After reducing the stake in Herc Holdings Inc. (HRI, Financial) several times in November and December, renowned investor Carl Icahn (Trades, Portfolio) disclosed last week he further decreased his firm’s position by 3.01%.

The guru’s Florida-based firm, Icahn Capital Management, is known for taking activist positions in struggling companies and working with management to improve profitability as well as unlock value for shareholders.

According to GuruFocus Real-Time Picks, a Premium feature based on 13D, 13G and Form 4 filings, Icahn shed 111,250 shares of the Bonita Springs, Florida-based equipment rental company on Jan. 19. The stock traded for an average price of $143.35 per share on the day of the transaction.

His firm now holds 3.58 million shares total, which account for 2.42% of the equity portfolio. GuruFocus estimates Icahn has gained 334.85% on the investment over its lifetime. The 13F filing for the three months ended Sept. 30 also showed it was his ninth-largest holding as of the third quarter.

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

About Herc

Spun off of Hertz Global in 2016, Herc Holdings rents equipment such as forklifts, towable generators, scissor lifts and light towers to customers in the construction, industrial, refining, infrastructure and automotive industries, among others.

The company is divided into four segments, with equipment rentals making up the majority of its revenue at $1.9 billion in 2021.

Valuation

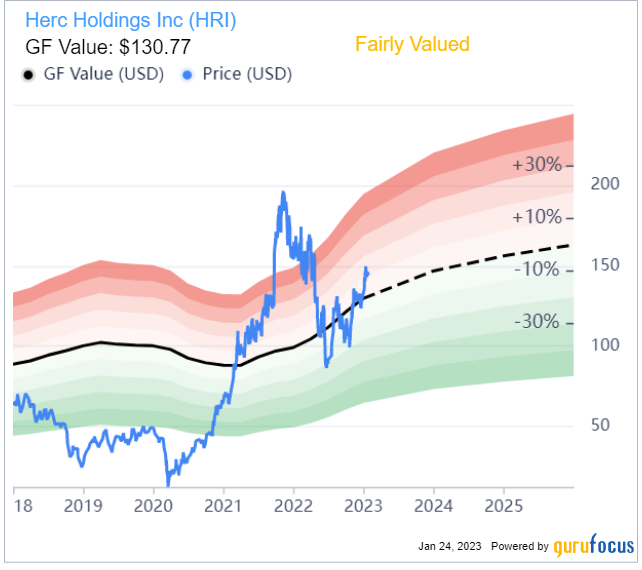

The company has a $4.21 billion market cap; its shares were trading around $143.92 on Tuesday with a price-earnings ratio of 14.36, a price-book ratio of 3.91 and a price-sales ratio of 1.73.

The GF Value Line suggests the stock is fairly valued currently based on its historical ratios, past financial performance and analysts’ future earnings estimates.

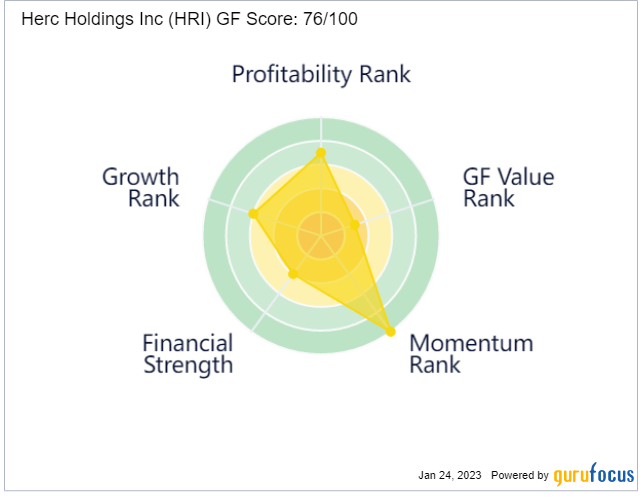

Additionally, the GF Score of 76 out of 100 indicates the company is likely to have average performance going forward. While it received high ratings for momentum and profitability, the growth and financial strength ranks were more moderate and the GF Value was low.

GuruFocus rated Herc’s financial strength 4 out of 10. In addition to issuing new long-term debt over the past several years, the company has inadequate interest coverage and a low Altman Z-Score of 1.34, which warns it could be at risk of bankruptcy. Further, assets are building up at a faster rate than revenue is growing, indicating it may be becoming less efficient. The return on invested capital is also eclipsed by the weighted average cost of capital, meaning it is struggling to create value as it grows.

The company’s profitability fared better with a 7 out of 10 rating on the back of an expanding operating margin, strong returns on equity, assets and capital that are outperforming versus industry peers and a high Piotroski F-Score of 8 out of 9, which means conditions are healthy.

Recent earnings

Herc reported solid third-quarter financial results in October. For the three months ended Sept. 30, it posted a 35.4% increase in total revenue from the prior-year quarter to $745.1 million, while net income grew 40.2% to $101.4 million, or $3.36 per share.

In a statement, President and CEO Larry Silber commented on the company’s performance.

"We continued to see strong demand for our equipment rental services across all of our geographic regions," he said. "Our rental revenue increased 35.9% over the prior year, while average fleet increased 35% to $5.3 billion. Adjusted Ebitda increased 40.3% to $345 million and adjusted Ebitda margin expanded 160 basis points to 46.3% in the quarter.”

As a result of this performance, Herc updated its full-year 2022 guidance. It now expects adjusted Ebitda in the range of $1.22 billion to $1.25 billion and net rental equipment capital expenditures between $1 billion and $1.10 billion.

"Demand from our customers continues to be strong as we close out 2022,” Silber said. “We continue to benefit from tight equipment inventory and believe a secular shift from ownership to rental is accelerating. With the steady announcement of new industrial, alternative energy and infrastructure projects, we believe we are well-positioned to generate continued revenue growth in 2023 and beyond."

The company announced it will report its fourth-quarter and full-year 2022 results before the opening bell on Feb. 14.

Dividend

In December, Herc issued its quarterly dividend of 57 cents per share. With a payout ratio of 0.22, the dividend yield of 1.59% is underperforming a majority of competitors in the business services space. It has outperformed versus its own history, however, over the past decade.

Guru interest

Icahn is by far the company’s largest guru shareholder with a 12.25% stake.

Other gurus invested in Herc Holdings as of the end of the third quarter included Mario Gabelli (Trades, Portfolio), Chuck Royce (Trades, Portfolio), Ken Fisher (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), Hotchkis & Wiley and Paul Tudor Jones (Trades, Portfolio).

Portfolio composition

Nearly 70% of Icahn’s $21.23 billion equity portfolio, which 13F filings show was composed of 17 stocks as of Sept. 30, was invested in the industrials sector.

The other industrials stock the guru held at the end of the quarter was Icahn Enterprises LP (IEP, Financial).