On September 30, 2024, State Street Corp executed a significant transaction involving Essex Property Trust Inc (ESS, Financial), marking a strategic adjustment in its investment portfolio. The firm reduced its holdings by 109,376 shares, with the transaction priced at $295.42 per share. Following this move, State Street Corp's remaining stake in Essex Property Trust stands at 5,172,350 shares, reflecting a nuanced shift in its investment strategy.

Profile of State Street Corp

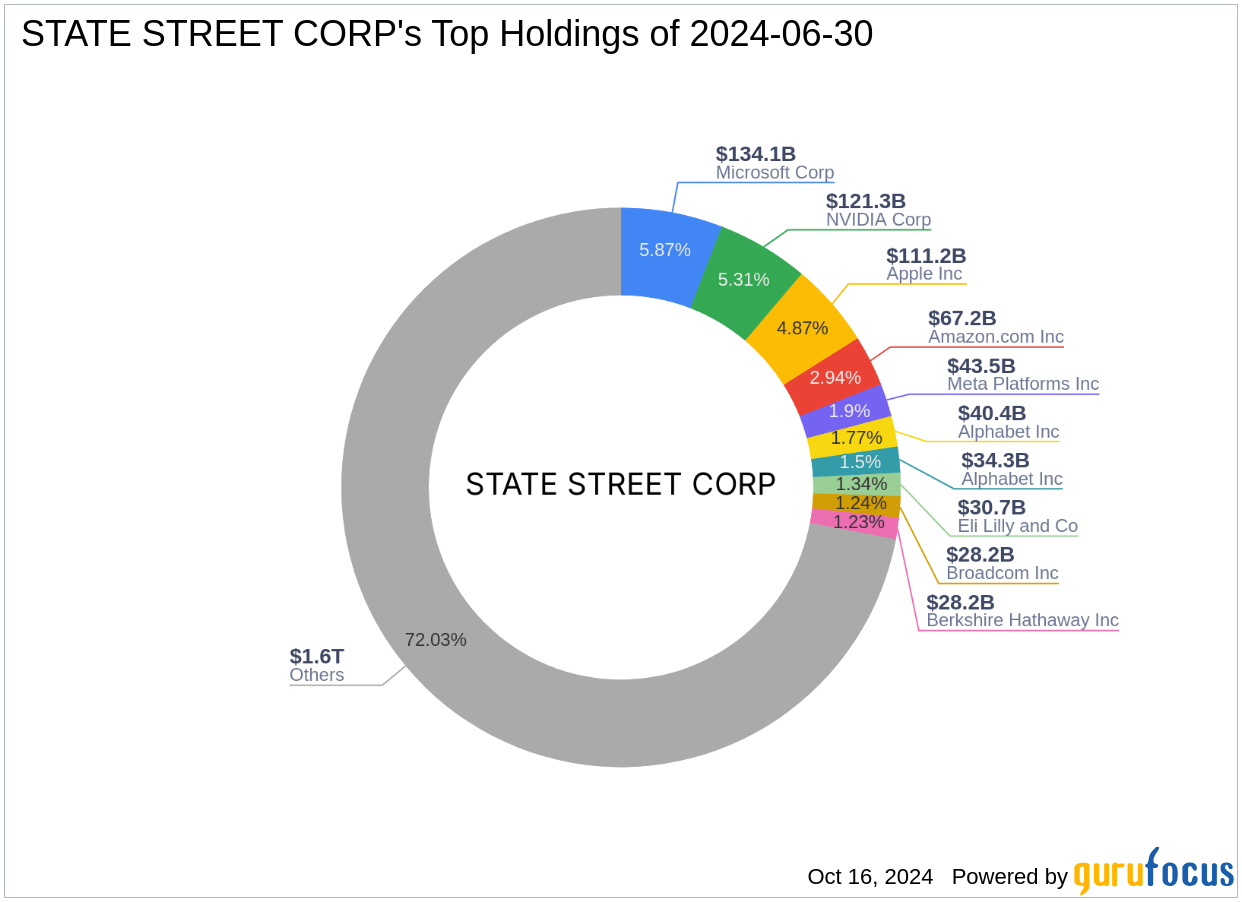

State Street Corp, headquartered in Boston, MA, is a prominent investment firm known for its robust portfolio management strategies. With a focus on leveraging technology and innovation, the firm manages a diverse range of assets across various sectors, with top holdings including giants like Apple Inc (AAPL, Financial) and Amazon.com Inc (AMZN, Financial). The firm's investment philosophy emphasizes long-term value creation, making its trading activities particularly noteworthy for market analysts and investors alike.

Understanding Essex Property Trust Inc

Essex Property Trust Inc, a key player in the REIT industry, manages a substantial portfolio of apartment communities primarily located on the West Coast of the United States. As of the latest data, the company boasts a market capitalization of $19.01 billion and maintains a PE Ratio of 36.63, indicating its profitability in a challenging market. The firm's strategic focus on high-quality properties in urban and suburban submarkets positions it well for sustained growth.

Impact of the Trade on State Street Corp's Portfolio

The recent transaction has adjusted State Street Corp's exposure to the real estate sector, with Essex Property Trust now constituting a 0.07% position in its overall portfolio, and an 8.10% stake in the company itself. This move aligns with the firm's strategy to optimize its investment spread across various sectors, balancing risk and potential returns.

Market and Financial Analysis of Essex Property Trust

Despite being labeled as modestly overvalued with a GF Value of $262.05, Essex Property Trust shows a promising GF Score of 81/100, indicating good potential for outperformance. The company's financial health is underscored by a Profitability Rank of 8/10 and a Growth Rank of 6/10, reflecting its capacity to sustain earnings and expand its market footprint.

Comparative Analysis with Other Gurus

State Street Corp is not alone in its interest in Essex Property Trust. Notable investors like Joel Greenblatt (Trades, Portfolio) and Ken Fisher (Trades, Portfolio) also hold positions in the company, with Davis Selected Advisers being the largest shareholder. This collective interest from top investors underscores the company's strong market position and potential for growth.

Sector and Industry Context

The REIT sector has shown resilience and growth, with companies like Essex Property Trust leading the charge. The firm's strategic focus on lucrative West Coast markets provides it with a competitive edge, aligning well with industry trends towards urban and suburban residential properties.

Conclusion

State Street Corp's recent reduction in its holdings of Essex Property Trust Inc reflects a strategic realignment rather than a shift in confidence in the company's prospects. With a solid financial standing and a strategic market position, Essex Property Trust remains a significant player in the REIT industry, poised for future growth. Investors and market watchers will undoubtedly keep a close eye on how these adjustments play out in State Street Corp's portfolio performance in the coming quarters.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.