Overview of Invesco's Recent Acquisition

In a notable transaction dated September 30, 2024, Invesco Ltd. (Trades, Portfolio) strategically increased its holdings in Endava PLC (DAVA, Financial), a prominent UK-based IT services firm. The firm added 94,519 shares to its portfolio, bringing its total ownership to 3,195,179 shares. This move reflects a significant commitment to Endava, with the trade executed at a price of $25.54 per share. Despite the substantial addition of shares, this transaction has a modest impact on Invesco’s vast portfolio, representing a 0.02% position.

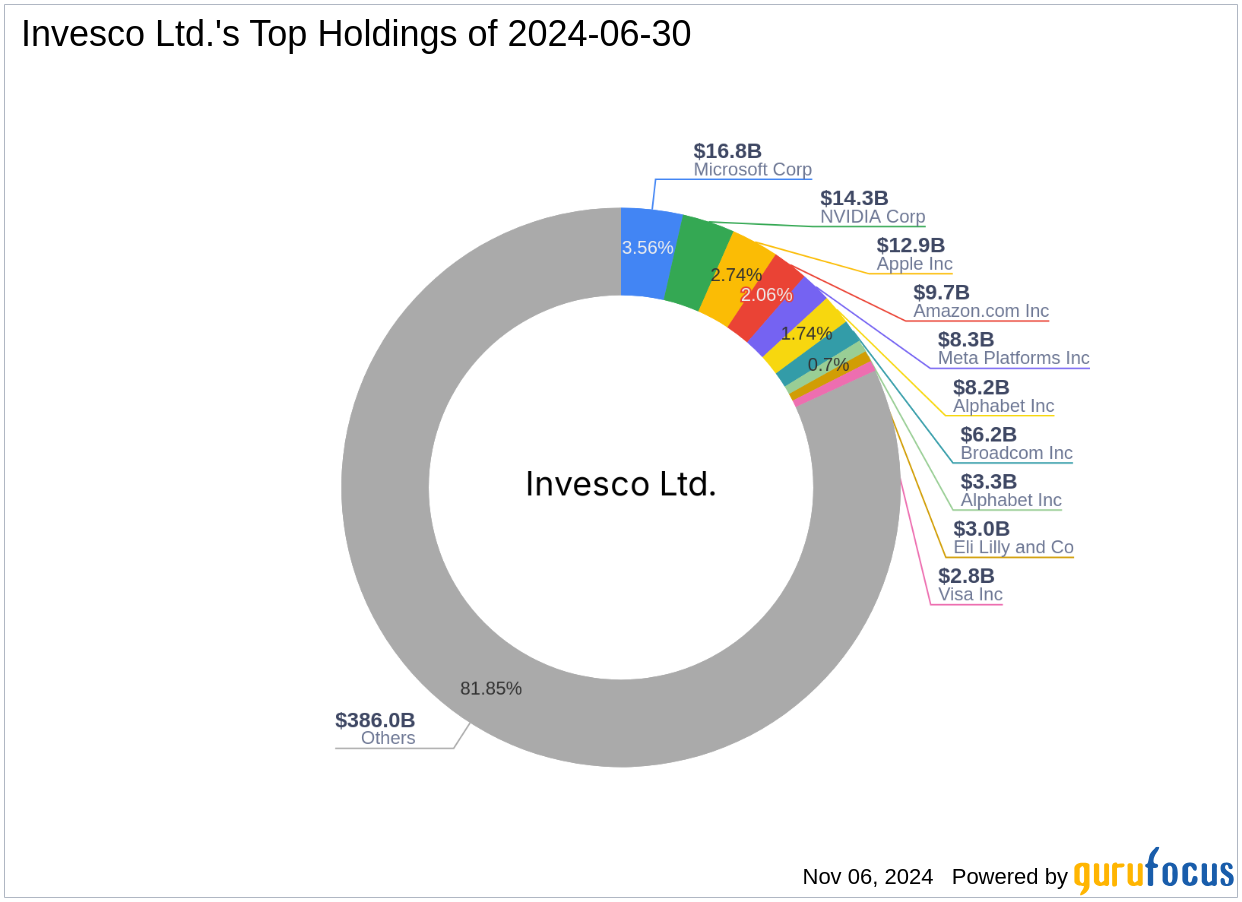

Profile of Invesco Ltd. (Trades, Portfolio)

Founded in 1935 and headquartered in Atlanta, Invesco Ltd. (Trades, Portfolio) has grown into a global powerhouse in the investment management industry. With a history marked by strategic acquisitions and global expansion, Invesco operates under various brands including Trimark, Invesco Perpetual, and Powershares. The firm manages assets across a broad range of mutual and exchange-traded funds, emphasizing a diversified investment approach that spans technology to financial services. As of the latest reports, Invesco oversees assets worth over $20 million and maintains a significant presence in the technology and financial sectors.

Insight into Endava PLC

Endava PLC specializes in digital transformation and software development, primarily serving clients in Europe within the financial services and tech sectors. Since its IPO in 2018, Endava has focused on leveraging its expertise in technology to support clients' growth. Despite current market challenges reflected in a PE ratio of 71.01 and a GF Value suggesting a potential value trap, Endava maintains a strong growth rank, indicating robust long-term potential.

Impact of the Trade on Invesco’s Portfolio

The recent acquisition of Endava shares by Invesco Ltd. (Trades, Portfolio) underscores the firm's strategy to invest in high-growth potential sectors like technology. Although the addition slightly alters the composition of Invesco’s portfolio, it aligns with their ongoing focus on expanding their technological and digital holdings. Endava now constitutes a 7.20% share of Invesco’s total holdings in the stock, marking a strategic position within its diverse investment landscape.

Market Performance and Sector Analysis

Endava’s stock has experienced a significant downturn year-to-date, with a decrease of 67.55%. This performance is part of a broader sectoral shift within technology investments, reflecting market volatility and valuation adjustments. In comparison to Invesco’s other major holdings like Apple Inc and Microsoft Corp, Endava represents a more niche but potentially rewarding investment, given its high growth rank and specialization in a critical sector.

Future Prospects for Endava PLC

Looking ahead, Endava’s focus on expanding its digital services and maintaining robust client relationships in the tech and financial sectors positions it well for recovery and growth. However, the market’s current skepticism, as indicated by its GF Value and recent stock performance, suggests that investors should approach with caution. The firm’s ability to navigate economic fluctuations and capitalize on digital transformation trends will be critical.

Conclusion

Invesco Ltd. (Trades, Portfolio)'s recent increase in its stake in Endava PLC highlights a strategic investment in a company poised for growth in the technology sector. This move aligns with Invesco’s broader portfolio strategy and reflects its commitment to investing in areas with high growth potential. As the market continues to evolve, the performance of this investment will be an important indicator of both Endava's operational success and Invesco's strategic positioning in the technology sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.