Despite being labeled as significantly overvalued with a GF Value of $14.06 and a current stock price of $38.52, CNX has shown robust year-to-date growth of 89.29%.

Analysis of the Trade's Market Impact

The reduction in Mason Hawkins (Trades, Portfolio)'s stake in CNX Resources comes at a time when the stock has experienced significant appreciation, marked by an 18.27% increase in price since the transaction. This strategic reduction could signal a rebalancing act by Hawkins, possibly realigning the portfolio in anticipation of market adjustments or cashing in on recent gains. The firm's decision to decrease its position by 13.56% could also reflect a response to the stock's valuation, which currently stands at a high GF Value to price ratio of 2.73.

Comparative and Sector Analysis

Within the oil and gas sector, CNX Resources Corp is positioned as a mid-cap entity with a market capitalization of $5.75 billion. The sector is experiencing dynamic shifts, particularly with the increasing emphasis on low carbon technologies and sustainable practices. CNX's focus on low carbon intensity natural gas positions it well within this trend. Other notable investors in CNX include Mario Gabelli (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio), indicating a continued interest from high-profile investors despite the stock's high valuation.

Future Outlook and Strategic Considerations

The trading actions by Mason Hawkins (Trades, Portfolio) and Southeastern Asset Management might influence other investors' perceptions of CNX Resources Corp's value and future prospects. With the natural gas industry at a critical juncture amidst energy transitions, CNX's strategic focus on sustainability and efficiency will be crucial. Investors will be watching closely to see how the company's strategies align with market opportunities and regulatory changes in the coming years.

This analysis reflects data and market conditions as of November 14, 2024, providing a snapshot of Mason Hawkins (Trades, Portfolio)'s investment maneuvers and their implications in the broader financial landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.