Introduction to the Transaction

On September 30, 2024, State Street Corp made a significant addition to its investment portfolio by acquiring 6,127,910 shares of PBF Energy Inc (PBF, Financial). This transaction, executed at a price of $30.95 per share, reflects a strategic move by the firm to bolster its holdings in the energy sector. The trade not only increased State Street Corp's total shares in PBF but also adjusted its portfolio composition slightly, emphasizing the firm's tactical investment approach.

Profile of State Street Corp

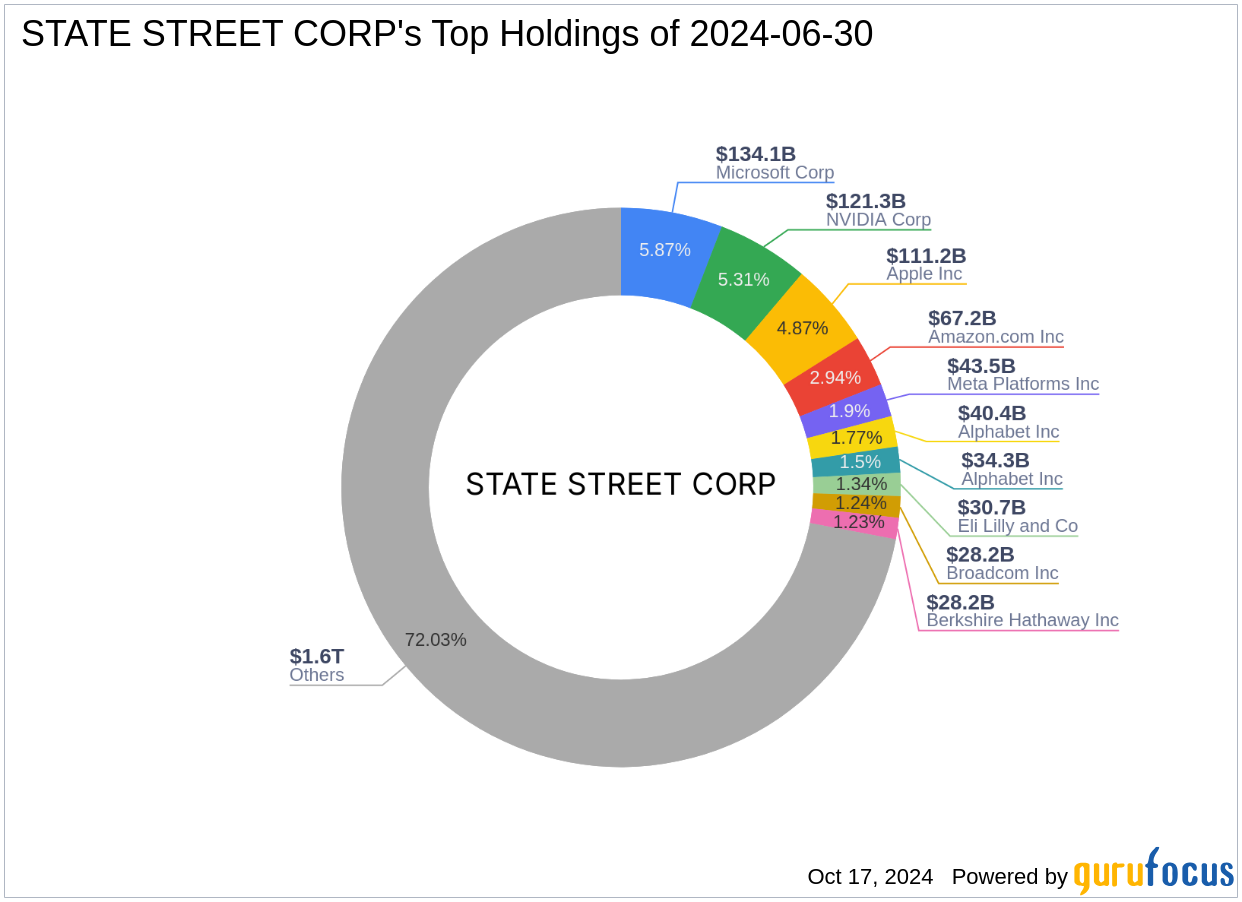

State Street Corp, headquartered at One Lincoln Street, Boston, MA, is a prominent financial services provider known for its robust investment strategies. The firm manages a diverse portfolio with a strong emphasis on technology and financial services, holding major stakes in companies like Apple Inc (AAPL, Financial) and Amazon.com Inc (AMZN, Financial). With an equity portfolio valued at approximately $2,285.63 trillion, State Street Corp is a significant player in the investment community, influencing market trends and corporate governance across various sectors.

Analysis of the Trade Impact

The recent acquisition of PBF Energy shares has expanded State Street Corp's influence in the oil and gas industry, marking a 5.20% ownership in the company. This strategic addition represents a minor yet impactful 0.01% position in State Street Corp’s vast portfolio, highlighting the firm's calculated approach to diversification and sector investment.

Overview of PBF Energy Inc

PBF Energy Inc, an independent petroleum refiner in the United States, operates through two main segments: Refining and Logistics. Since its IPO on December 13, 2012, PBF has grown to manage refineries across multiple states, contributing significantly to the petroleum and logistics market. The company's strategic operations and asset base have positioned it as a key player in the energy sector.

Market Context and Stock Valuation

Currently, PBF Energy Inc is valued at $3.87 billion in market capitalization with a stock price of $33.01, reflecting a 6.66% increase since the transaction date. The stock is deemed "Fairly Valued" with a GF Value of $34.98, indicating a close alignment between its market price and intrinsic value. This valuation suggests a stable investment outlook for PBF, supported by a price to GF Value ratio of 0.94.

Comparative Insight

State Street Corp is not the only major investor in PBF Energy; First Eagle Investment (Trades, Portfolio) Management, LLC holds a significant share, alongside other notable investors like Barrow, Hanley, Mewhinney & Strauss. This collective interest from top investment firms underscores the strategic importance of PBF Energy in the investment community.

Financial Health and Future Outlook

PBF Energy's financial health is robust, with a Financial Strength rank of 8/10 and a Profitability Rank of 7/10. However, its Growth Rank stands at 4/10, indicating some challenges in expansion. The GF Score of 70/100 suggests a moderate future performance potential, balanced by a solid Piotroski F-Score of 5, which points to a stable financial situation.

Conclusion

State Street Corp's acquisition of PBF Energy shares is a calculated move to strengthen its portfolio in the energy sector. This transaction not only enhances the firm's market position but also aligns with its strategic investment philosophy, promising potential growth and stability in the evolving market landscape. Investors and market watchers will undoubtedly keep a close eye on how this investment influences both State Street Corp's portfolio and PBF Energy's market performance in the coming years.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.