On July 31, 2023, investment firm Dodge & Cox (Trades, Portfolio) reduced its stake in Molson Coors Beverage Co (TAP, Financial), a leading beer manufacturer. This article provides an in-depth analysis of the transaction, the profiles of both Dodge & Cox (Trades, Portfolio) and Molson Coors, and the potential implications for value investors.

Details of the Transaction

Dodge & Cox (Trades, Portfolio) sold 11,472,654 shares of Molson Coors at a price of $69.77 per share, reducing its stake by 40.80%. This transaction had a -0.55% impact on Dodge & Cox (Trades, Portfolio)'s portfolio. Despite the reduction, Molson Coors still represents a significant 0.8% of Dodge & Cox (Trades, Portfolio)'s portfolio, with the firm holding 16,647,400 shares, equivalent to a 7.70% stake in the beverage company.

Profile of Dodge & Cox (Trades, Portfolio)

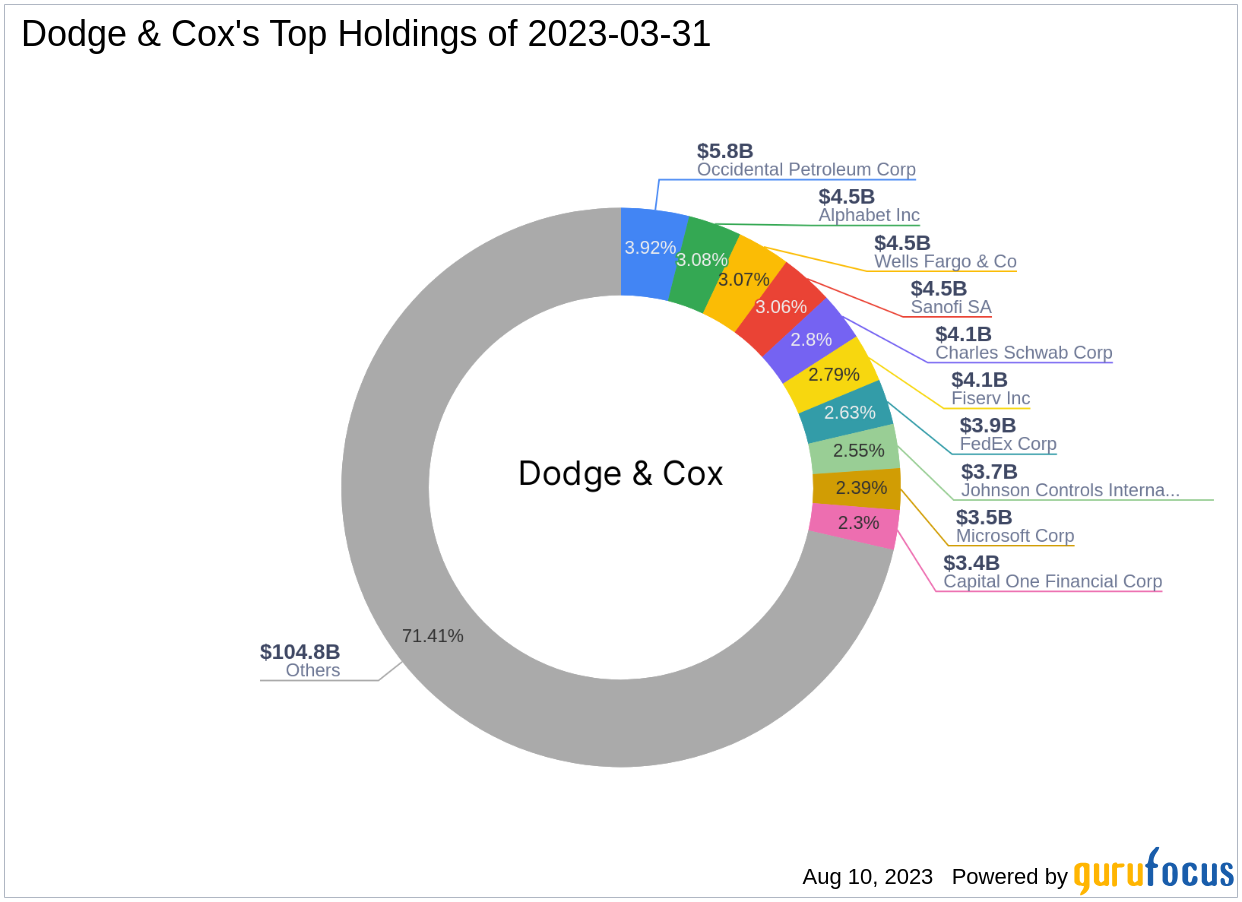

Dodge & Cox (Trades, Portfolio), a San Francisco-based investment firm, was founded in 1930 by Van Duyn Dodge and E. Morris Cox. The firm employs a team research approach in making investment decisions, guided by an ongoing search for superior relative value. Dodge & Cox (Trades, Portfolio)'s portfolio consists of 202 stocks, with a total equity of $146.75 billion. The firm's top holdings include Alphabet Inc (GOOG, Financial), Occidental Petroleum Corp (OXY, Financial), Charles Schwab Corp (SCHW, Financial), Sanofi SA (SNY, Financial), and Wells Fargo & Co (WFC, Financial). The firm's top sectors are Financial Services and Healthcare.

Overview of Molson Coors Beverage Co

Molson Coors Beverage Co, a USA-based company, is the second-largest beer maker in the U.S., Canada, and the U.K. in both value and volume terms. The company owns well-known beer brands including Miller, Coors, Blue Moon, and Carling. It also brews and distributes beer and hard seltzer under partner brands from Heineken, Anheuser-Busch InBev, Asahi, and Coca-Cola. As of August 11, 2023, the company has a market capitalization of $13.93 billion and a stock price of $64.32.

Analysis of the Traded Stock

According to GuruFocus, Molson Coors is modestly overvalued with a GF Value of $55.61 and a Price to GF Value ratio of 1.16. The stock has gained 321.77% since its IPO in 1975 and 30.1% year-to-date. However, since the transaction, the stock has declined by 7.81%. The stock's GF Score is 67/100, indicating poor future performance potential. The company's Financial Strength is ranked 5/10, Profitability Rank is 6/10, and Growth Rank is 3/10.

Comparison with Other Gurus

Other gurus who hold Molson Coors stock include John Rogers (Trades, Portfolio), Barrow, Hanley, Mewhinney & Strauss, and Joel Greenblatt (Trades, Portfolio). However, Dodge & Cox (Trades, Portfolio) remains the largest guru shareholder in Molson Coors.

Conclusion

In conclusion, Dodge & Cox (Trades, Portfolio)'s decision to reduce its stake in Molson Coors could be attributed to the stock's modest overvaluation and poor future performance potential as indicated by its GF Score. However, the firm still holds a significant stake in the company, suggesting a level of confidence in its long-term prospects. This transaction provides valuable insights for value investors, highlighting the importance of assessing a company's valuation and future performance potential when making investment decisions.