Overview of the Recent Transaction

On November 8, 2024, FMR LLC (Trades, Portfolio) executed a significant transaction by reducing its holdings in PagSeguro Digital Ltd (PAGS, Financial), a key player in the Brazilian financial technology sector. The firm sold 6,514,027 shares at a price of $8.12 each, resulting in a notable shift in its investment portfolio. Post-transaction, FMR LLC (Trades, Portfolio) retains 13,308,774 shares, marking a substantial adjustment but maintaining a considerable stake in the company.

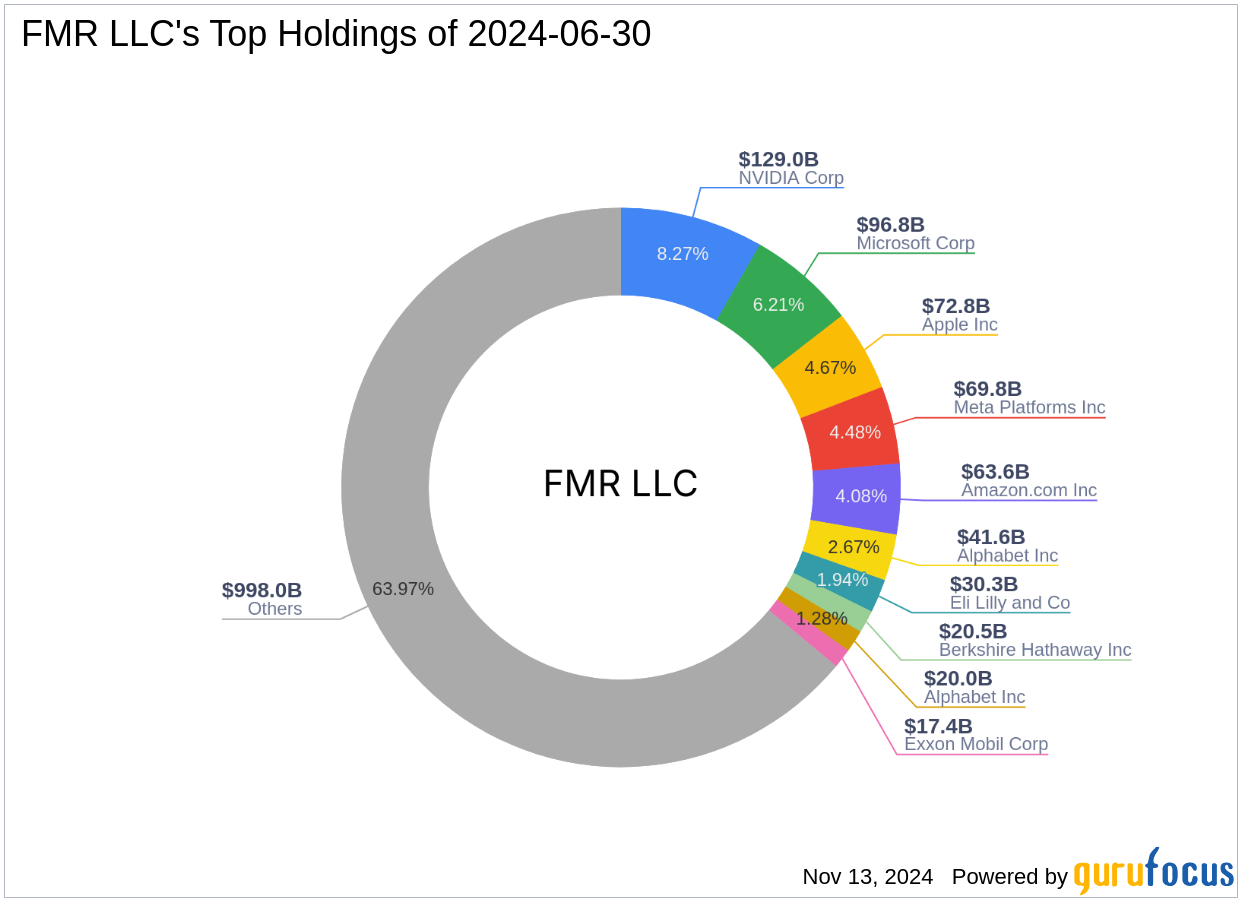

Insight into FMR LLC (Trades, Portfolio)

FMR LLC (Trades, Portfolio), commonly known as Fidelity, was established in 1946 and has grown into a powerhouse in investment management. With a history of pioneering mutual funds and embracing technological innovations in trading, Fidelity has consistently focused on growth through strategic risk-taking and research-driven investment decisions. The firm's investment philosophy centers on leveraging individual talent and cutting-edge technology to manage a diverse array of assets, which now surpass $1 trillion.

About PagSeguro Digital Ltd

PagSeguro Digital Ltd, headquartered in Brazil, specializes in providing comprehensive financial technology solutions aimed primarily at micro-merchants and small to medium-sized businesses. Since its IPO on January 24, 2018, PagSeguro has offered a variety of services including payment solutions, digital accounts, and access to working capital, facilitating seamless financial transactions and business management for its clients.

Impact of the Trade on FMR LLC (Trades, Portfolio)’s Portfolio

The recent sale of PagSeguro shares by FMR LLC (Trades, Portfolio) has slightly altered the firm's portfolio composition, with the transaction representing a 0.01% position. Despite this reduction, FMR LLC (Trades, Portfolio) still holds a significant 6.36% of its portfolio in PAGS, indicating a continued belief in the stock’s potential, albeit at a reduced exposure.

Current Market Performance of PagSeguro Digital Ltd

Currently, PagSeguro's stock is trading at $8.51, which is below the GF Value of $20.37, suggesting that the stock might be undervalued. However, with a GF Value Rank of 2/10, investors are advised to think twice, as it could be a potential value trap. The stock has seen a year-to-date decline of 29.79%, reflecting broader market challenges and internal company dynamics.

Strategic Sector Focus

Technology and healthcare are predominant sectors within FMR LLC (Trades, Portfolio)’s investment portfolio, reflecting the firm's strategic emphasis on industries driven by innovation and growth. This focus influences investment decisions, aligning with the firm’s historical approach to prioritizing sectors that are poised for long-term value creation.

Future Outlook for PagSeguro Digital Ltd

The decision by FMR LLC (Trades, Portfolio) to reduce its stake in PagSeguro might be indicative of a strategic realignment or risk management tactic, considering the stock's current market performance and valuation concerns. Looking forward, PagSeguro's focus on expanding its fintech solutions and capturing more of the digital payments market in Brazil could potentially enhance its financial metrics and market position.

Conclusion

In summary, FMR LLC (Trades, Portfolio)'s recent reduction in PagSeguro Digital Ltd shares marks a significant portfolio adjustment. This move reflects broader strategic considerations and market evaluations. Investors and market watchers will be keenly observing the future performance of PagSeguro, as it continues to innovate within the fintech space.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.