Overview of FIL Ltd (Trades, Portfolio)'s Recent Transaction

On November 8, 2024, FIL Ltd (Trades, Portfolio), a prominent investment firm, executed a significant transaction by acquiring 12,415,598 shares of Emera Inc (EMRAF, Financial), marking a new holding in their investment portfolio. This purchase, made at a price of $36.17 per share, represents a 0.44% impact on FIL Ltd (Trades, Portfolio)'s portfolio, establishing a 4.31% ownership stake in Emera Inc. This strategic move highlights FIL Ltd (Trades, Portfolio)'s ongoing adjustments to its diverse and expansive investment portfolio.

Profile of FIL Ltd (Trades, Portfolio)

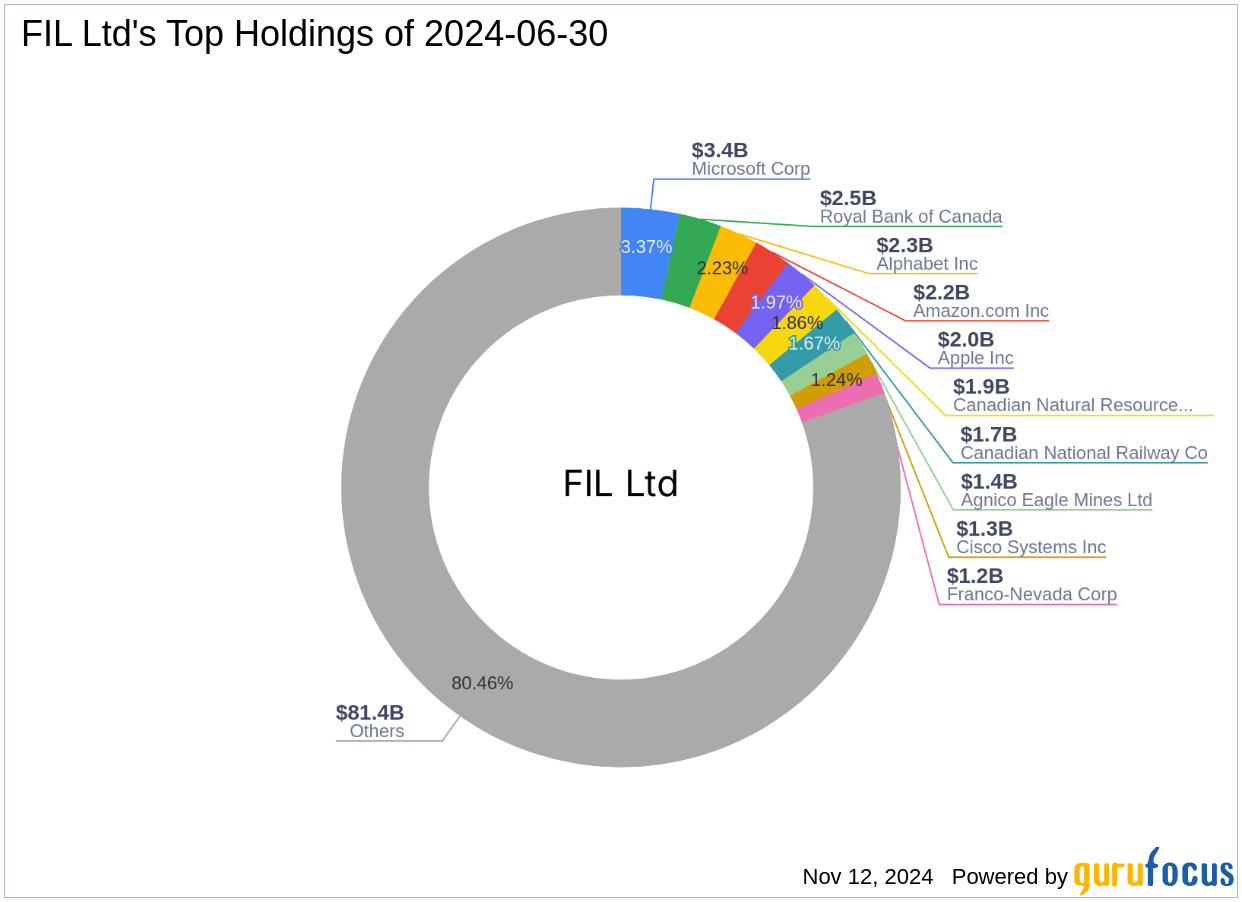

FIL Ltd (Trades, Portfolio), known globally as Fidelity Worldwide Investments, was established in 1969 and has grown into one of the world’s largest investment management firms. With a presence in 24 countries and a team of over 7,000 employees, the firm manages a vast array of assets across multiple sectors. Fidelity Worldwide Investments is renowned for its research-driven, bottom-up investment approach, focusing on long-term value creation. The firm’s top holdings include major names like Apple Inc (AAPL, Financial) and Microsoft Corp (MSFT, Financial), predominantly in the technology and financial services sectors.

Introduction to Emera Inc

Emera Inc is a diversified utility company based in Canada, involved in electricity generation, transmission, and distribution, as well as gas transmission and utility energy services. With operations spread across North America and the Caribbean, Emera plays a crucial role in the energy sector. The company is currently valued at $10.35 billion, with a stock price of $36.13, closely aligning with its GF Value of $37.87, indicating it is fairly valued.

Analysis of the Trade's Impact

The acquisition of Emera Inc shares by FIL Ltd (Trades, Portfolio) not only diversifies the firm's portfolio but also strengthens its position in the utilities sector. This move is aligned with FIL Ltd (Trades, Portfolio)’s strategy of investing in stable and regulated industries. The trade represents a significant new position, accounting for 0.44% of FIL Ltd (Trades, Portfolio)'s total portfolio, which underscores the strategic importance of this investment within their broader asset allocation.

Market Context and Strategic Importance

At the time of the transaction, Emera Inc was trading at a price-to-GF Value ratio of 0.95, suggesting that the stock was nearly fairly valued. The company's stock has seen a year-to-date decline of 5.39%, which may have presented a buying opportunity for FIL Ltd (Trades, Portfolio). The firm's decision to invest in Emera could be attributed to the stock's stable financial metrics and a solid GF Score of 75/100, indicating potential for long-term performance.

Future Outlook and Implications

The investment in Emera Inc is expected to contribute positively to FIL Ltd (Trades, Portfolio)'s portfolio, especially given the utility sector's reputation for providing steady dividends and stable growth. This sector aligns well with FIL Ltd (Trades, Portfolio)’s investment philosophy which prioritizes long-term value and stability. The broader implications for the market segment of Utilities - Regulated suggest that FIL Ltd (Trades, Portfolio) is positioning itself to capitalize on consistent returns from this industry, amidst varying economic conditions.

In conclusion, FIL Ltd (Trades, Portfolio)'s acquisition of a new stake in Emera Inc reflects a strategic alignment with its investment objectives, focusing on stability and long-term growth within the utilities sector. This move is likely to influence both the firm's portfolio performance and the broader market dynamics in the regulated utilities segment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.