Insight into the Latest 13F Filing for Q3 2024

Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio), under the leadership of Executive Director Mr. Barrow, has recently disclosed its 13F filing for the third quarter of 2024. The Dallas-based investment firm, known for managing the Vanguard Windsor II and Selected Value Funds, adheres to a philosophy of investing in stocks with below-market price-to-earnings ratios, above-market dividend yields, and robust financial metrics. This approach has historically yielded significant returns, outperforming negative market trends with a 9.33% annual return over a decade ending March 31, 2010.

New Strategic Acquisitions

During the third quarter of 2024, Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio) expanded its portfolio by adding 59 new stocks. Noteworthy among these is the substantial investment in Xcel Energy Inc (XEL, Financial), purchasing 5,483,686 shares valued at approximately $358 million, making it 1.17% of the total portfolio. Other significant new holdings include Warner Music Group Corp (WMG, Financial) with 5,519,842 shares, and Amentum Holdings Inc (AMTM, Financial) with 3,225,967 shares.

Significant Position Increases

The firm also strategically increased its stakes in several key holdings. A notable adjustment was made in Bank of America Corp (BAC, Financial), where an additional 8,979,216 shares were acquired, resulting in a 280.63% increase in share count and impacting the portfolio by 1.16%. Another major increase was in Carnival Corp (CCL, Financial), with an additional 11,431,356 shares, marking a 45.84% rise in share count.

Reductions in Portfolio

Conversely, Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio) reduced its positions in 139 stocks. Significant reductions include Allstate Corp (ALL, Financial), where shares were cut by 70.5%, and DuPont de Nemours Inc (DD, Financial), with a 76.25% reduction in shares. These adjustments reflect the firm’s ongoing portfolio optimization strategy.

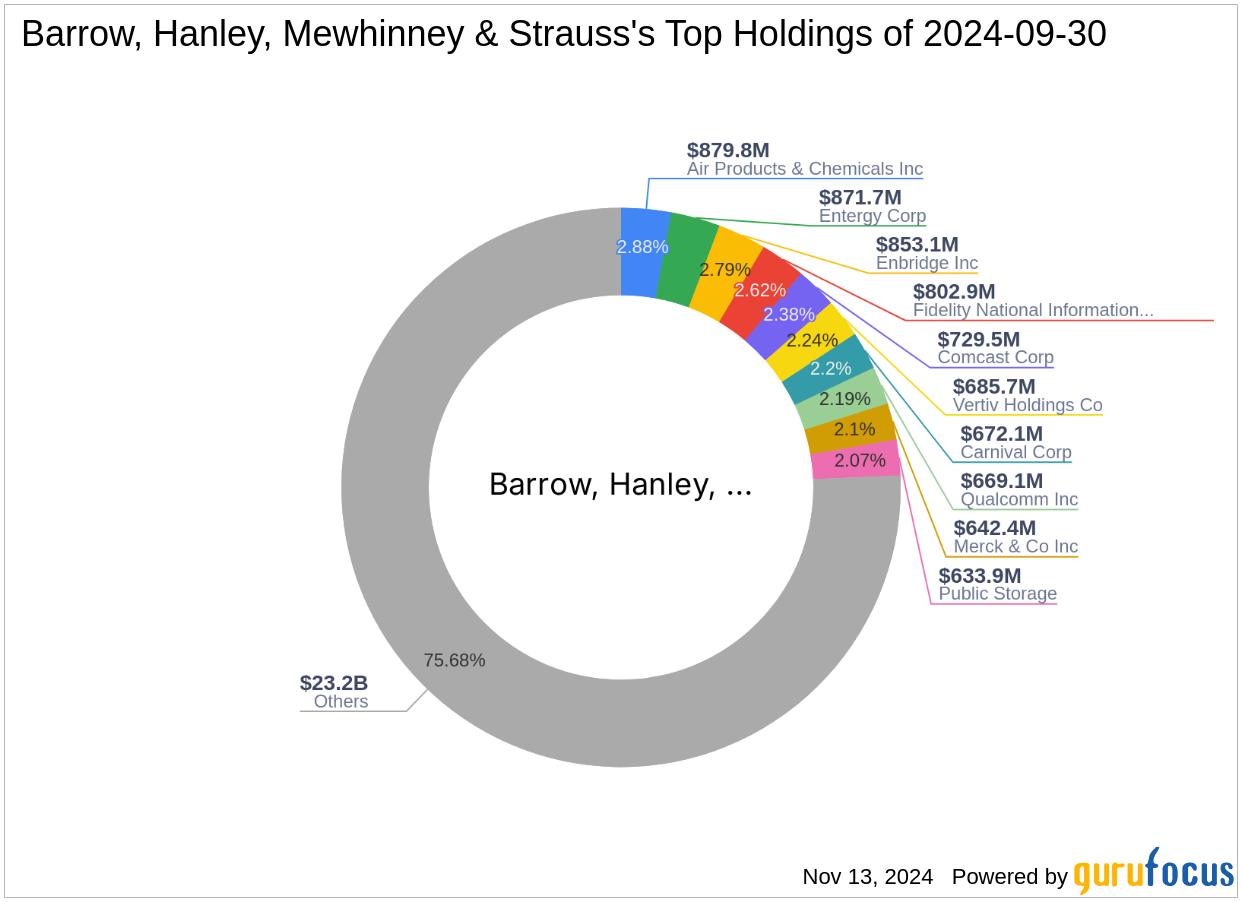

Portfolio Overview and Sector Allocation

As of the third quarter of 2024, the firm's portfolio comprises 327 stocks with top holdings in diverse sectors. Leading the portfolio are Air Products & Chemicals Inc (APD, Financial), Entergy Corp (ETR, Financial), and Enbridge Inc (ENB, Financial). The investments span across all 11 industries, with significant allocations in Industrials, Financial Services, and Technology.

This detailed analysis of Barrow, Hanley, Mewhinney & Strauss (Trades, Portfolio)’s latest 13F filing highlights the firm's strategic adjustments and ongoing commitment to value investing, providing valuable insights for potential investors and market analysts.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.