Critical debt levels build up across the solar sector in China as leading module suppliers prepare to resume capacity expansions in 2026.

SANTA MONICA, CA / ACCESSWIRE / October 30, 2024 / PV ModuleTech Bankability Ratings Quarterly, the leading market report analyzing global solar photovoltaic (PV) module suppliers, reveals its latest report with headline insights on the largely dominated international market.

Emerging themes from the reported data forecast widespread insolvencies after three years of surplus market investments across the PV sector in China. The PV ModuleTech Bankability Ratings report also highlights a critical industry shakeout anticipated for 2025, correcting the current imbalance between supply and demand.

The top six Chinese PV module suppliers, JinkoSolar, JA Solar Technology, Trina Solar, LONGi Green Energy Technology, Tongwei and Canadian Solar, are projected to remain financially well positioned. These leaders are predicted to absorb the impact of upcoming losses during the current industry downturn and are expected to resume manufacturing expansions in 2026.

"Excessive foreign investment into new solar manufacturing facilities in the past three years has reached a tipping point, and there is an essential need now to balance production with market demand," notes Finlay Colville, Head of Research at PV-Tech, Informa Markets. "Ten years ago, the market experienced a similar downturn also triggered by overinvestment in the East which resulted in the bankruptcy of many Western contributors. This time, the insolvencies will be widespread."

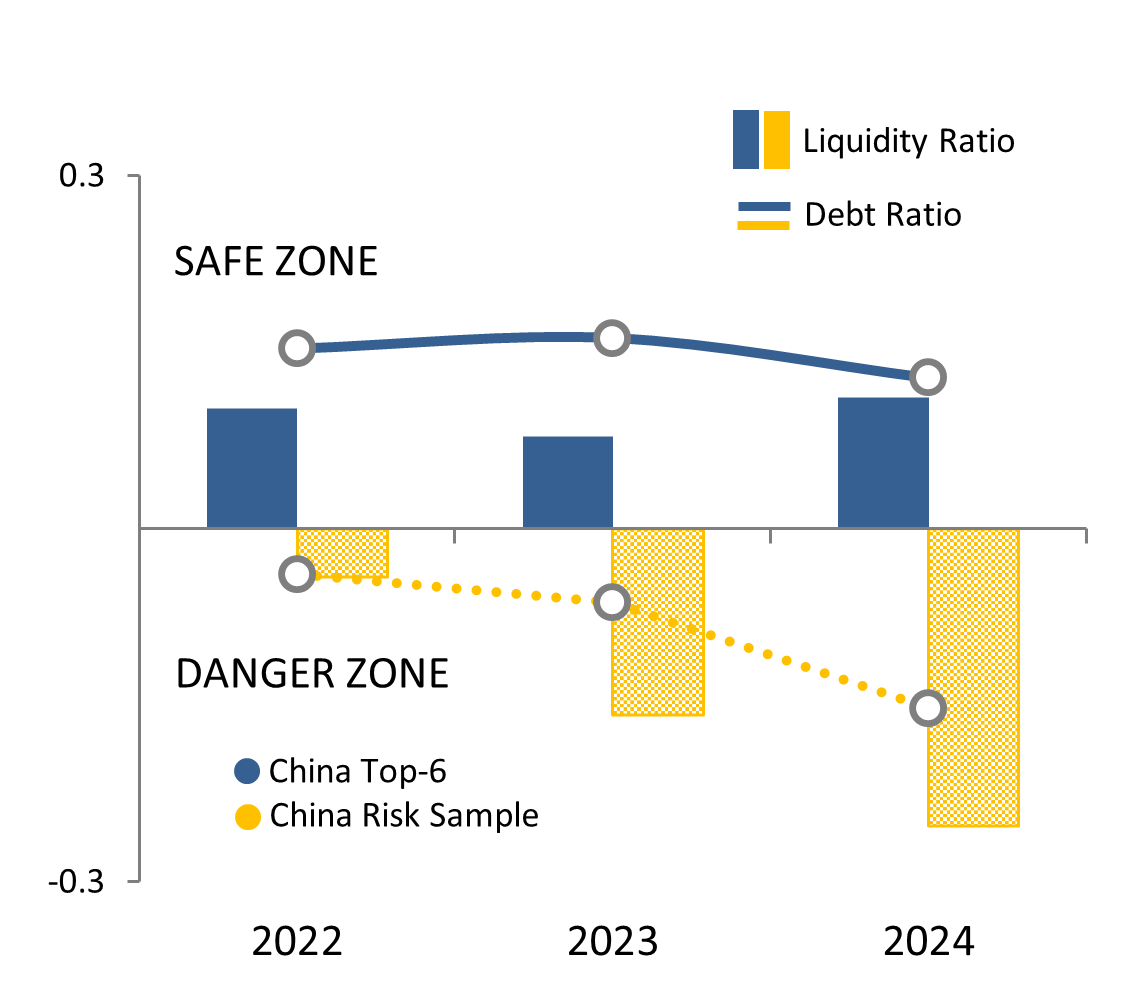

China dominates the manufacturing of PV modules today, accounting for more than 90 percent of global shipments, with 40 of these suppliers in the gigawatt plus category. Currently, one third of China's module suppliers are operating with severe liquidity and debt concerns, with production costs exceeding sales by more than 50 percent.

Figure: Liquidity and debt trends for Chinese solar module supplier categories.

Figure: Liquidity and debt trends for Chinese solar module supplier categories.Source: PV ModuleTech Bankability Ratings Quarterly report

The leading six Chinese suppliers controlling 60 percent of the market, have reacted to the downturn, cutting capital expenditure commitments by 50 percent and implementing additional short-term cost moderation measures. With the further reduction on operating spends, and introduction of new products, the dependency on module sales will lessen.

These main players for solar modules in China are indicated to have sufficient cash reserves to survive through the downturn of 2025, with control of long-term debt also in place. Concerns exist still for many Chinese suppliers that have shown liquidity challenges leading into the downturn and are now at risk of enforced insolvency proceedings next year.

Profitability is expected to return to the solar industry in 2026 ahead of a new investment phase that could last until 2030. Module suppliers that can expand manufacturing capacity during this period while keeping costs under control will emerge as the leaders at this time.

To learn more about the PV ModuleTech Bankability Ratings Quarterly report, please visit www.marketresearch.solarmedia.co.uk.

About PV Tech Research

PV Tech, a part of Informa Markets Engineering, is the leading source for in-depth research analysis on the solar PV supply chain internationally. Founded in 2009, PV Tech's publications online and in print attract over 2.5 million visits annually. PV-Tech conferences, established in 2014, are conducted 4 times per year around the world and bring together key technologists and project developers that shape the technology roadmap for the solar industry. To learn more, visit www.pv-tech.org.

About Informa Markets Engineering

Informa Markets' Engineering portfolio, a subsidiary of Informa plc (LON:INF), is the leading B2B event producer, publisher, and digital media business for the world's $3-trillion advanced, technology-based manufacturing industry. Our print and electronic products deliver trusted information to the engineering market and leverage our proprietary 1.3-million-name database to connect suppliers with buyers and purchase influencers. We produce more than 50 events and conferences in a dozen countries, connecting manufacturing professionals from around the globe. The Engineering portfolio is organized by Informa, the world's leading exhibitions organizer that brings a diverse range of specialist markets to life, unlocking opportunities and helping them to thrive 365 days of the year. For more information, please visit www.informamarkets.com.

Media Contact

Informa Markets Engineering PR

[email protected]

SOURCE: INFORMA MARKETS - ENGINEERING

View the original press release on accesswire.com