Overview of the Recent Transaction

On September 30, 2024, Phoenix Financial Ltd. (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 606,204 shares of Ellomay Capital Ltd. (ELLO, Financial), an independent power producer based in Israel. This transaction increased Phoenix Financial's total holdings in Ellomay to 925,955 shares, marking a substantial increase of 189.59% in their position. The shares were purchased at a price of $12.01 each, reflecting a strategic move by the firm to bolster its presence in the utilities sector.

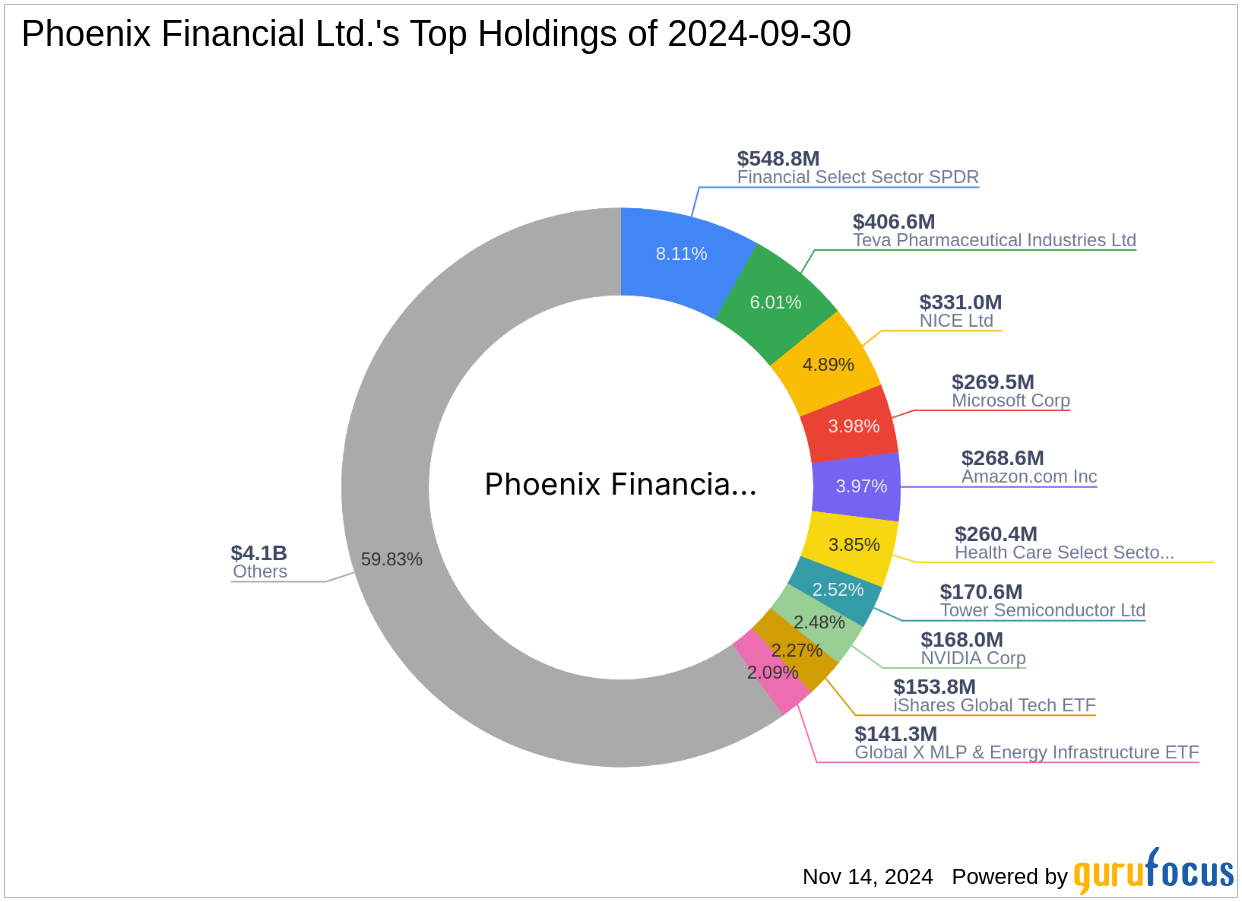

Phoenix Financial Ltd. (Trades, Portfolio) at a Glance

Located at 53 Derech Ha'shalom St., Givatayim, Phoenix Financial Ltd. (Trades, Portfolio) is a prominent investment firm with a keen focus on the Technology and Healthcare sectors. With top holdings in major companies like Financial Select Sector SPDR (XLF, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial), the firm manages an equity portfolio valued at approximately $6.77 billion. Phoenix Financial is known for its strategic investment decisions aimed at long-term value creation.

Introducing Ellomay Capital Ltd.

Founded in 1995 and headquartered in Israel, Ellomay Capital Ltd. operates primarily in the energy and infrastructure sectors, with a focus on renewable energy projects including Photovoltaic power plants and bio-gas facilities. The company has a market capitalization of $179.422 million and has been actively expanding its operations across various geographies, primarily in Spain.

Ellomay's Market Performance and Valuation

Despite a challenging market environment, Ellomay's stock price has seen a significant uptick of 16.24% since the transaction, currently priced at $13.96. The stock is considered modestly undervalued with a GF Value of $15.72, indicating a potential upside. However, the company's year-to-date performance shows a decline of 6.62%, reflecting the volatile nature of the utilities sector.

Strategic Impact on Phoenix Financial's Portfolio

The recent acquisition has increased Phoenix Financial's stake in Ellomay Capital to 7.20%, making it a significant part of their investment portfolio with a 0.17% position. This move aligns with Phoenix Financial's strategy to diversify into the utilities sector, which offers potential for stable returns and growth in the renewable energy market.

Financial Health and Future Prospects of Ellomay

Ellomay's financial health presents a mixed picture. The company's Financial Strength is relatively low, with a cash-to-debt ratio of 0.13, indicating higher leverage. However, its GF Score of 76 suggests a good potential for future performance. The company's focus on expanding its renewable energy footprint could drive long-term growth, despite current financial leverage concerns.

Conclusion

Phoenix Financial Ltd. (Trades, Portfolio)'s recent investment in Ellomay Capital Ltd. reflects a strategic positioning towards renewable energy and utilities, sectors that are expected to experience significant growth. This transaction not only diversifies Phoenix's portfolio but also aligns with global trends towards sustainable energy solutions. For value investors, this move by Phoenix Financial might signal a promising opportunity, especially considering Ellomay's growth potential and current market valuation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.