Overview of Recent Transaction by Dimensional Fund Advisors LP

On September 30, 2024, Dimensional Fund Advisors LP, a prominent investment firm, executed a significant transaction by acquiring 500,471 shares of First Internet Bancorp (INBK, Financial). This addition reflects a strategic move within the firm's portfolio, emphasizing their confidence in INBK's market position and future growth potential. The shares were purchased at a price of $34.26 each, marking a notable investment in the banking sector.

Insight into Dimensional Fund Advisors LP

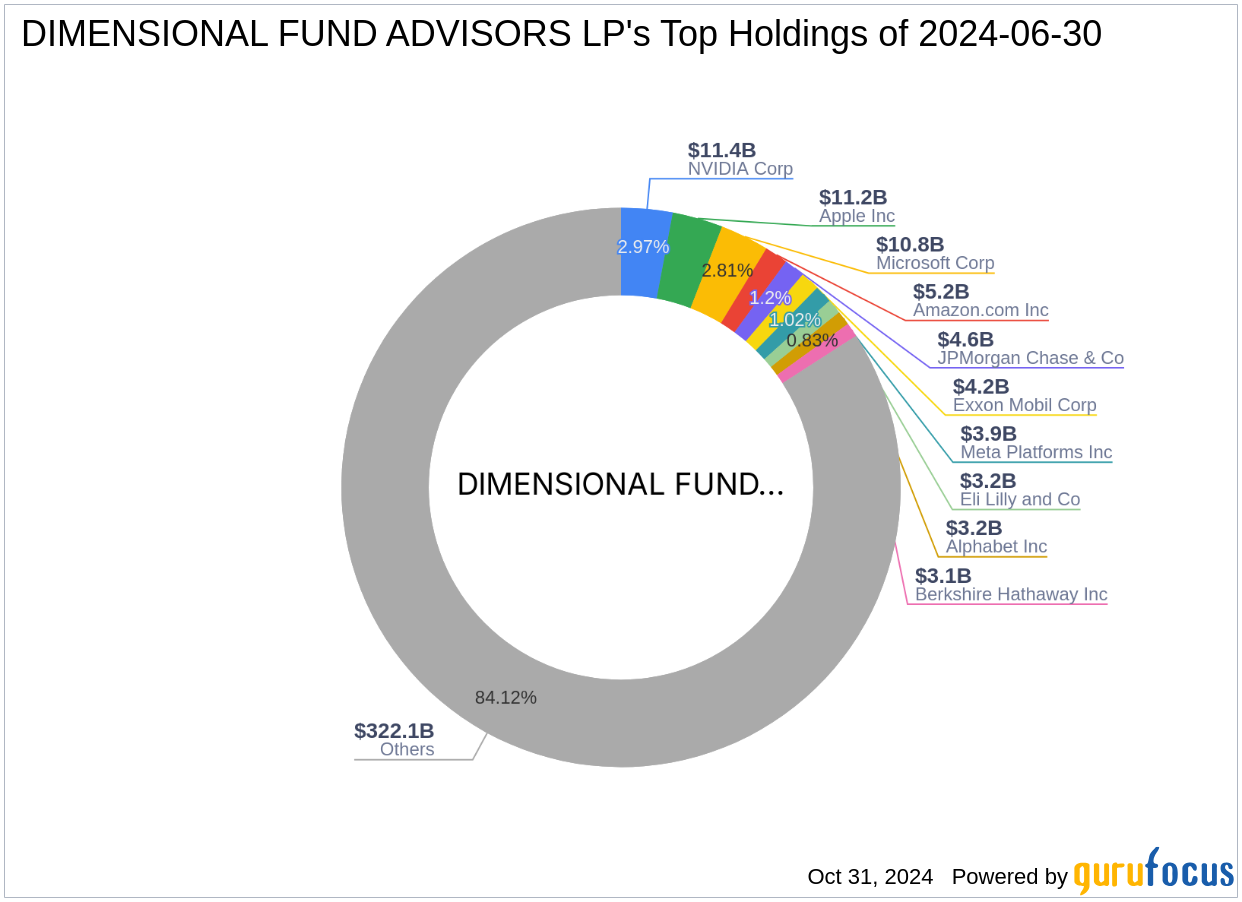

Founded in 1981 by David G. Booth and Rex Sinquefield, Dimensional Fund Advisors LP has grown into a global powerhouse with approximately $400 billion in assets under management. The firm is renowned for its foundation in academic research and a disciplined investment approach that emphasizes market, size, and value factors. With a significant presence in over 25 countries, Dimensional maintains a diversified portfolio with a strong emphasis on technology and financial services sectors. Some of its top holdings include giants like Apple Inc (AAPL, Financial) and Amazon.com Inc (AMZN, Financial).

Details of the Trade Action

The recent acquisition of First Internet Bancorp shares has increased Dimensional Fund Advisors LP's total holdings in the company to 500,471 shares, representing a 5.80% ownership stake. This move is part of the firm's broader strategy to capitalize on the growth potential within the financial services sector, particularly in niche markets like online banking.

Analysis of First Internet Bancorp (INBK, Financial)

First Internet Bancorp operates as a bank holding company primarily through the internet, eschewing traditional physical branches. Specializing in commercial real estate and industrial lending, INBK has carved out a unique space in the banking industry. Despite being modestly overvalued with a GF Value of $29.22 and a current stock price of $35.13, the company shows a promising GF Score of 76/100, indicating potential for future performance.

Market Context and Stock Valuation

Currently, INBK's stock is considered modestly overvalued, trading at a 20% premium over its GF Value. The stock has seen a 45.59% increase year-to-date, reflecting strong market confidence. This valuation suggests that while the stock is not at its most attractive price point, Dimensional Fund Advisors LP's recent purchase indicates a belief in its sustained growth.

Strategic Implications of the Trade

Dimensional Fund Advisors LP's decision to increase its stake in First Internet Bancorp aligns with its investment philosophy of targeting companies with robust growth potential and solid market positioning. This strategic move likely reflects the firm's confidence in INBK's innovative business model and its ability to thrive in a competitive banking environment.

Sector and Market Analysis

The banking sector faces various challenges, including interest rate fluctuations and regulatory changes. However, First Internet Bancorp's focus on internet-based services provides a competitive edge by reducing operational costs and reaching a broader customer base. This strategic positioning within its industry could be a key driver behind Dimensional Fund Advisors LP's investment decision.

Conclusion and Future Outlook

The recent acquisition by Dimensional Fund Advisors LP underscores its strategic approach to investment, focusing on companies with strong growth trajectories like First Internet Bancorp. As the banking sector continues to evolve, INBK's innovative model and robust financial metrics position it well for future growth, potentially benefiting Dimensional's portfolio in the long term.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.