Overview of the Recent Transaction

Kopernik Global Investors, LLC (Trades, Portfolio), a prominent investment firm, has recently expanded its portfolio by purchasing 7,073,746 shares of Platinum Group Metals Ltd (PLG, Financial) on September 30, 2024. This transaction marks a new holding for the firm, with the shares acquired at a price of $1.43 each. This strategic move not only diversifies Kopernik's investments but also underscores its confidence in the metals and mining sector.

Insight into Kopernik Global Investors, LLC (Trades, Portfolio)

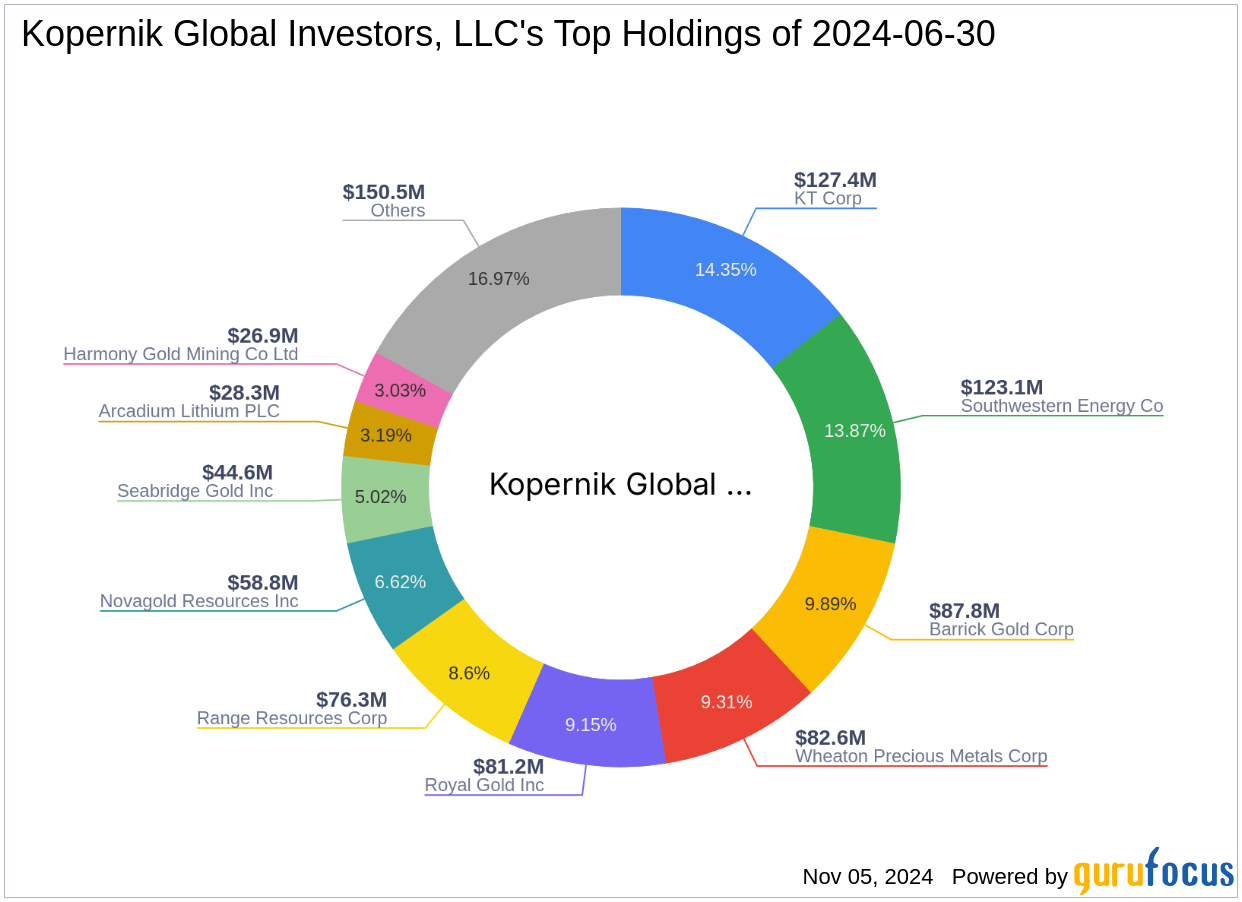

Based in Tampa, Florida, Kopernik Global Investors, LLC (Trades, Portfolio) is known for its keen focus on value investing, particularly in sectors like Basic Materials and Energy. With an equity portfolio valued at approximately $888 million and top holdings in companies such as Royal Gold Inc (RGLD, Financial) and Barrick Gold Corp (GOLD, Financial), Kopernik maintains a robust presence in the investment landscape. The firm's investment philosophy emphasizes long-term potential and intrinsic value, aligning with its choice of sectors and specific investments.

Detailed Analysis of the Trade

The acquisition of over 7 million shares in Platinum Group Metals Ltd significantly impacts Kopernik's portfolio, introducing a 1.13% new position. This move not only reflects the firm's strategic investment approach but also its belief in PLG's potential within the metals and mining industry. The firm now holds a 6.90% stake in PLG, highlighting its substantial commitment to this investment.

Understanding Platinum Group Metals Ltd

Platinum Group Metals Ltd, headquartered in Canada, is primarily involved in the development of the Waterberg Project, a major palladium, platinum, rhodium, and gold mine in South Africa. Despite a challenging market, with a market capitalization of $177.046 million and a current stock price of $1.73, PLG continues to focus on growth and operational efficiency in its sector.

Financial and Market Performance of PLG

Currently, PLG's stock has seen a 20.98% increase since the transaction date, with a year-to-date rise of 51.75%. However, the stock has experienced a significant decline of 91.35% since its IPO in 2007. The GF Score of 43 indicates potential challenges ahead, with low rankings in profitability and growth. The firm's financial strength, however, is highlighted by a cash to debt ratio of 17.27, suggesting a solid liquidity position despite broader operational challenges.

Strategic Implications of Kopernik's Investment

The decision by Kopernik Global Investors to invest in Platinum Group Metals Ltd could be driven by several factors, including the potential undervaluation of PLG's shares and the strategic importance of the Waterberg Project. This investment aligns with Kopernik's focus on materials and energy, sectors poised for recovery and growth amidst global economic shifts.

Market and Sector Analysis

The Metals & Mining industry faces numerous challenges, including fluctuating commodity prices and regulatory changes. However, companies like PLG that are involved in the production of critical minerals for technology and automotive industries may offer long-term growth opportunities. Kopernik’s investment in PLG fits within these broader industry trends and reflects a calculated risk on recovering commodity markets.

Conclusion

Kopernik Global Investors, LLC (Trades, Portfolio)'s recent acquisition of shares in Platinum Group Metals Ltd underscores a strategic approach to value investing in the metals and mining sector. This move not only diversifies Kopernik’s portfolio but also positions it to potentially benefit from the future growth of PLG and the sector at large. As market conditions evolve, this investment may play a pivotal role in shaping the firm’s returns and strategic positioning in the global investment landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.