Insights into the Investment Shifts of a Renowned Hedge Fund Manager

Louis Moore Bacon (Trades, Portfolio), an esteemed American hedge fund manager, recently disclosed his investment activities for the third quarter of 2024 through a 13F filing. Bacon, born in 1956, is celebrated for his global macro strategy in trading and investment. He founded Moore Capital Management in 1989, a prominent hedge fund based in New York City. After transitioning the fund to focus solely on his personal investments in late 2019, Bacon continues to influence the financial markets significantly. His latest moves provide valuable insights into his strategic thinking during this period.

Summary of New Buys

Louis Moore Bacon (Trades, Portfolio) expanded his portfolio by adding a total of 119 stocks. Notable new acquisitions include:

- Equinix Inc (EQIX, Financial), purchasing 74,951 shares, which now comprise 1.3% of the portfolio, valued at $66.53 million.

- Airbnb Inc (ABNB, Financial), with 428,288 shares, making up approximately 1.06% of the portfolio, valued at $54.31 million.

- SPDR S&P Regional Banking ETF (KRE, Financial), adding 950,000 shares, accounting for 1.05% of the portfolio, valued at $53.77 million.

Key Position Increases

Bacon also increased his stakes in 50 stocks, with significant boosts in:

- Meta Platforms Inc (META, Financial), adding 128,207 shares, resulting in a total of 141,544 shares. This adjustment marks a 961.29% increase in share count, impacting the portfolio by 1.44%, with a total value of $81.03 million.

- Cameco Corp (CCJ, Financial), with an additional 972,699 shares, bringing the total to 990,199. This represents a 5558.28% increase in share count, valued at $47.29 million.

Key Position Reductions

Significant reductions were made in 104 stocks, including:

- Amazon.com Inc (AMZN, Financial), with a reduction of 616,475 shares, leading to a 75.68% decrease in shares and a -2.13% impact on the portfolio. The stock had an average trading price of $182.46 during the quarter and has seen a 24.81% return over the past three months and a 39.73% year-to-date increase.

- GE Vernova Inc (GEV, Financial), reducing 545,013 shares, which resulted in a 98.2% decrease in shares and a -1.67% impact on the portfolio. The stock traded at an average price of $192.02 during the quarter and has returned 80.51% over the past three months.

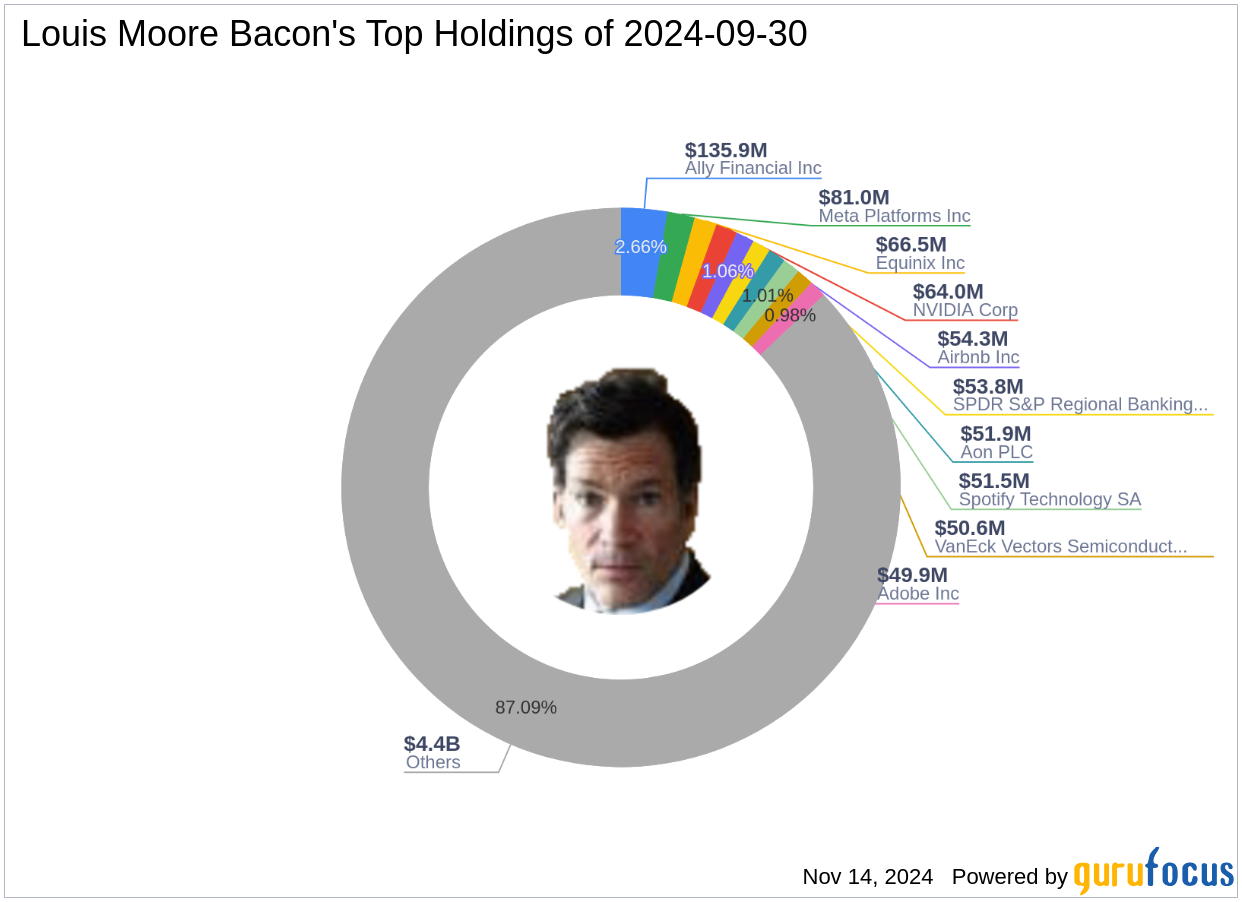

Portfolio Overview

As of the third quarter of 2024, Louis Moore Bacon (Trades, Portfolio)'s portfolio included 440 stocks. The top holdings were 2.66% in Ally Financial Inc (ALLY, Financial), 1.59% in Meta Platforms Inc (META, Financial), 1.3% in Equinix Inc (EQIX, Financial), 1.25% in NVIDIA Corp (NVDA, Financial), and 1.06% in Airbnb Inc (ABNB, Financial). The holdings are predominantly concentrated across 11 industries, including Financial Services, Technology, and Industrials, among others.

This detailed analysis of Louis Moore Bacon (Trades, Portfolio)'s latest 13F filing reveals strategic shifts and preferences, providing valuable insights for investors and market watchers alike.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.