Insight into Akre's Latest 13F Filings and Strategic Shifts

Chuck Akre (Trades, Portfolio), the founder of Akre Capital Management, has recently disclosed his investment activities for the third quarter of 2024 through the latest 13F filing. With a career spanning over five decades, Akre is renowned for his value investment philosophy, focusing on companies with exceptional business models, capable management, and significant reinvestment opportunities. His strategy emphasizes long-term growth in economic value per share, viewing short-term market fluctuations as potential investment opportunities. This quarter's filing reveals significant adjustments in his portfolio, including a notable reduction in Moody's Corp and increased positions in several promising stocks.

Key Position Increases

During the third quarter, Chuck Akre (Trades, Portfolio) expanded his investments in five stocks. Noteworthy increases include:

- A substantial addition to Airbnb Inc (ABNB, Financial), with 1,713,522 additional shares, bringing the total to 2,649,398 shares. This adjustment marks a significant 183.09% increase in share count and a 1.81% impact on the current portfolio, totaling a value of $335,970,160.

- Another major increase was in CCC Intelligent Solutions Holdings Inc (CCCS, Financial), with an additional 2,865,676 shares, bringing the total to 10,681,398. This represents a 36.67% increase in share count, with a total value of $118,029,450.

Summary of Sold Out Positions

Chuck Akre (Trades, Portfolio) completely exited one holding in the third quarter of 2024:

- SBA Communications Corp (SBAC, Financial): Akre sold all 500,000 shares, resulting in a -0.86% impact on the portfolio.

Key Position Reductions

Akre also reduced his stakes in ten stocks, with significant changes in:

- Moodys Corp (MCO, Financial), where he reduced his holdings by 858,224 shares. This adjustment led to a -20.33% decrease in shares and a -3.18% impact on the portfolio. The stock traded at an average price of $463.45 during the quarter and has returned 3.58% over the past three months and 23.72% year-to-date.

- KKR & Co Inc (KKR, Financial) saw a reduction of 2,295,980 shares, resulting in a -16.77% reduction in shares and a -2.13% impact on the portfolio. The stock traded at an average price of $118.32 during the quarter and has returned 31.48% over the past three months and 84.70% year-to-date.

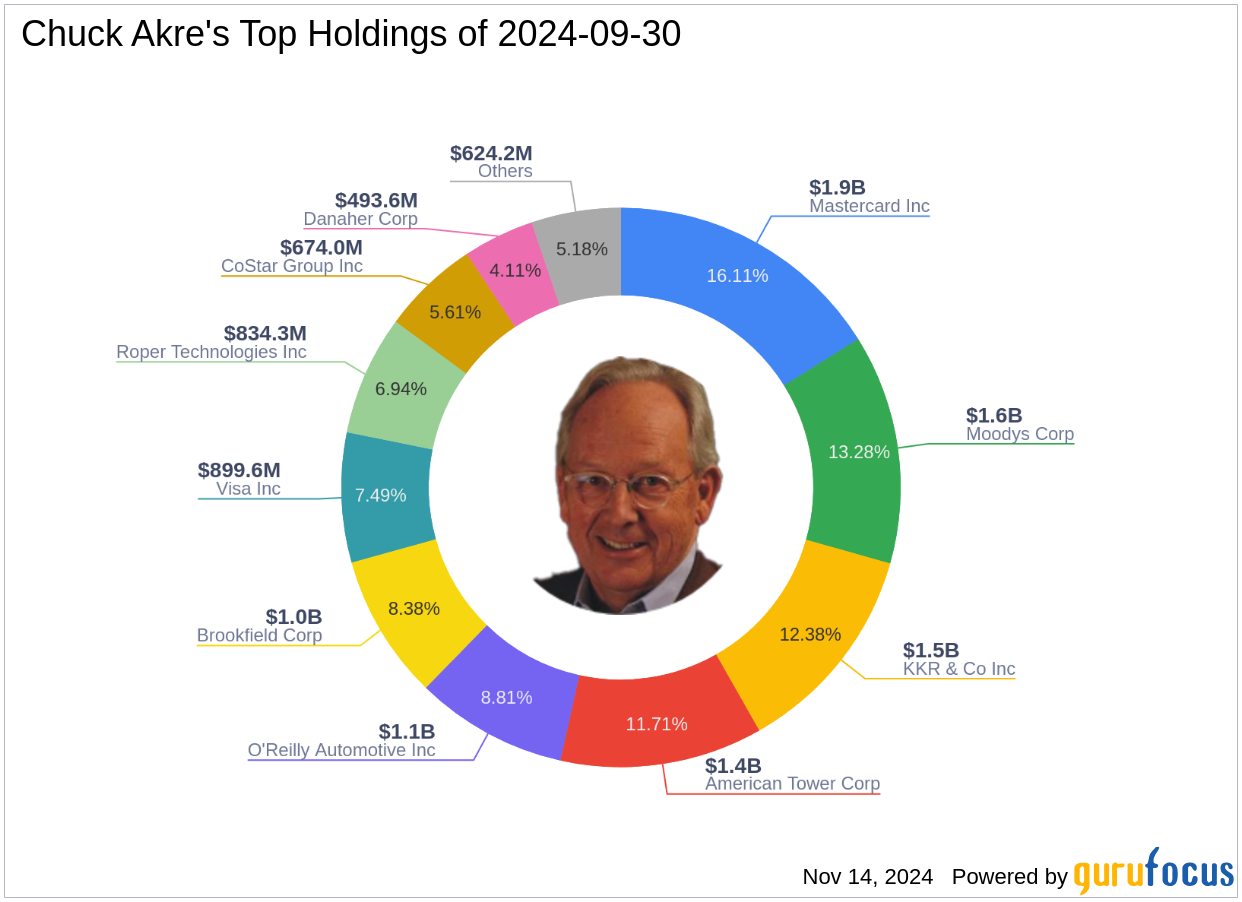

Portfolio Overview

As of the third quarter of 2024, Chuck Akre (Trades, Portfolio)'s portfolio included 18 stocks. The top holdings were 16.11% in Mastercard Inc (MA, Financial), 13.28% in Moodys Corp (MCO), 12.38% in KKR & Co Inc (KKR), 11.71% in American Tower Corp (AMT, Financial), and 8.81% in O'Reilly Automotive Inc (ORLY, Financial). The holdings are mainly concentrated in six industries: Financial Services, Real Estate, Consumer Cyclical, Technology, Healthcare, and Industrials.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.