Overview of Recent Transaction by Tocqueville Asset Management

On September 30, 2024, Tocqueville Asset Management L.P., a prominent New York-based investment firm, executed a significant transaction involving the shares of Coda Octopus Group Inc. (CODA, Financial). The firm decided to reduce its holdings in CODA by 50,831 shares, which resulted in a new total of 442,964 shares held. This move reflects a strategic adjustment in Tocqueville's investment portfolio, with the transaction carried out at a price of $7.25 per share.

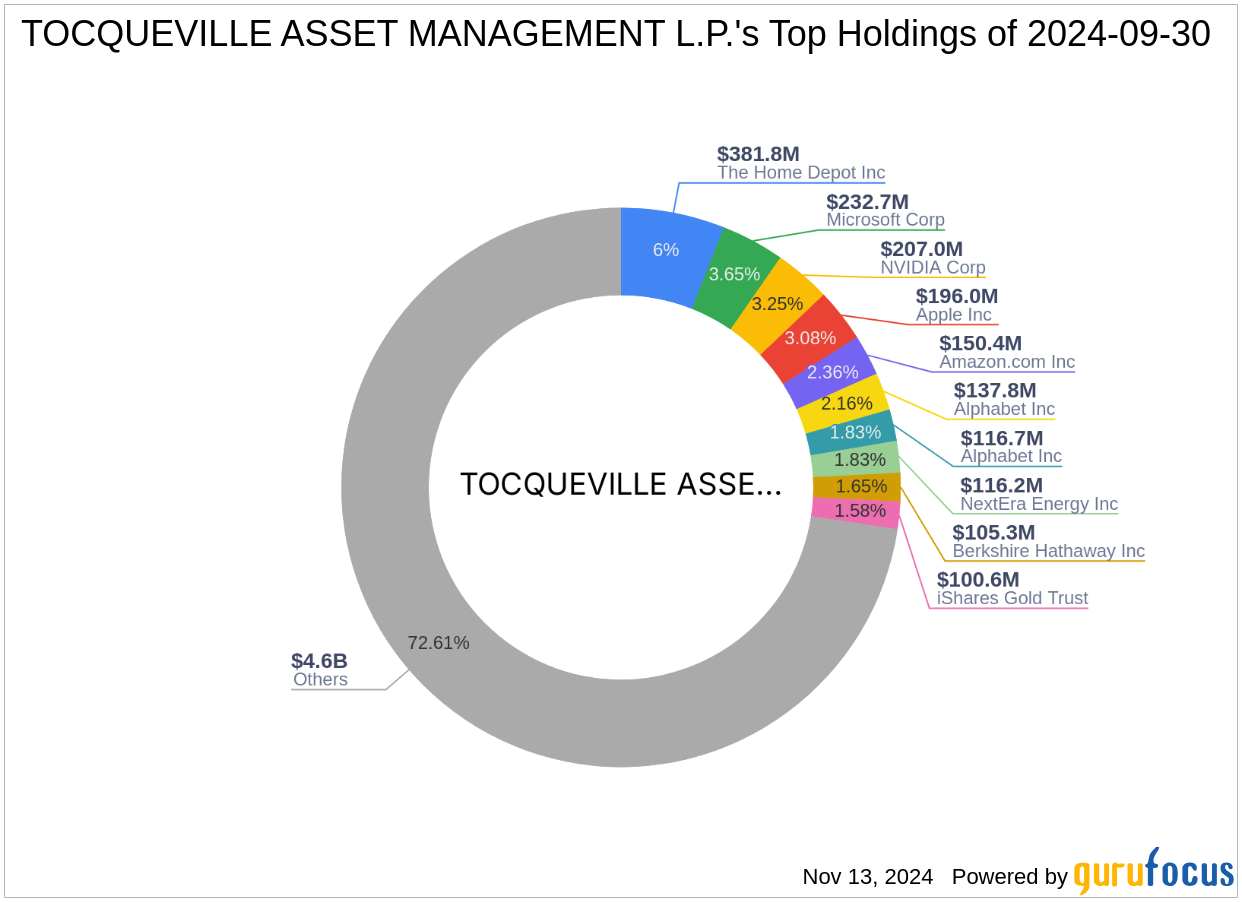

Insight into Tocqueville Asset Management L.P.

Founded in 1985, Tocqueville Asset Management has built a reputation for its contrarian investment approach and rigorous fundamental analysis. The firm manages over $13 billion in assets, focusing on value stocks across various sectors, with a significant emphasis on the materials sector. Tocqueville's investment philosophy is deeply rooted in challenging preconceived notions and adapting strategies based on market realities. The firm's client base primarily includes individuals and high net worth entities, among others.

Company Profile: Coda Octopus Group Inc.

Coda Octopus Group Inc., established in 1994, specializes in advanced underwater technologies with applications in imaging, mapping, defense, and surveying. The company operates through two main segments: Marine Technology and Marine Engineering, with the majority of its revenue generated from the Marine Technology segment. CODA's innovative solutions serve both commercial and defense markets globally.

Detailed Transaction Analysis

The reduction in CODA shares by Tocqueville Asset Management represents a 10.29% decrease in their previous holding, impacting their portfolio by a mere 0.01%. Despite this reduction, the firm still maintains a significant 4.00% holding in the company, indicating a continued belief in its value within a diversified investment strategy.

Market Impact and Valuation Concerns

Currently, Coda Octopus Group Inc. is considered significantly overvalued with a GF Value of $6.59, while the stock trades at $8.76, indicating a price to GF Value ratio of 1.35. This valuation suggests caution, as the stock price may not fully reflect underlying fundamentals. The stock has seen a substantial year-to-date increase of 43.72%, further emphasizing the need for careful analysis.

Performance and Sector Analysis

CODA scores highly on the GF Score with 80/100, indicating potential for future performance. The company's financial strength and profitability are robust, with a Financial Strength rank of 10/10 and a Profitability Rank of 7/10. However, its growth metrics are less impressive, reflecting some challenges in expanding its market reach.

Conclusion: Strategic Implications for Tocqueville Asset Management

The recent transaction by Tocqueville Asset Management in reducing its stake in Coda Octopus Group Inc. aligns with its strategic portfolio adjustments and contrarian investment approach. While CODA remains a significant part of Tocqueville's diverse portfolio, the firm's cautious reduction mirrors its commitment to adapting strategies based on comprehensive market analysis and valuation metrics. Investors and market watchers will be keen to see how this adjustment plays out in the firm’s performance in the coming quarters.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.