Overview of the Recent Transaction

On September 30, 2024, Brandes Investment Partners, LP (Trades, Portfolio) executed a significant transaction by adding 827,498 shares of American Outdoor Brands Inc (AOUT, Financial). This move increased their holdings by 18.62%, reflecting a new position size of 6.44% in the company. The shares were acquired at a price of $9.22 each, making this addition noteworthy in the firm's investment strategy.

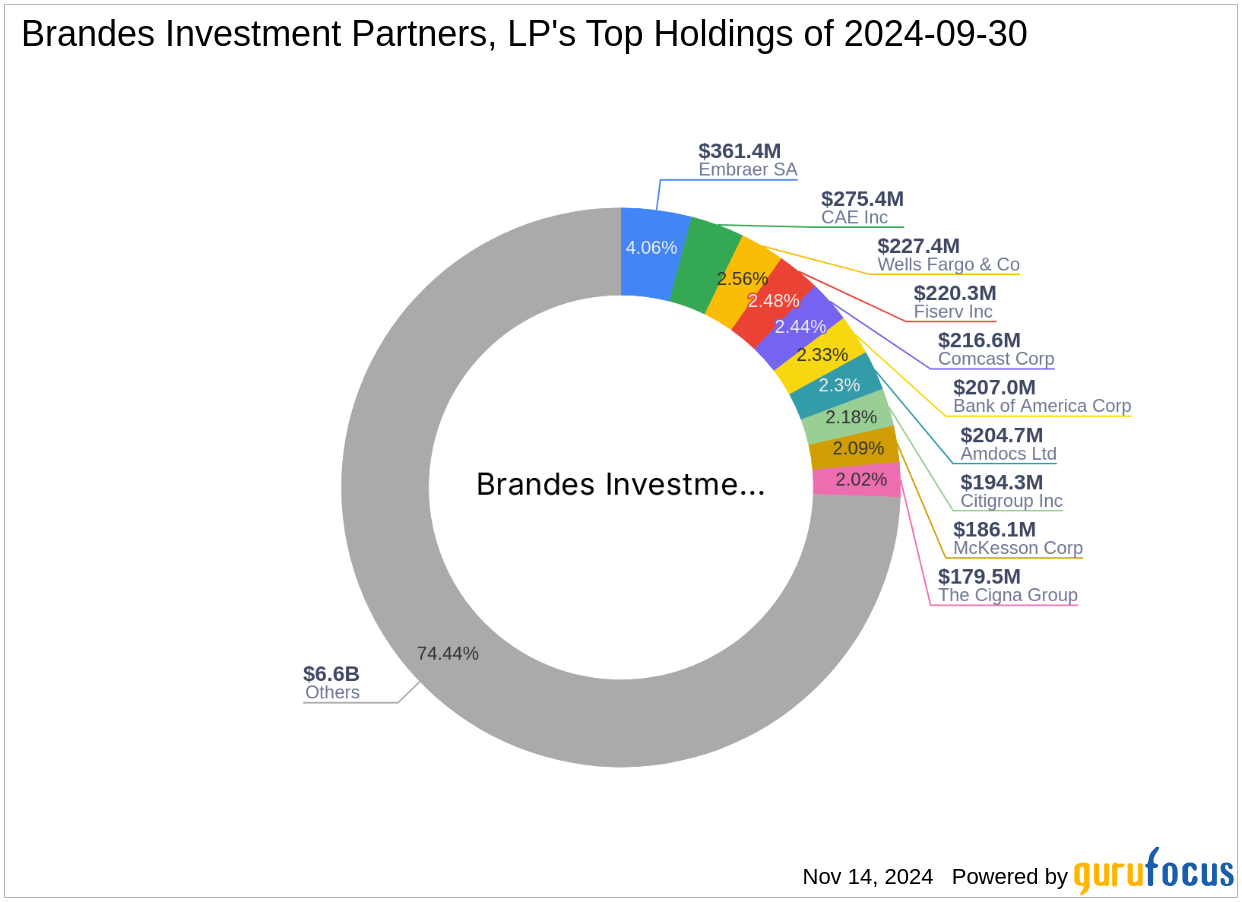

Profile of Brandes Investment Partners, LP (Trades, Portfolio)

Founded in 1974 by Charles Brandes, Brandes Investment Partners, LP (Trades, Portfolio) is a prominent investment advisory firm known for its global equity and fixed-income asset management. The firm adheres to the value investing principles pioneered by Benjamin Graham, focusing on undervalued securities. With a portfolio management approach that emphasizes long-term holdings, Brandes Investment Partners, LP (Trades, Portfolio) has established itself as a leader in the investment community.

Introduction to American Outdoor Brands Inc

American Outdoor Brands Inc, listed under the symbol AOUT, operates in the Travel & Leisure industry, providing a wide range of outdoor and personal security products. Since its IPO on August 10, 2020, the company has focused on outdoor lifestyle and shooting sports segments, offering products from hunting knives to emergency preparedness gear. Despite challenging market conditions, AOUT strives to innovate within its sector.

Analysis of the Trade's Impact

The recent acquisition by Brandes Investment Partners, LP (Trades, Portfolio) has increased their total shareholding in American Outdoor Brands to 827,498, representing a 0.09% impact on their portfolio. This strategic addition underscores the firm's confidence in AOUT's potential for recovery and growth, aligning with their investment philosophy of targeting undervalued assets.

Market Context and Stock Valuation

Currently, American Outdoor Brands Inc is considered "Fairly Valued" with a GF Value of $9.51, closely aligning with its current market price of $9.09. This valuation suggests a balanced market perception of the stock's worth, though it has experienced a 1.41% decline since the transaction date.

Performance Metrics of American Outdoor Brands Inc

American Outdoor Brands Inc holds a GF Score of 67/100, indicating moderate future performance potential. The company's financial strength and profitability have been areas of concern, with low rankings in these categories. However, its momentum rank is notably high, suggesting some market optimism regarding its short-term movement potential.

Sector and Industry Analysis

Brandes Investment Partners, LP (Trades, Portfolio) has a diversified portfolio with significant investments in the Healthcare and Financial Services sectors. The addition of American Outdoor Brands Inc complements their holdings in the Travel & Leisure industry, diversifying their investment landscape further.

Other Significant Stakeholders

Notably, other prominent investors like Mario Gabelli (Trades, Portfolio) also hold stakes in American Outdoor Brands Inc. This collective interest from well-known investors could signal underlying value in AOUT that aligns with Brandes Investment Partners, LP (Trades, Portfolio)'s strategy of investing in undervalued securities.

Conclusion

The recent transaction by Brandes Investment Partners, LP (Trades, Portfolio) reflects a strategic move to capitalize on the potential upside of American Outdoor Brands Inc, considering its current market valuation and the firm's investment philosophy. As the market continues to evolve, this addition may play a pivotal role in the performance of Brandes Investment Partners, LP (Trades, Portfolio)'s portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.