The collapse of SVB Financial’s (SIVB, Financial) Silicon Valley Bank has sent shockwaves through startups, and clean tech startups have been no exception. Since its founding, the innovation industry’s favorite bank has been there to understand the struggles and the potential of tech-focused startups. The bank worked with over 1,500 clean tech companies, which have now been left scrambling to find new lenders.

However, the clean tech space as a whole is no longer as new and inexperienced as it once was. In particular, clean energy has really taken off, proving that these companies can be profitable for lenders and investors alike, at least on the revenue, earnings and capital gains front.

What about dividend yields, though? Has the clean energy space reached the point where dividend stocks are a viable deal yet? Let’s take a look at the small handful of clean energy stocks with dividend yields over 2%, found using the GuruFocus All-in-One Screener, to see whether any of them could provide that rare combination of long-term growth potential and shareholder returns.

Atlantica Sustainable Infrastructure

Atlantica Sustainable Infrastructure PLC (AY, Financial) is a U.K.-based sustainable infrastructure company that owns and manages renewable energy, energy storage, natural gas, transmission and water assets. It focuses on developing long-life facilities and long-term agreements to secure stable cash flows.

Revenue growth has not been particularly fast since 2016, and earnings per share are still unreliable. That is likely due in large part to the company’s hefty dividend yield of 6.51%. Utilities are not generally considered a growth sector, focusing instead on near-term returns, and Atlantica seems to have embraced that perspective rather than trying to achieve rapid growth.

In Atlantica’s case, I do think the dividend yield is a little too high considering the company’s sluggish growth. It is good to prioritize shareholder returns, but as Warren Buffett (Trades, Portfolio) says, high dividends should only be paid out if there are no attractive ways to invest in the growth of the business. Given that renewable energy companies in Europe have been given a huge opportunity to grow as the region looks to replace Russian gas, it would be worrying to see this company continuing to sacrifice growth for dividends going forward.

NextEra Energy Partners

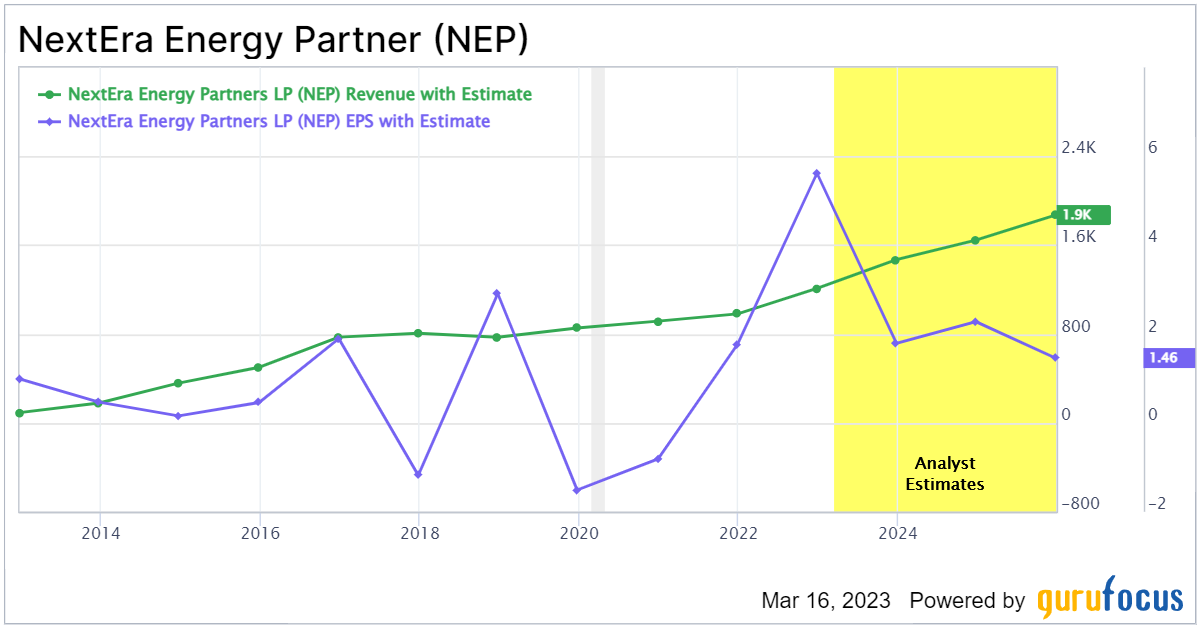

NextEra Energy Partners LP (NEP, Financial) is a growth-oriented subsidiary of NextEra Energy Inc. (NEE, Financial). The Florida-based company acquires and manages contracted clean energy projects with a focus on stable, long-term cash flows. It primarily invests in wind and solar projects.

True to its stated goals, NextEra has grown its top line consistently over the years. Earnings per share have also showed strong growth, though analysts are predicting a pullback in profitability in the coming years, which is perhaps due to the high interest rate environment. The dividend yield is a respectable 4.96%. Unfortunately, that is more than countered by the three-year share buyback ratio of -9.7%.

It is nice that NextEra is trying to return some cash to shareholders. For investors that have decided to hang on for the long term and have faith in the “growth first” approach, this provides some recompense. The continuous net issuance of shares works against investors, though, as existing shares are always becoming less valuable.

Brookfield Renewable

An offshoot of the iconic Canadian alternative asset manager Brookfield Asset Management (BAM, Financial), Brookfield Renewable Corp. (BEPC, Financial) is one of the largest pure-play renewable power companies in the world. It owns and manages hydroelectric, wind, solar and storage facilities around the world.

Brookfield Renewable has achieved truly stunning top and bottom line growth in recent years, all while paying a solid dividend yield that comes out to 4.19% as of this writing. Growth looks even better when we factor in the fact that the company is not issuing new shares left and right. Its share count stands at about the same level as it did near the end of 2022.

Despite the strong dividend yield, high growth rates and operating margin of 32.01%, Brookfield Renewable trades at a price-earnings ratio of just 3.54. The forward price-earnings ratio is much higher at 36.72 as analysts are anticipating earnings to be hit by economic headwinds, but in the longer term, Morningstar Inc. (MORN, Financial) analysts are projecting a future three-to-five-year earnings per share growth rate of 34%.

Takeaway

Overall, it seems the clean energy sector truly is not ready yet for dividends to become a major part of returns. Only Brookfield Renewable looks like a safe clean energy dividend stock; while Atlantica and NextEra also have solid dividends, they are held back by low growth and excessive share issuance, respectively. All three could still be worth keeping an eye on, though, as industry tailwinds and better management could transform them into more lucrative opportunities.