Overview of the Recent Transaction

On September 30, 2024, FMR LLC (Trades, Portfolio), a prominent investment firm, expanded its portfolio by acquiring an additional 821,597 shares of AMN Healthcare Services Inc (AMN, Financial), a leading healthcare staffing company in the United States. This transaction increased FMR LLC (Trades, Portfolio)'s total holdings in AMN to 4,640,598 shares, reflecting a significant investment at a trade price of $42.39 per share. This move underscores FMR LLC (Trades, Portfolio)'s strategic positioning within the healthcare sector, marking a notable expansion in one of its key investment areas.

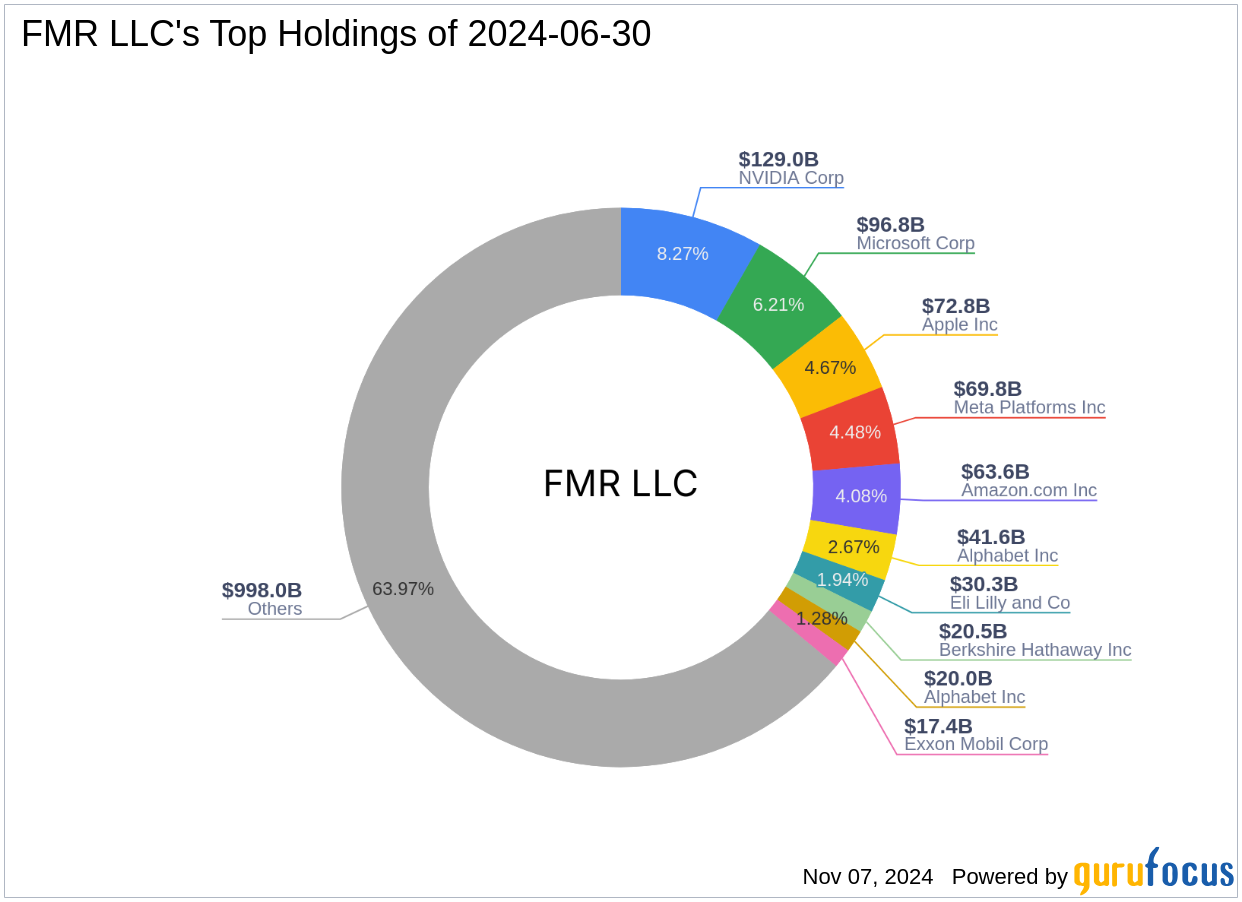

Profile of FMR LLC (Trades, Portfolio)

FMR LLC (Trades, Portfolio), widely recognized as Fidelity Investments, was founded in 1946 and has evolved into a global powerhouse in financial services. The firm is known for its rigorous research and a commitment to long-term growth opportunities, managing a diverse portfolio that spans various sectors with a significant emphasis on technology and healthcare. Fidelity's approach combines innovative technology with deep sector expertise, aiming to deliver consistent returns to its investors.

Insight into AMN Healthcare Services Inc

AMN Healthcare Services Inc, established with an IPO on November 13, 2001, operates primarily in nurse and allied solutions, physician and leadership solutions, and technology and workforce solutions. With a market capitalization of $1.54 billion and a PE ratio of 15.68, AMN plays a pivotal role in the U.S. healthcare staffing industry. Despite recent market challenges, AMN remains significantly undervalued with a GF Value of $70.91, suggesting a strong potential for future appreciation.

Impact of the Trade on FMR LLC (Trades, Portfolio)'s Portfolio

The recent acquisition of AMN shares represents a modest yet strategic addition to FMR LLC (Trades, Portfolio)'s extensive portfolio, accounting for a 0.01% position. This move aligns with FMR LLC (Trades, Portfolio)'s broader investment strategy, which balances robust positions in major sectors like technology and healthcare, demonstrating confidence in AMN's growth prospects and stability within the healthcare industry.

Market Context and Stock Valuation

AMN Healthcare Services Inc is currently trading at a price to GF Value ratio of 0.58, indicating that the stock is significantly undervalued. This valuation is particularly compelling given the stock's historical performance and the intrinsic value calculated through GuruFocus's exclusive methods. Despite a year-to-date price decline of 47.56%, the long-term growth potential based on its fundamental strengths remains attractive.

Sector and Market Analysis

The healthcare sector, particularly staffing, faces various challenges and opportunities. AMN's role as a major player in this sector aligns with FMR LLC (Trades, Portfolio)'s investment strategy, which often focuses on sectors with long-term growth potential. The ongoing demand for healthcare professionals and AMN's comprehensive service offerings position it well to capitalize on industry trends.

Performance Metrics and Future Outlook

AMN boasts a Profitability Rank of 10/10 and a Growth Rank of 10/10, reflecting its strong market position and potential for future earnings growth. The company's robust Piotroski F-Score and solid earnings growth over the past three years underscore its operational efficiency and financial health.

Other Significant Investors

Alongside FMR LLC (Trades, Portfolio), Gotham Asset Management, LLC, and Keeley-Teton Advisors, LLC (Trades, Portfolio) are notable investors in AMN, each employing distinct investment strategies but similarly recognizing AMN's value and potential within the healthcare sector.

Conclusion

FMR LLC (Trades, Portfolio)'s recent acquisition of AMN shares is a calculated move that fits well within its larger portfolio strategy, emphasizing growth and innovation in high-potential sectors. As AMN continues to navigate the evolving healthcare landscape, this investment may offer substantial returns, reflecting FMR LLC (Trades, Portfolio)'s adept selection and strategic market positioning.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.