Overview of the Recent Transaction

On September 30, 2024, State Street Corp made a significant addition to its investment portfolio by acquiring 493,662 shares of PPG Industries Inc (PPG, Financial), a leading global producer of coatings. This transaction increased State Street Corp's total holdings in PPG to 11,719,387 shares, reflecting a substantial commitment to the company. The shares were purchased at a price of $132.46 each, marking a notable investment move by the firm.

Profile of State Street Corp

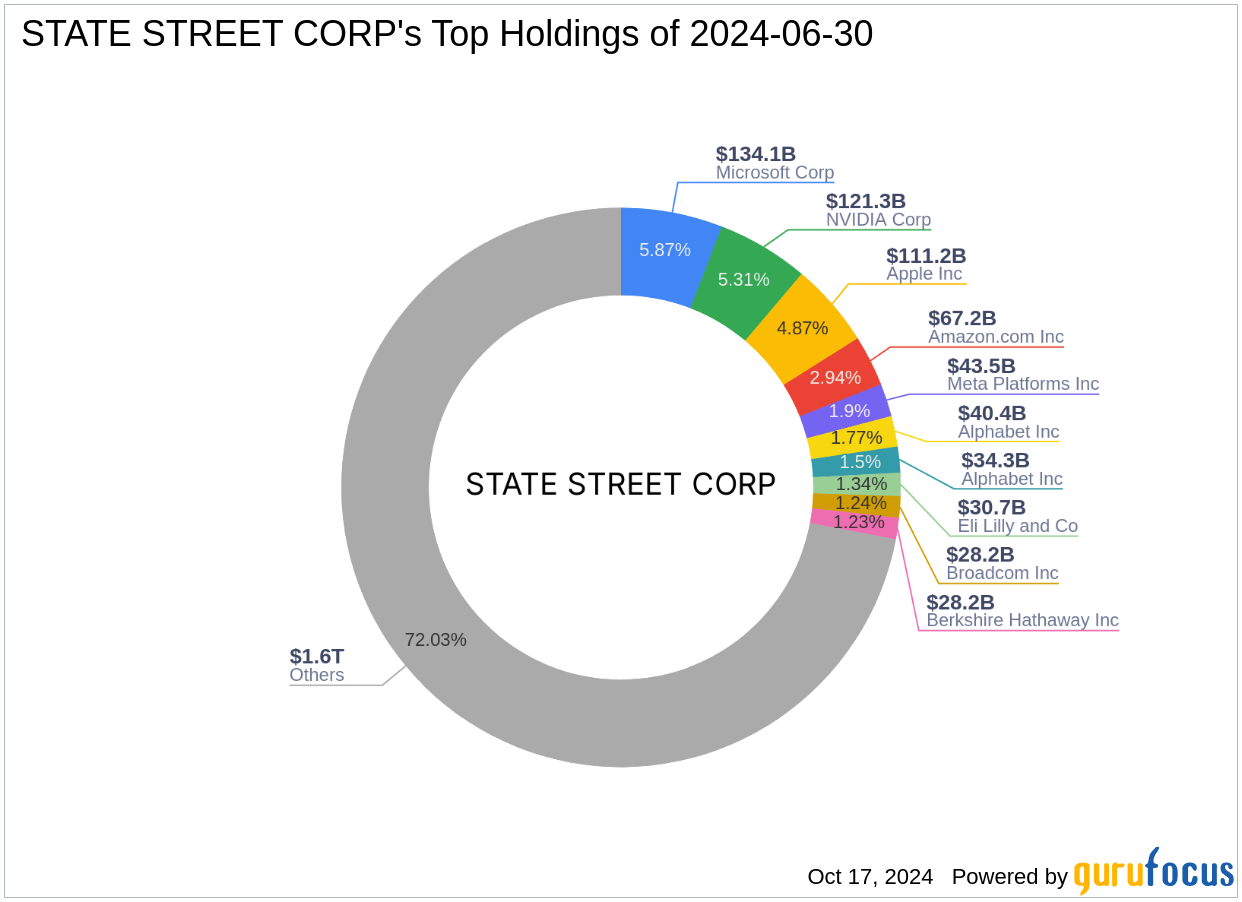

Located at One Lincoln Street, Boston, MA, State Street Corp is a prominent investment firm known for its strategic investments across various sectors, with a strong emphasis on technology and financial services. The firm manages an impressive equity portfolio valued at approximately $2,285.63 trillion. Its top holdings include major tech giants such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and NVIDIA Corp (NVDA, Financial). State Street Corp's investment philosophy focuses on leveraging market trends and technological advancements to maximize returns.

Introduction to PPG Industries Inc

PPG Industries Inc, headquartered in the USA, has been a pivotal player in the coatings industry since its IPO in 1945. The company operates through two main segments: Industrial Coatings and Performance Coatings, providing solutions globally with a significant presence outside North America. PPG is committed to innovation and expansion in emerging markets, highlighted by strategic acquisitions like Comex.

Financial and Market Analysis of PPG Industries Inc

PPG Industries is currently valued at a market capitalization of $30.27 billion, with a stock price of $129.76. The company holds a PE Ratio of 21.27, indicating profitability, and is rated as "Fairly Valued" with a GF Value of $138.84. Despite a year-to-date price decline of 11.9%, PPG's long-term stock performance remains robust, with an increase of 6588.66% since its IPO. The firm's GF Score of 84 suggests good potential for future performance.

Impact of the Trade on State Street Corp’s Portfolio

The recent acquisition of PPG shares has increased State Street Corp's position in the company to 5.00% of their total holdings, with a portfolio position ratio of 0.07%. This strategic addition underscores the firm's confidence in PPG's market position and future growth prospects, aligning with State Street Corp’s investment strategy of focusing on high-potential sectors.

Comparative Analysis with Other Investment Gurus

Other notable investors in PPG Industries include First Eagle Investment (Trades, Portfolio) Management, Joel Greenblatt (Trades, Portfolio), and Jefferies Group (Trades, Portfolio). Each brings a unique investment strategy to the table, with First Eagle holding a significant share percentage, emphasizing the attractiveness of PPG to diverse investment philosophies.

Market and Future Outlook for PPG Industries Inc

PPG Industries exhibits a strong Profitability Rank of 8/10 and a Growth Rank of 6/10, supported by a solid Financial Strength score. The company's focus on expanding its global footprint and enhancing product offerings is expected to drive future growth, despite current market challenges.

Conclusion

State Street Corp's recent acquisition of PPG Industries shares is a testament to the firm's strategic investment approach, focusing on companies with strong market positions and growth potential. This move is likely to benefit State Street Corp's portfolio performance, reflecting a well-calculated decision to capitalize on PPG's industry standing and future opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.