Overview of the Recent Transaction

On September 30, 2024, Morgan Stanley executed a significant transaction involving the Western Asset Inflation-Linked Opportunities and Income Fund (WIW, Financial), marking a strategic move within its investment portfolio. The firm reduced its holdings by 11,577,873 shares, resulting in a remaining total of 3,213,991 shares. This adjustment reflects a notable shift in Morgan Stanley's investment strategy, with the transaction carried out at a price of $8.84 per share.

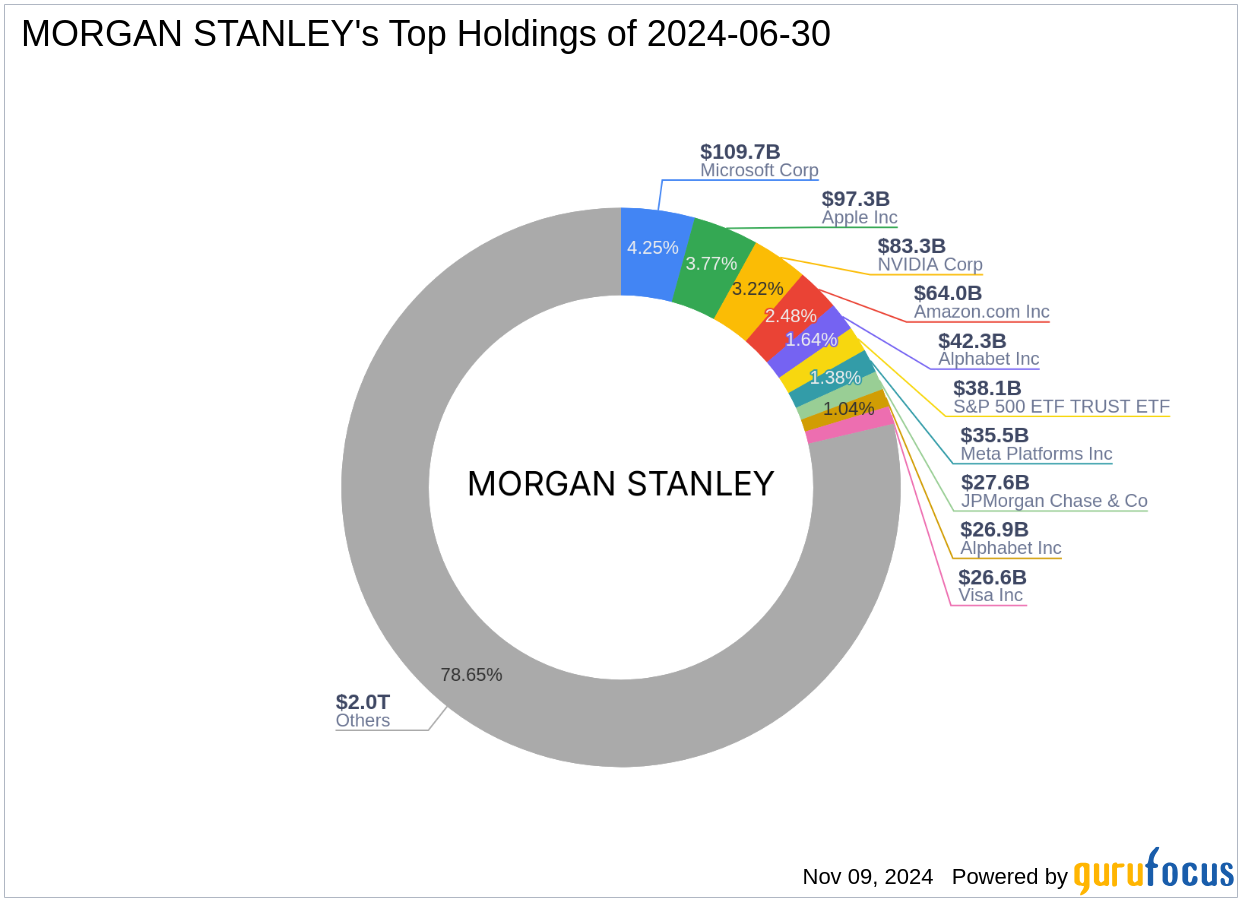

Insight into Morgan Stanley

Morgan Stanley, established in 1935, has evolved into a global leader in financial services, offering a wide array of investment banking, securities, investment management, and wealth management services. With a presence in 42 countries and over 1,300 offices worldwide, the firm manages assets worth over $800 billion. Its operations are divided into three main segments: Institutional Securities, Wealth Management, and Investment Management, highlighting its diversified approach to financial services.

Analysis of Morgan Stanley's Trade Action

The recent reduction in WIW shares by Morgan Stanley significantly alters the firm's exposure to the asset management industry. This move could be indicative of a strategic realignment or risk management adjustment, considering the current economic climate and market conditions. Despite the large number of shares sold, this transaction had a minimal impact on the firm's overall portfolio, suggesting a calculated adjustment rather than a wholesale strategy shift.

About Western Asset Inflation-Linked Opportunities and Income Fund

Western Asset Inflation-Linked Opportunities and Income Fund is a diversified, closed-end management investment company focused primarily on current income and, secondarily, on capital appreciation. With a market capitalization of approximately $537.198 million and a stock price of $8.78, WIW aims to meet the needs of income-focused investors.

Financial Health and Stock Performance Indicators

WIW currently holds a GF Score of 37 out of 100, indicating potential challenges in future performance. The fund's financial strength and profitability are areas of concern, with low rankings in both sectors. Additionally, the stock has experienced a significant revenue decline over the past three years, further impacting its growth prospects.

Strategic Implications and Market Positioning

Morgan Stanley's investment philosophy often reflects a blend of tactical asset allocation and strategic market insights. The reduction in WIW shares may align with a broader strategy to optimize return on investment against market volatility and inflation concerns. This move also positions Morgan Stanley to potentially increase investments in sectors that align more closely with emerging economic trends and opportunities.

Comparative and Future Outlook

Within the asset management industry, WIW's performance and financial health have been relatively weaker, which might have influenced Morgan Stanley's decision to reduce its stake. Looking forward, the fund's management will need to address these challenges to improve its attractiveness to institutional investors. For Morgan Stanley, this transaction is likely part of a larger portfolio realignment strategy aimed at capitalizing on more robust investment opportunities in the current economic environment.

In conclusion, Morgan Stanley's recent reduction in its holdings of WIW shares is a strategic move that reflects its adaptive investment approach in response to changing market conditions. This decision not only impacts the firm's portfolio but also highlights important trends within the asset management sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.