Overview of the Recent Transaction

On September 30, 2024, Wolverine Asset Management LLC executed a significant transaction involving the shares of AlphaTime Acquisition Corp (ATMC, Financial). The firm reduced its holdings by 4,923 shares, resulting in a new total of 433,010 shares. This move, priced at $11.20 per share, reflects a strategic adjustment in Wolverine's investment portfolio, with the current position of ATMC now representing a modest 0.1% of the firm's total holdings.

Profile of Wolverine Asset Management LLC

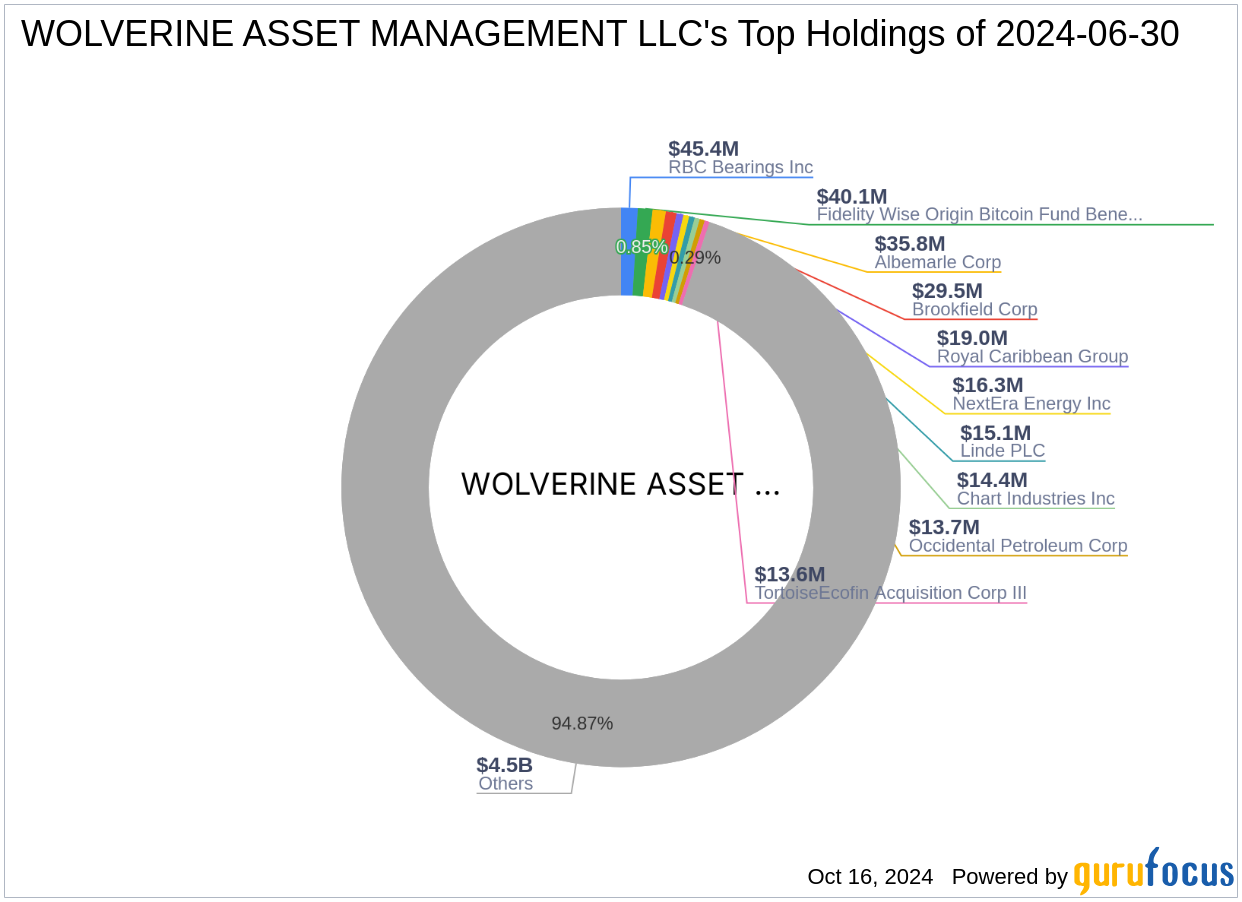

Wolverine Asset Management LLC, based in Chicago, Illinois, is a prominent investment entity known for its diverse investment strategies. The firm manages a substantial equity portfolio valued at approximately $4.73 billion, with top holdings in various sectors including Financial Services and Industrials. Wolverine's investment philosophy emphasizes strategic stake adjustments in response to market conditions, aiming to optimize investment returns for its stakeholders.

Insight into AlphaTime Acquisition Corp (ATMC, Financial)

AlphaTime Acquisition Corp, a blank check company based in the Cayman Islands, focuses on mergers and acquisitions within diverse sectors. Since its IPO on January 19, 2023, ATMC has been actively seeking opportunities to leverage its capital in pursuit of substantial growth. With a market capitalization of $77.326 million and a current stock price of $11.25, the company operates under the diversified financial services industry.

Financial Metrics and Stock Performance of ATMC

ATMC's financial performance and stock metrics present a mixed picture. The company's stock has seen a year-to-date increase of 4.65% and an 11.94% rise since its IPO. However, its GF Score of 23/100 indicates potential challenges in future performance. The firm's financial strength and profitability are areas of concern, with low rankings in growth and profitability.

Impact of the Trade on Wolverine's Portfolio

The recent transaction has slightly altered Wolverine Asset Management's exposure to ATMC, reducing its stake to a mere 0.1% of its total portfolio. This adjustment suggests a strategic shift, possibly due to the firm's assessment of ATMC's financial metrics and market performance.

Market Reaction and Stock Performance Post-Transaction

Since the transaction, ATMC's stock price has shown a modest increase of 0.45%. This reaction could be indicative of the market's neutral response to Wolverine's portfolio adjustment, considering the broader financial context and ATMC's performance metrics.

Strategic Implications of the Transaction

Wolverine Asset Management's decision to reduce its stake in ATMC aligns with its cautious approach towards companies with uncertain financial trajectories. This move could be part of a broader strategy to reallocate resources to more promising investment opportunities, reflecting the firm's adaptive investment philosophy.

Conclusion

The reduction of Wolverine Asset Management's stake in AlphaTime Acquisition Corp marks a strategic realignment within its portfolio. Given ATMC's current financial health and market performance, this move could be seen as a tactical decision to optimize the firm's investment structure in response to evolving market conditions. Investors and market watchers will likely keep a close eye on both entities to gauge the long-term impact of this adjustment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.