Overview of the Recent Transaction

On September 30, 2024, State Street Corp made a significant addition to its investment portfolio by acquiring 1,276,929 shares of Lakeland Financial Corp (LKFN, Financial). This transaction, executed at a price of $65.12 per share, reflects a strategic move by the firm to bolster its holdings in the financial sector. The addition of these shares has increased State Street Corp's total stake in Lakeland Financial to 5.00% of its portfolio, emphasizing the importance of this investment within its diverse array of assets.

Profile of State Street Corp

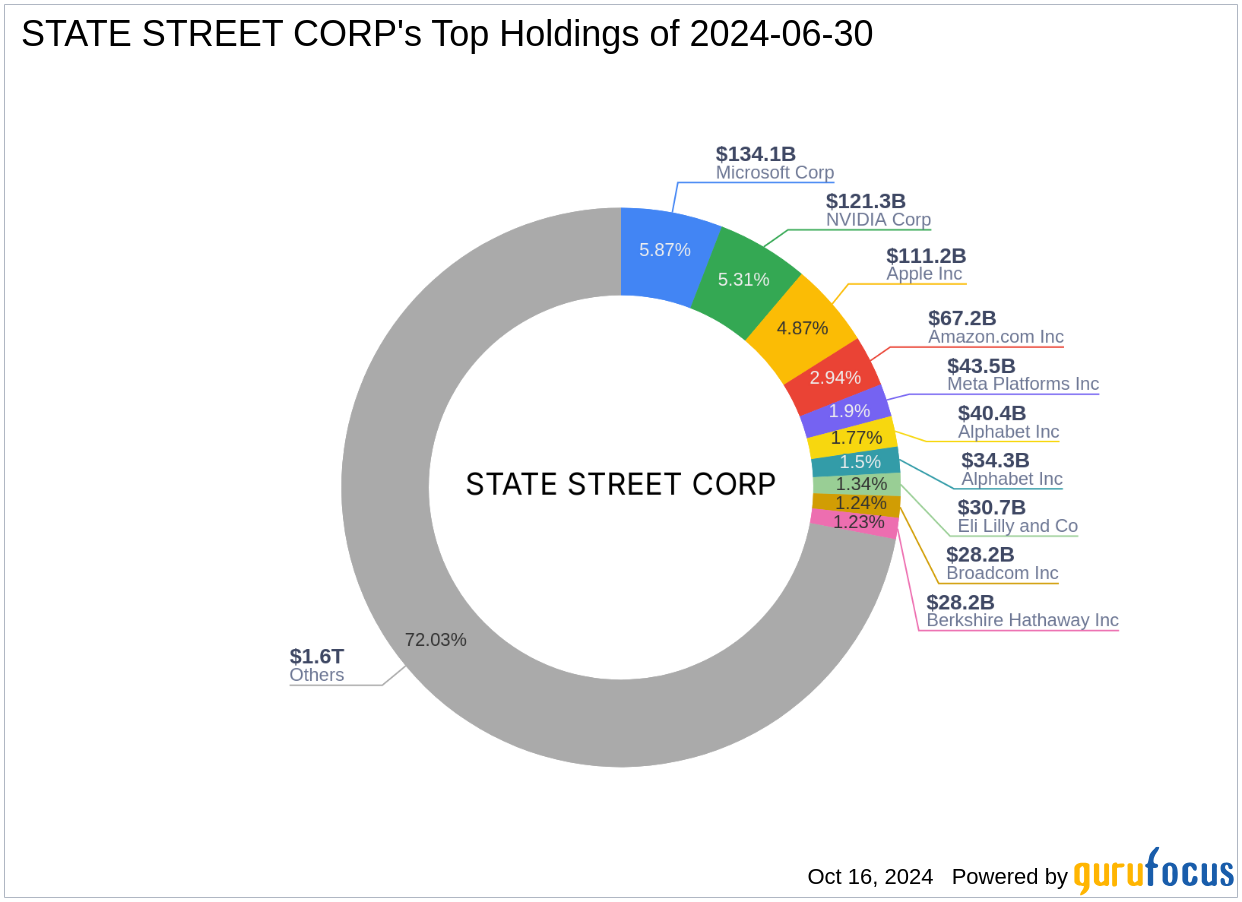

State Street Corp, headquartered at One Lincoln Street, Boston, MA, is a prominent financial services provider known for its robust investment strategies. The firm manages a vast equity portfolio totaling $2,285.63 trillion, with a strong emphasis on technology and financial services sectors. Its top holdings include major corporations such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial), showcasing its focus on high-growth potential markets.

Introduction to Lakeland Financial Corp

Lakeland Financial Corp, based in the USA, operates as a bank holding company offering a wide range of commercial and retail banking services. Since its IPO on August 14, 1997, Lakeland has shown substantial growth and resilience in the banking industry. The company's services include wealth advisory, investment management, and treasury management, catering to diverse sectors such as real estate, manufacturing, and healthcare.

Financial and Market Analysis of Lakeland Financial Corp

Currently, Lakeland Financial Corp holds a market capitalization of $1.7 billion with a stock price of $66.84, reflecting a PE Ratio of 17.05. The stock is deemed 'Fairly Valued' with a GF Value of $73.47 and a price to GF Value Rank of 9/10. Despite a modest Financial Strength ranking of 4/10, the company maintains a solid profitability and growth rank of 6/10, underpinned by a robust return on equity (ROE) of 16.26%.

Impact of the Trade on State Street Corp's Portfolio

The recent acquisition of Lakeland Financial shares significantly enhances State Street Corp's exposure to the financial services sector, aligning with its strategic focus. This addition not only diversifies the firm's portfolio but also strengthens its position in a steadily growing industry. The strategic significance of this investment is evident as it represents a substantial 5.00% of the firm's total portfolio, indicating a strong conviction in Lakeland's future performance.

Market Reaction and Future Outlook

Following the transaction, Lakeland Financial Corp's stock has seen a positive uptick of 2.64% in its price. The stock's year-to-date performance stands at 2.88%, with a promising GF Score of 80/100, suggesting a likely average to above-average future performance.

Conclusion

In summary, State Street Corp's recent acquisition of shares in Lakeland Financial Corp marks a strategic enhancement to its portfolio, reflecting confidence in the financial sector's growth potential. This move is aligned with the firm's investment philosophy and its focus on sectors with high growth prospects. The positive market reaction and robust GF Score further validate the potential of this investment to contribute significantly to State Street Corp's portfolio performance in the coming years.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.