Overview of Recent Transaction

On September 30, 2024, Deep Track Capital, LP (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 4,096,452 shares of 4D Molecular Therapeutics Inc (FDMT, Financial). This transaction, executed at a price of $10.81 per share, marks an increase of 35,051 shares, reflecting a modest portfolio impact of 0.01%. Following this acquisition, Deep Track Capital now holds a 7.88% stake in FDMT, making it a noteworthy move in the biotechnology sector.

Deep Track Capital, LP (Trades, Portfolio): A Strategic Investor

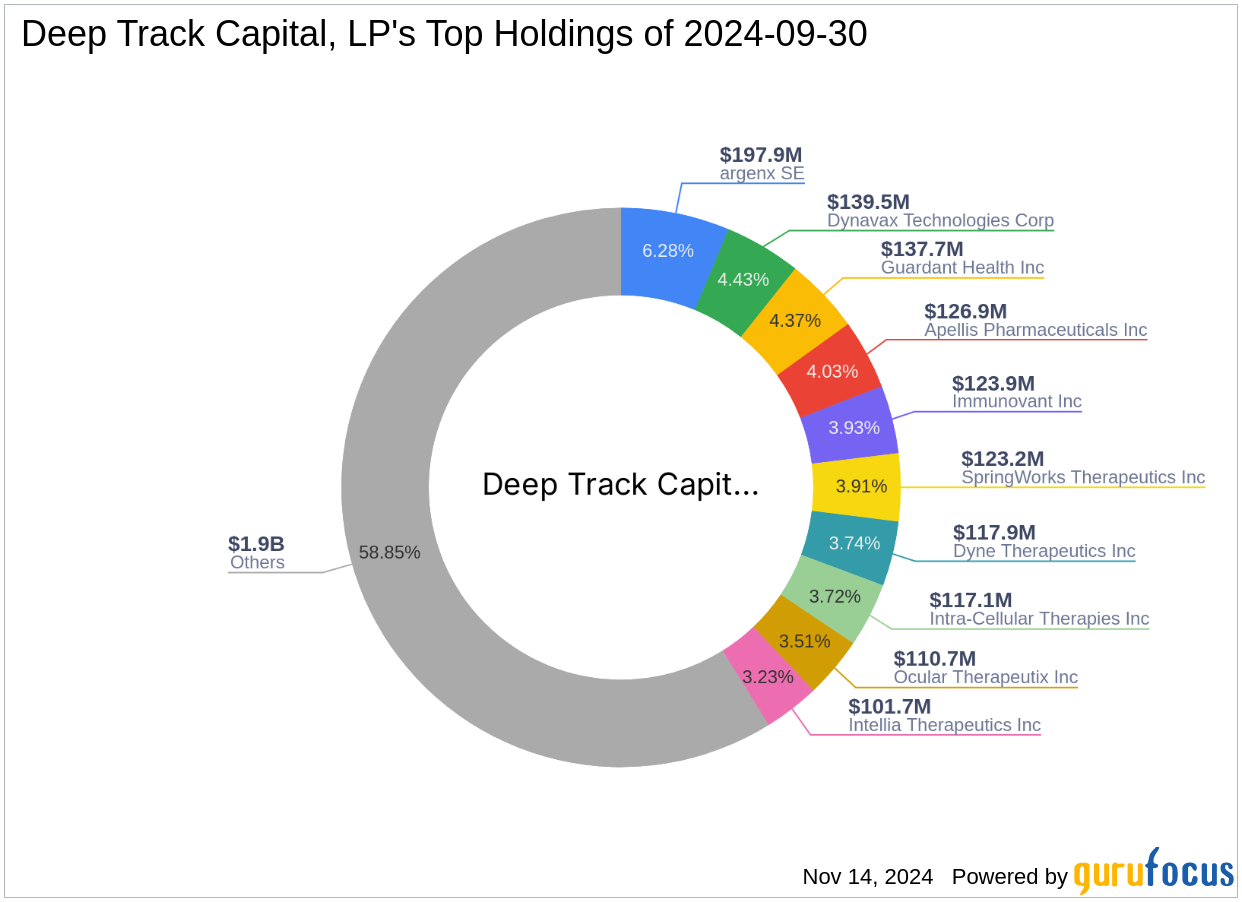

Deep Track Capital, LP (Trades, Portfolio), based in Greenwich, Connecticut, is recognized for its strategic investments in the healthcare and biotechnology sectors. With a portfolio of 71 stocks and an equity value of approximately $3.15 billion, the firm has consistently demonstrated a keen eye for promising biotech ventures. Its top holdings include notable names such as Dynavax Technologies Corp (DVAX, Financial) and argenx SE (ARGX, Financial), among others. Deep Track Capital's investment philosophy focuses on identifying and capitalizing on undervalued assets with significant growth potential.

Insight into 4D Molecular Therapeutics Inc

4D Molecular Therapeutics Inc, headquartered in the USA, operates as a clinical-stage gene therapy company. Since its IPO on December 11, 2020, FDMT has been at the forefront of developing targeted and evolved AAV vectors for gene therapy across various therapeutic areas including ophthalmology, cardiology, and pulmonology. The company collaborates with industry leaders like Astellas and the Cystic Fibrosis Foundation, enhancing its research and development capabilities.

Financial and Market Performance of FDMT

As of the latest data, 4D Molecular Therapeutics Inc has a market capitalization of $407.519 million, with a current stock price of $7.8415. Despite being labeled as modestly undervalued with a GF Value of $10.56, the stock has experienced a significant downturn, with a year-to-date price decrease of 63.1%. The company's financial strength and growth metrics, such as a Financial Strength rank of 7/10 and a Growth Rank of 2/10, suggest a challenging financial landscape.

Valuation and Investment Rationale

The GF Value of FDMT indicates that the stock is currently trading below its intrinsic value, which presents a potential investment opportunity for value investors. The GF Score of 63 suggests that the stock might face poor future performance potential, which aligns with its current market challenges. However, the strategic acquisition by Deep Track Capital could be based on long-term growth prospects in the biotechnology sector.

Strategic Positioning by Deep Track Capital

Deep Track Capital’s recent acquisition increases its total holdings in FDMT to over 4 million shares, accounting for 1.32% of its total portfolio. This strategic move likely reflects the firm's confidence in FDMT's long-term value, despite current market volatilities and the company's financial metrics.

Market Outlook and Future Prospects

The biotechnology industry is known for its high volatility and substantial growth potential. Companies like 4D Molecular Therapeutics, with innovative gene therapy solutions, are well-positioned to capitalize on technological advancements and strategic partnerships. However, the sector's future success heavily relies on regulatory approvals and market acceptance of new therapies.

Conclusion

The recent transaction by Deep Track Capital, LP (Trades, Portfolio) in 4D Molecular Therapeutics Inc underscores a significant endorsement of the company’s potential in the gene therapy market. While current financial metrics suggest caution, the strategic nature of this investment could align with long-term growth objectives in the evolving biotechnology landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.