Introduction to the Transaction

On November 8, 2024, FIL Ltd (Trades, Portfolio), a prominent asset management firm, executed a significant transaction by acquiring an additional 80,250,100 shares of VNET Group Inc. This move not only increased FIL Ltd (Trades, Portfolio)'s total holdings in VNET to 96,300,120 shares but also raised its position in the company to 6.36% of its portfolio, reflecting a substantial commitment to VNET.

Profile of FIL Ltd (Trades, Portfolio)

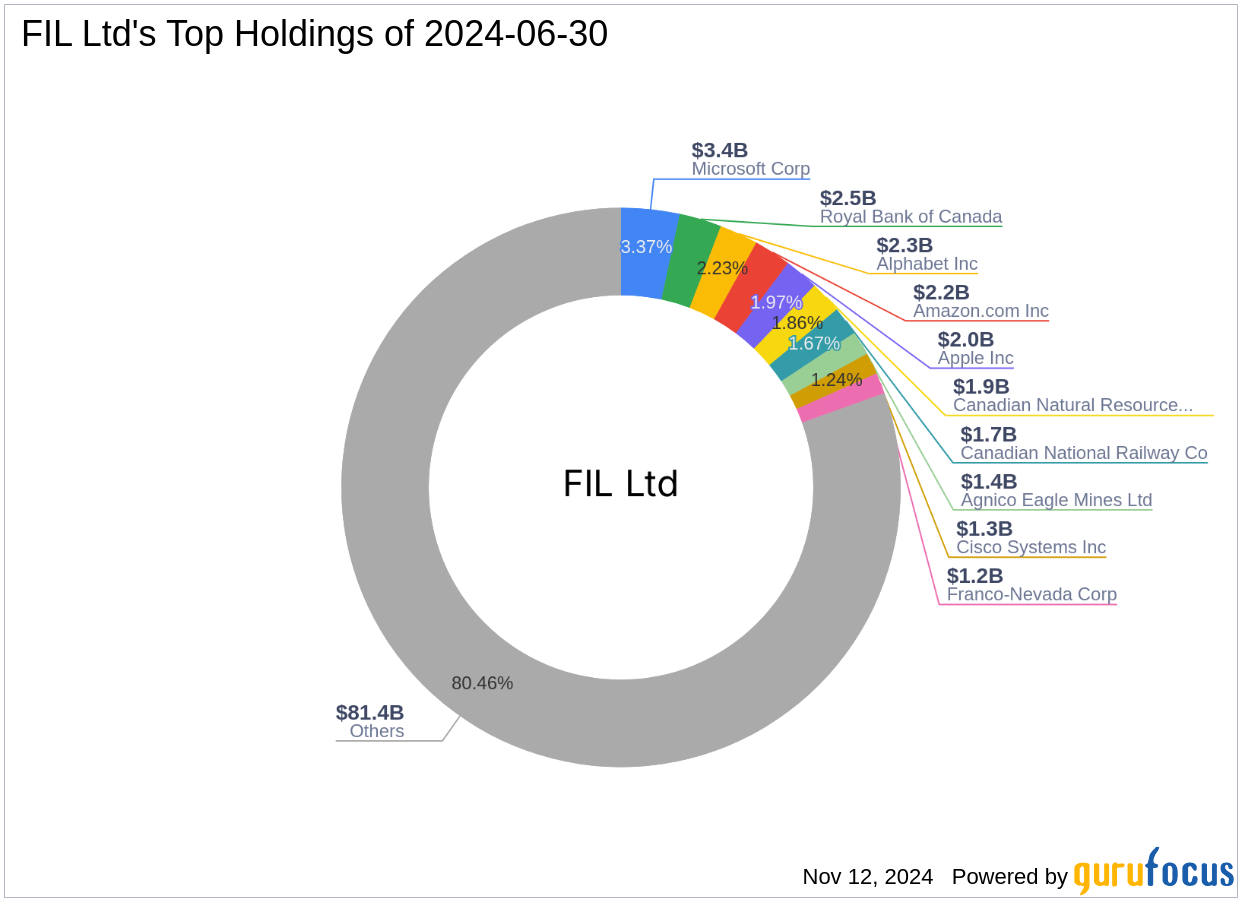

FIL Ltd (Trades, Portfolio), known globally as Fidelity Worldwide Investments, was established in 1969 and has since grown into a major player in the international investment scene. With a presence in 24 countries and a team of over 7,000 employees, the firm manages a diverse array of investment funds and strategies. Fidelity Worldwide Investments is renowned for its research-driven, bottom-up investment approach, focusing on long-term value creation across various asset classes. The firm's top holdings include major names like Apple Inc, Amazon.com Inc, and Microsoft Corp, emphasizing its strong inclination towards technology and financial services sectors.

Overview of VNET Group Inc

VNET Group Inc, formerly known as 21Vianet and listed on the Nasdaq since 2011, is a leading provider of data center services in China. The company has expanded its services to include colocation and cloud services, catering to both retail and hyperscale customers like Alibaba Cloud and Tencent Cloud. As of mid-2024, VNET operates a substantial infrastructure comprising thousands of cabinets and significant wholesale capacity, positioning it as a key player in China's IT services industry.

Details of the Trade

The recent acquisition by FIL Ltd (Trades, Portfolio) was conducted at a price of $3.49 per share, marking a strategic addition to its portfolio. Post-transaction, the firm's stake in VNET now represents 0.33% of its total portfolio with a modest impact of 0.28% on its overall composition. This move underscores FIL Ltd (Trades, Portfolio)'s confidence in VNET's growth prospects despite the stock's modest overvaluation relative to the GF Value of $2.94.

Financial Analysis of VNET Group Inc

VNET's financial health presents a mixed picture. The company's stock performance has seen a year-to-date increase of 28.89%, although it remains significantly down by 82.82% since its IPO. The GF Score of 64 suggests a moderate future performance potential, supported by a strong growth rank of 8/10. However, challenges are evident in its profitability and financial strength, with low rankings in these areas reflecting underlying risks.

Market Context and Strategic Implications

FIL Ltd (Trades, Portfolio)'s decision to increase its investment in VNET likely stems from a belief in the company's strategic positioning within the rapidly growing Chinese digital economy. This investment could leverage VNET's expanding infrastructure and client base, potentially leading to significant returns as the market for cloud and data center services continues to evolve in the region.

Conclusion

The recent transaction by FIL Ltd (Trades, Portfolio) highlights a significant endorsement of VNET Group Inc's market position and future potential. By increasing its stake, FIL Ltd (Trades, Portfolio) not only capitalizes on the expected growth trajectory of China's IT infrastructure sector but also aligns its portfolio with emerging technological trends. This move could bear substantial implications for both entities, influencing their operational and financial strategies in the forthcoming years.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.