Overview of the Recent Transaction

On August 6, 2022, Curative Ventures V LLC (Trades, Portfolio) executed a significant transaction involving the sale of 1,898,593.95 shares of Instil Bio Inc (TIL, Financial), a notable player in the biotechnology industry. This move reduced their holdings by 99.98%, leaving them with just 409.7 shares. The shares were sold at a price of $127.6 each, impacting the firm's portfolio by -138.07%. This transaction not only adjusted Curative Ventures V LLC (Trades, Portfolio)’s investment in Instil Bio Inc but also marked a pivotal shift in their investment strategy.

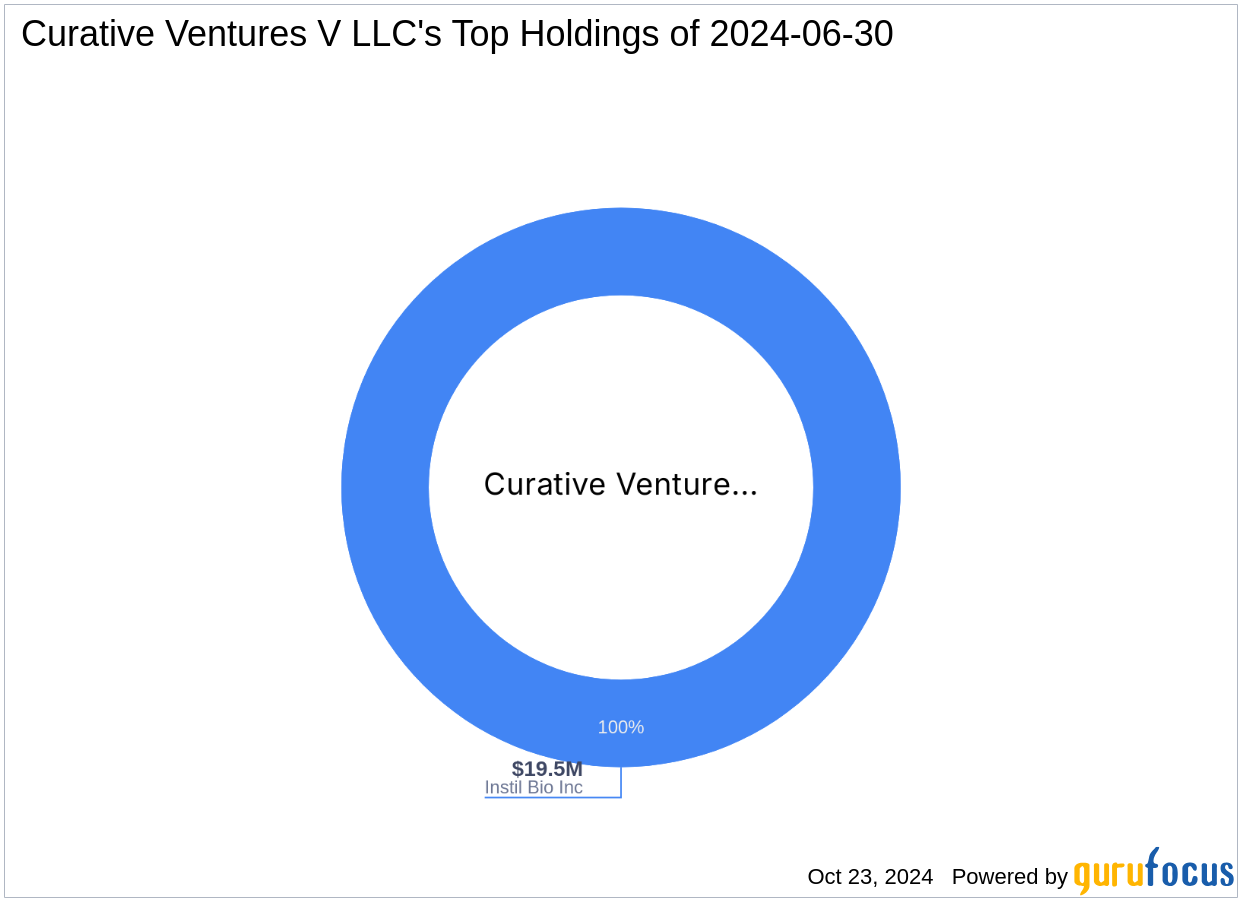

Profile of Curative Ventures V LLC (Trades, Portfolio)

Curative Ventures V LLC (Trades, Portfolio), based at 3963 Maple Avenue, Dallas, TX, operates as a focused investment entity. With a portfolio centered around a single top holding, Instil Bio Inc (TIL, Financial), the firm's investment philosophy is deeply rooted in the biotechnology sector. Despite the recent reduction, Instil Bio remains a significant part of their investment focus, reflecting the firm's strategic approach to managing its $20 million equity.

Introduction to Instil Bio Inc

Instil Bio Inc is at the forefront of the biotechnology industry, specializing in the development of autologous tumor infiltrating lymphocyte therapies for cancer treatment. The company is also pioneering the Co-Stimulatory Antigen Receptor (CoStAR) platform, which enhances the efficacy of these therapies. Its leading pipeline candidate, ITIL-306, targets a range of solid tumors, making significant strides in oncological research.

Financial and Market Analysis of Instil Bio Inc

As of the latest data, Instil Bio Inc holds a market capitalization of approximately $218.401 million, with a current stock price of $33.58. The company's financial metrics indicate challenges, with a PE Ratio of 0.00, suggesting it is not generating profits currently. The GF Score of 35/100 points to potential underperformance in the future, reflecting concerns in several key areas of its operations.

Impact of the Trade on Curative Ventures V LLC (Trades, Portfolio)’s Portfolio

The drastic reduction in Instil Bio shares has significantly altered Curative Ventures V LLC (Trades, Portfolio)’s investment landscape. The remaining 409.7 shares now constitute a mere -0.08% of their portfolio, yet still represent 36.80% of their holdings in the traded stock. This move could suggest a strategic shift or a reallocation of resources within their investment strategy.

Market Reaction and Stock Performance

Following the transaction, Instil Bio Inc’s stock price has experienced a decline of 73.68% since the trade date, with a staggering 93.58% drop from its IPO price. However, the stock has seen a year-to-date increase of 332.18%, indicating a volatile performance in the market.

Future Outlook for Instil Bio Inc

Despite current financial challenges, Instil Bio Inc's innovative approach in cancer treatment holds promise. The development of its CoStAR platform could potentially revolutionize treatments, aligning with ongoing research trends in biotechnology. However, financial health indicators such as the Profitability Rank and Growth Rank suggest that the company needs to overcome significant hurdles to achieve sustainable growth.

Conclusion

The recent transaction by Curative Ventures V LLC (Trades, Portfolio) represents a significant realignment of their investment in Instil Bio Inc. While this reduction drastically decreases their exposure to Instil Bio, it also raises questions about the firm's future investment strategy and the ongoing potential of Instil Bio Inc in the biotechnology market. Investors and market watchers will undoubtedly keep a close eye on both entities as they continue to evolve within this dynamic industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.