Overview of the Recent Transaction

Jane Street Group, LLC, a prominent player in electronic trading, recently expanded its portfolio by acquiring an additional 739,862 shares of Carvana Co (CVNA, Financial) on September 30, 2024. The shares were purchased at a price of $174.11 each, marking a significant investment in the e-commerce platform dedicated to buying and selling used cars. This transaction increased Jane Street Group's total holdings in Carvana to 1,820,245 shares, representing a 2.60% ownership stake in the company.

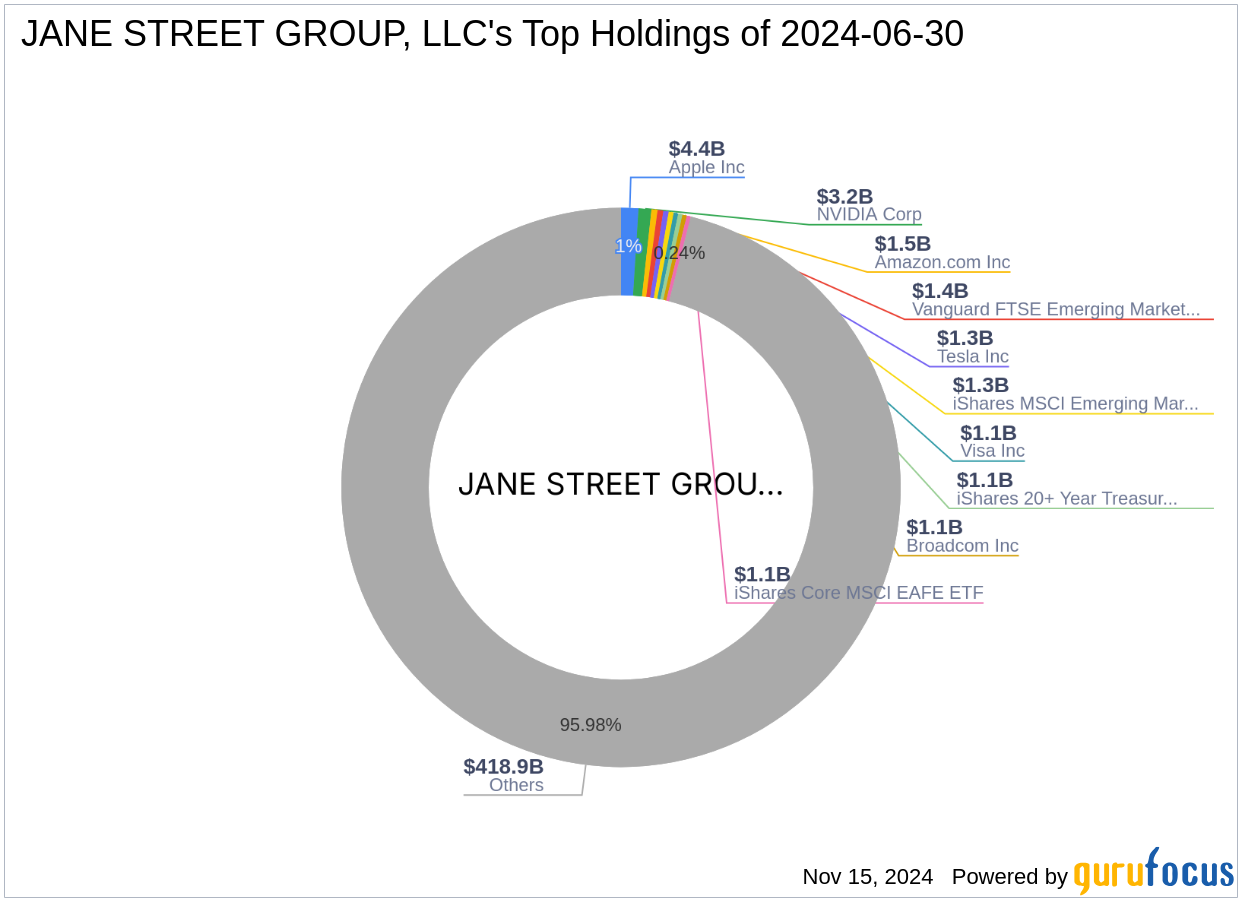

Profile of Jane Street Group, LLC

Jane Street Group operates under a veil of secrecy with a strong emphasis on technology and algorithmic trading. Founded in 2000 by Tim Reynolds and partners, the firm has grown into a major force in global trading markets, handling daily transactions worth billions of dollars across a myriad of financial products. Jane Street's prowess in ETF liquidity is particularly notable, making it a key player in real-time trading of over 2,000 ETFs globally. The firm's strategic use of sophisticated software and in-house technology solutions underscores its innovative approach to trading and investment.

Insight into Carvana Co

Carvana Co has revolutionized the used car market with its robust e-commerce platform that simplifies the buying and selling process of vehicles. Despite its innovative business model, Carvana is currently facing financial challenges, as reflected in its significantly overvalued GF Value of $33.66 compared to a current stock price of $240.44. The company's financial metrics indicate a precarious position with a GF Score of 66/100, suggesting moderate future performance potential.

Impact of the Trade on Jane Street Group's Portfolio

The recent acquisition of Carvana shares has a modest impact on Jane Street Group's portfolio, contributing only 0.03%. However, this move is strategic, considering Carvana's explosive year-to-date stock price increase of 392%. Holding 2.60% of Carvana's shares positions Jane Street to potentially benefit from future price appreciations or strategic market movements.

Market Context and Strategic Timing

The timing of Jane Street Group's increased investment in Carvana is noteworthy. Despite Carvana's stock being significantly overvalued, its year-to-date growth of 392% presents a lucrative, albeit risky, market opportunity. This strategic acquisition aligns with Jane Street's reputation for leveraging market volatilities, suggesting a calculated move to capitalize on potential future gains.

Broader Market Implications

This transaction not only affects Jane Street Group but also sends ripples across the market, particularly within the technology and consumer cyclical sectors where Carvana operates. Other major investors and firms with stakes in Carvana, including Gotham Asset Management and George Soros (Trades, Portfolio), may also react to this significant market play by Jane Street.

Conclusion

Jane Street Group's recent acquisition of Carvana shares is a strategic move that aligns with its sophisticated trading ethos and technological prowess. While the investment represents a small fraction of Jane Street's vast portfolio, it holds potential for significant impact given Carvana's volatile market performance. Investors and market watchers will undoubtedly keep a close eye on this development, anticipating Jane Street's next moves in the ever-evolving trading landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.