Insights into Ariel Investment's Latest Moves and Portfolio Adjustments

John Rogers (Trades, Portfolio), the founder of Ariel Investment, LLC, has been a prominent figure in the investment world since 1983. Known for his column "Patient Investor," Rogers has built a reputation on focusing on undervalued small and mid-cap companies. His investment philosophy emphasizes patience, independent thinking, and a long-term outlook, aiming to identify companies with high barriers to entry, sustainable competitive advantages, and predictable fundamentals that allow for significant earnings growth. His recent 13F filing for the third quarter of 2024 provides valuable insights into his strategic decisions during this period.

New Additions to the Portfolio

John Rogers (Trades, Portfolio) expanded his portfolio by adding four new stocks in the third quarter of 2024. The most notable new holdings include:

- Western Alliance Bancorp (WAL, Financial) with 363,305 shares, valued at $31.42 million, making up 0.32% of the portfolio.

- WEX Inc (WEX, Financial), comprising 149,440 shares, also representing about 0.32% of the portfolio, with a total value of $31.34 million.

- Comerica Inc (CMA, Financial) with 304,481 shares, accounting for 0.19% of the portfolio, valued at $18.24 million.

Significant Increases in Existing Positions

The third quarter also saw John Rogers (Trades, Portfolio) increase his stakes in 25 existing holdings. Key increases include:

- Bio-Rad Laboratories Inc (BIO, Financial), where Rogers added 274,508 shares, bringing his total to 378,695 shares. This adjustment marks a 263.48% increase in share count and a 0.94% impact on the current portfolio, valued at $126.70 million.

- The Middleby Corp (MIDD, Financial) saw an addition of 616,021 shares, resulting in a total of 1,126,148 shares. This represents a 120.76% increase in share count, with a total value of $156.68 million.

Complete Exits from Positions

In a significant portfolio adjustment, John Rogers (Trades, Portfolio) exited nine positions entirely in the third quarter of 2024, including:

- Stericycle Inc (SRCL, Financial), where Rogers sold all 1,526,043 shares, impacting the portfolio by -0.96%.

- Truist Financial Corp (TFC, Financial), with all 995,605 shares sold, causing a -0.42% impact on the portfolio.

Reductions in Key Holdings

John Rogers (Trades, Portfolio) also reduced his positions in 79 stocks. The most significant reductions were:

- Baidu Inc (BIDU, Financial), reduced by 718,141 shares, resulting in a -65.69% decrease in shares and a -0.67% impact on the portfolio. Baidu traded at an average price of $88.32 during the quarter and has seen a -2.01% return over the past three months and -29.07% year-to-date.

- Adtalem Global Education Inc (ATGE, Financial), reduced by 689,374 shares, marking a -23.43% reduction in shares and a -0.51% impact on the portfolio. Adtalem traded at an average price of $73.75 during the quarter and has returned 22.90% over the past three months and 52.42% year-to-date.

Portfolio Overview and Sector Allocation

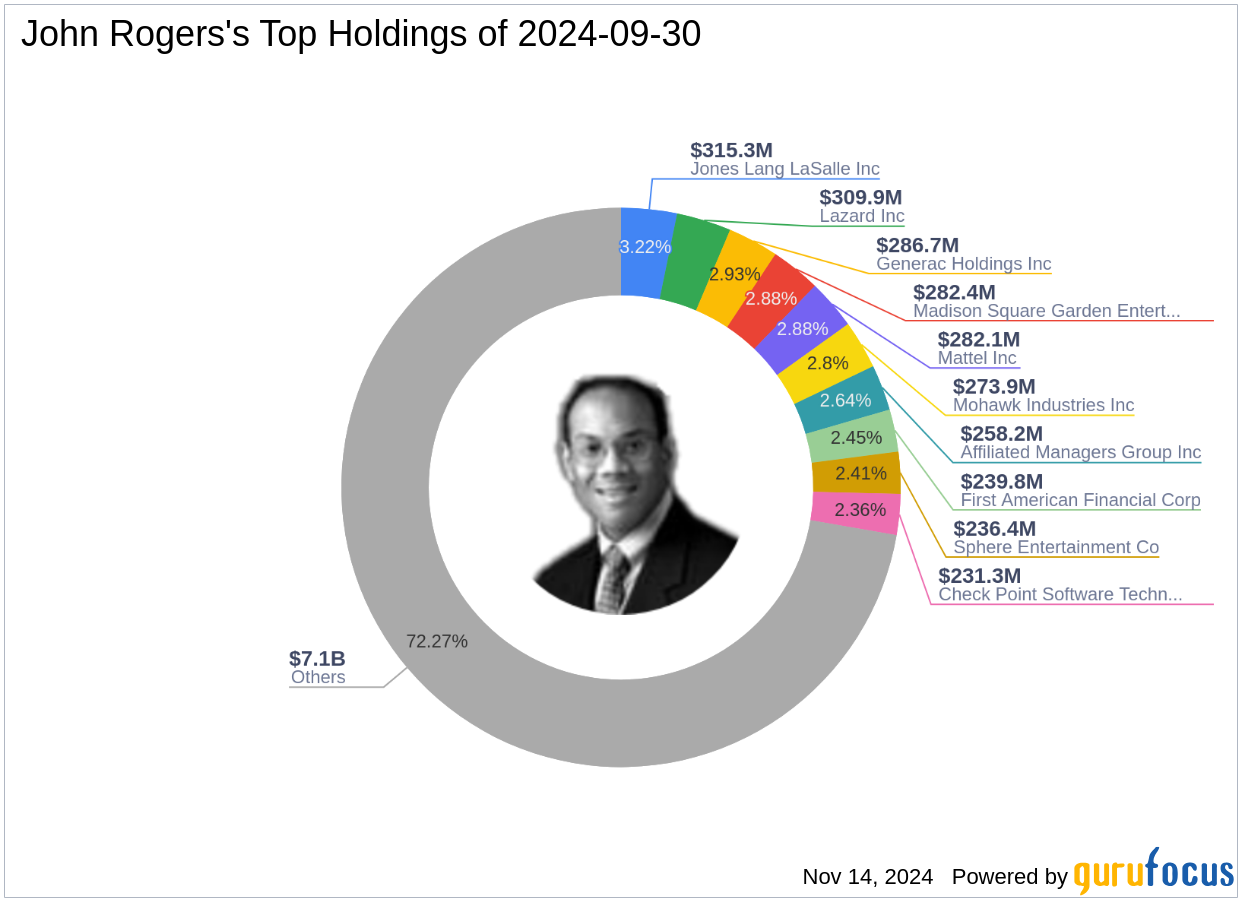

As of the third quarter of 2024, John Rogers (Trades, Portfolio)'s portfolio included 110 stocks. The top holdings were 3.22% in Jones Lang LaSalle Inc (JLL, Financial), 3.16% in Lazard Inc (LAZ, Financial), 2.93% in Generac Holdings Inc (GNRC, Financial), 2.88% in Madison Square Garden Entertainment Corp (MSGE, Financial), and 2.88% in Mattel Inc (MAT, Financial). The holdings are predominantly concentrated in 10 of the 11 industries, including Consumer Cyclical, Financial Services, Industrials, and more.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.