Overview of the Recent Transaction

On October 10, 2024, Conversant Capital LLC (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 11,757,779 shares of Sonida Senior Living Inc (SNDA, Financial). This transaction not only increased the firm's holdings in the company but also impacted its portfolio by 0.14%. The shares were purchased at a price of $22.78 each, reflecting a strategic move by the investment firm.

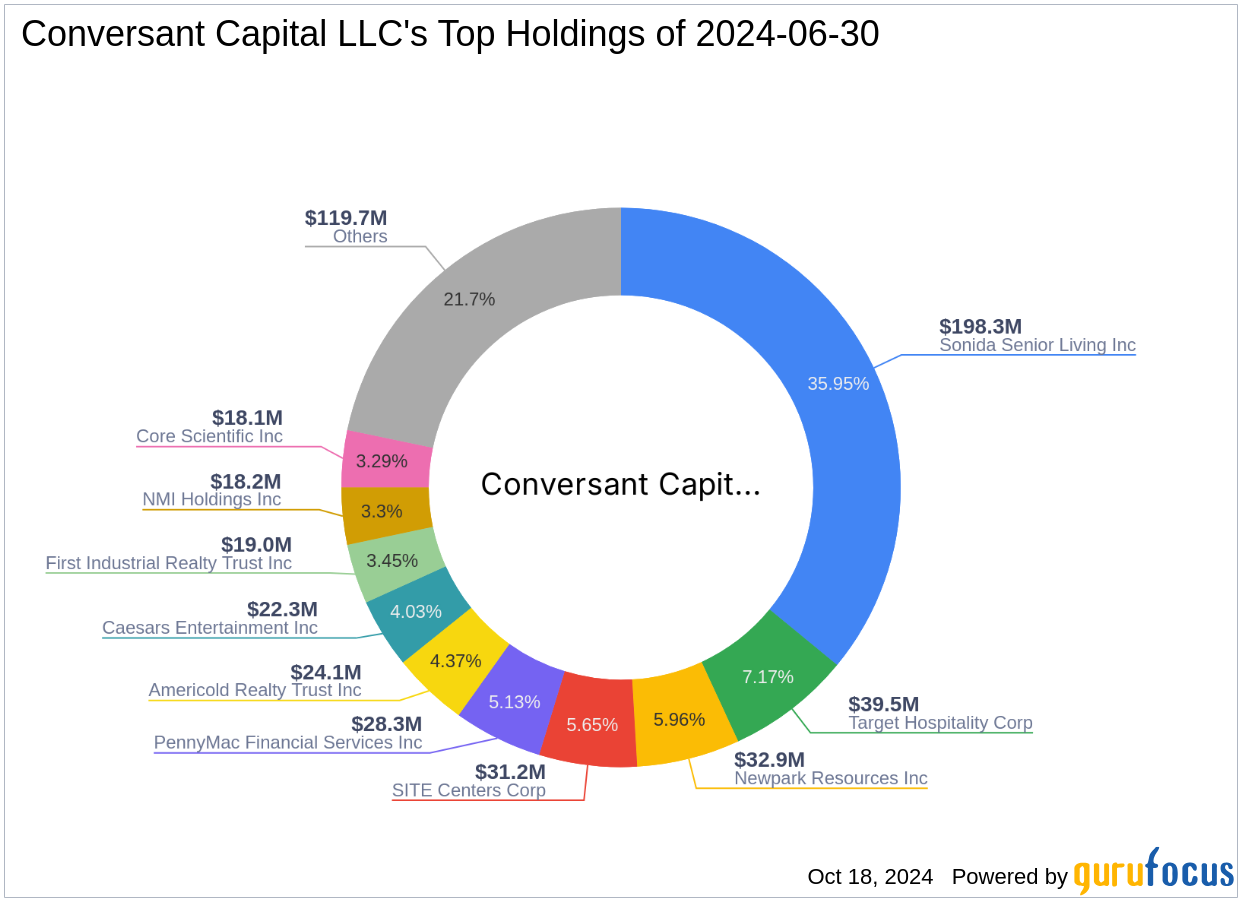

Conversant Capital LLC (Trades, Portfolio): A Strategic Investor

Conversant Capital LLC (Trades, Portfolio), based at 25 DEFOREST AVENUE, 3RD FLOOR, SUMMIT, NJ, is recognized for its focused investment strategy in the healthcare and real estate sectors. With an equity portfolio valued at $552 million and 17 major holdings, the firm has a significant influence in its chosen markets. Sonida Senior Living Inc (SNDA, Financial) tops its list of investments, demonstrating the firm's commitment to this sector.

Insight into Sonida Senior Living Inc

Sonida Senior Living Inc, headquartered in the USA, operates senior housing communities offering a range of services from independent living to memory care. Since its IPO on October 31, 1997, the company has aimed to provide valuable services at reasonable prices. Despite its market capitalization of $515.088 million and a current stock price of $27.01, the company is rated as significantly overvalued with a GF Value of $8.17.

Detailed Transaction Analysis

The recent acquisition by Conversant Capital LLC (Trades, Portfolio) involved 34,448 additional shares, bringing its total holdings in SNDA to 11,757,779 shares. This transaction represents 48.49% of the firm's portfolio and 54.10% of the total shares outstanding of Sonida Senior Living Inc. The trade price of $22.78 significantly contrasts with the current stock price of $27.01, indicating a potential overvaluation concern.

Market Performance and Strategic Implications

Since the IPO, Sonida Senior Living Inc's stock has seen a decline of 89.25%, yet it has surged by 203.48% year-to-date. The stock's GF Score of 43 suggests poor future performance potential. The firm's decision to increase its stake could be driven by a strategic belief in the company's long-term growth or restructuring potential, despite current valuation concerns.

Sector Influence and Comparative Analysis

Conversant Capital LLC (Trades, Portfolio)'s interest in the healthcare and real estate sectors is evident from its top holdings. Sonida Senior Living Inc, operating within these sectors, presents a unique blend of real estate management and healthcare services, aligning with the firm's investment philosophy.

Conclusion

The recent transaction by Conversant Capital LLC (Trades, Portfolio) reflects a significant commitment to Sonida Senior Living Inc, suggesting a strategic move with potential long-term benefits. Despite the stock's current overvaluation and mixed financial health indicators, the firm's increased stake could be a bet on future improvements or market positioning. Investors and market watchers will be keen to see how this investment plays out in the evolving landscape of healthcare and real estate investments.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.